- United States

- /

- Packaging

- /

- NYSE:SLGN

Leadership Changes and New $500M Buyback Could Be a Game Changer for Silgan Holdings (SLGN)

Reviewed by Sasha Jovanovic

- Silgan Holdings recently announced a series of executive leadership changes, appointing Shawn C. Fabry as Executive Vice President and Chief Financial Officer, alongside key promotions for other senior roles, and confirmed a new US$500 million share repurchase program set to run through 2029.

- These moves, which include both long-term succession planning and a sizable new capital return initiative, reflect a dual focus on management continuity and shareholder value.

- We'll now consider how the new US$500 million share buyback program may influence Silgan Holdings' overall investment thesis.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Silgan Holdings Investment Narrative Recap

Being a shareholder in Silgan Holdings means believing in the company's ability to adapt its packaging portfolio for evolving consumer trends while capitalizing on strengths in dispensing products and pet food packaging. The recent executive shakeup, while meaningful for succession planning, does not materially alter the most important short-term catalyst: ongoing growth in higher-value markets. The main risk, exposure to shifting consumer habits and customer concentration, remains unchanged by these leadership moves.

The company's newly authorized US$500 million share repurchase program stands out as particularly relevant. This announcement signals continued commitment to capital returns, a potential positive for confidence during leadership transitions, and may help offset any valuation pressure that comes from sector-specific risks discussed above. Still, it does not directly alleviate long-term questions around market share if secular packaging trends shift more rapidly than anticipated.

On the other hand, investors should be watching for any early warning signs if customer concentration issues grow more acute…

Read the full narrative on Silgan Holdings (it's free!)

Silgan Holdings is projected to reach $6.8 billion in revenue and $448.6 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 3.1% and a $146.6 million increase in earnings from the current $302.0 million.

Uncover how Silgan Holdings' forecasts yield a $56.70 fair value, a 46% upside to its current price.

Exploring Other Perspectives

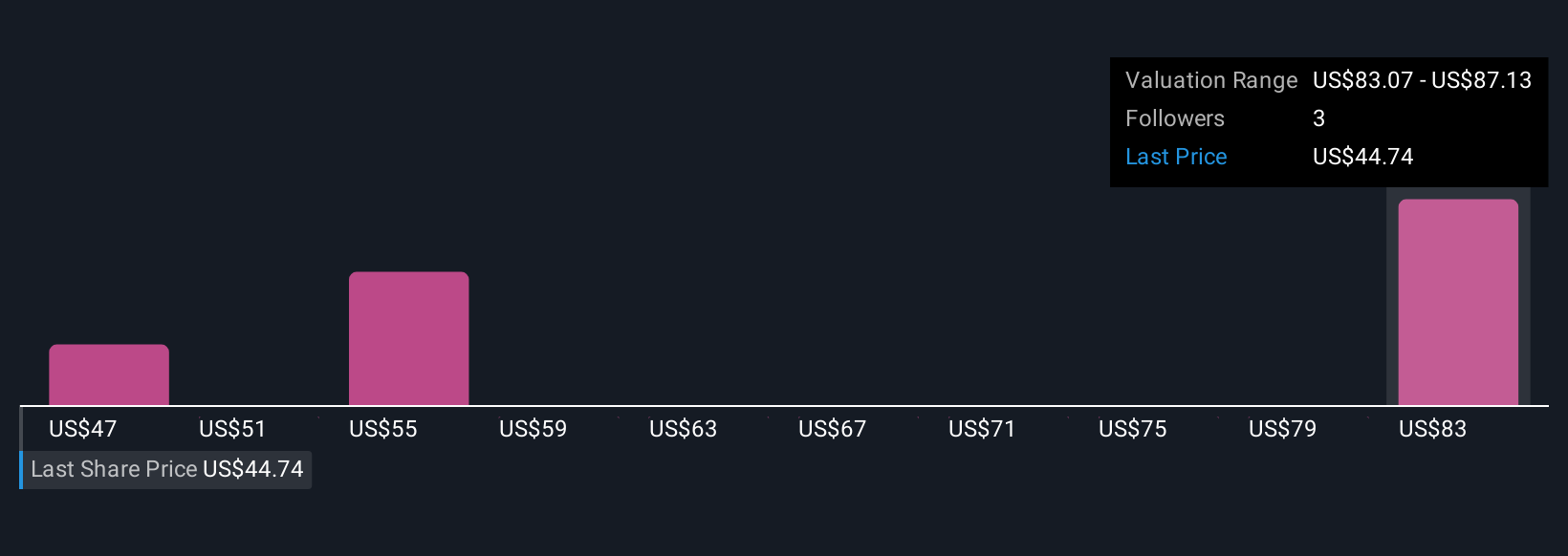

Simply Wall St Community estimates for fair value on Silgan Holdings run wide, from US$46.51 to US$85.70, spanning three different viewpoints. As you explore these varied opinions, keep in mind that ongoing shifts in consumer preferences may continue to test the company's long-term growth potential.

Explore 3 other fair value estimates on Silgan Holdings - why the stock might be worth just $46.51!

Build Your Own Silgan Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silgan Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Silgan Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silgan Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLGN

Silgan Holdings

Manufactures and sells rigid packaging solutions for consumer goods products in the United States and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives