- United States

- /

- Chemicals

- /

- NYSE:SHW

Sherwin-Williams (SHW): Evaluating Valuation After Earnings Beat and Suvinil Acquisition Boost Outlook

Reviewed by Simply Wall St

Sherwin-Williams reported third-quarter earnings and revenue that beat expectations, supported by higher prices and strong performance across its core business segments. The company's recent acquisition of Suvinil was also highlighted in its updated full-year guidance.

See our latest analysis for Sherwin-Williams.

Sherwin-Williams’ solid quarterly results and timely acquisition of Suvinil come after a year marked by resilient performance, with the share price up 2.5% year-to-date. The company still reflects a 12.9% drop in total shareholder return over twelve months. Despite recent headwinds, long-term momentum remains positive. This is highlighted by a 38% total return over three years and 51% over five years, signaling potential for recovery as the business stays focused on growth opportunities.

If you’re curious about what other companies are seeing renewed interest and ownership trends, now’s a great moment to discover fast growing stocks with high insider ownership.

With Sherwin-Williams trading below analyst price targets after a year of mixed returns, the real question is whether there is hidden value here for investors or if the market has already priced in all future growth.

Most Popular Narrative: 11.7% Undervalued

At $341.49, Sherwin-Williams closed noticeably below the most popular narrative's fair value estimate of $386.52, setting up a compelling debate about hidden upside in the shares. This discrepancy is fueling intense focus on whether future earnings growth will be enough to justify the higher valuation target.

Heightened investment in targeted customer-facing growth initiatives during a period of competitor retrenchment, layoffs, and price disruptions in the industry is likely to accelerate share gains with professional contractors and commercial projects, supporting long-term topline growth substantially above industry averages.

Want to know why this narrative thinks Sherwin-Williams may defy industry trends? The story revolves around bold sales growth, margin expansion, and an earnings forecast that could surprise the market. What are the hidden projections driving this fair value? Dive in to uncover what’s underpinning the optimism before the next price move.

Result: Fair Value of $386.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand in core markets or ongoing supply chain challenges could quickly undermine the current growth narrative for Sherwin-Williams.

Find out about the key risks to this Sherwin-Williams narrative.

Another View: Are the Multiples Hiding Risks?

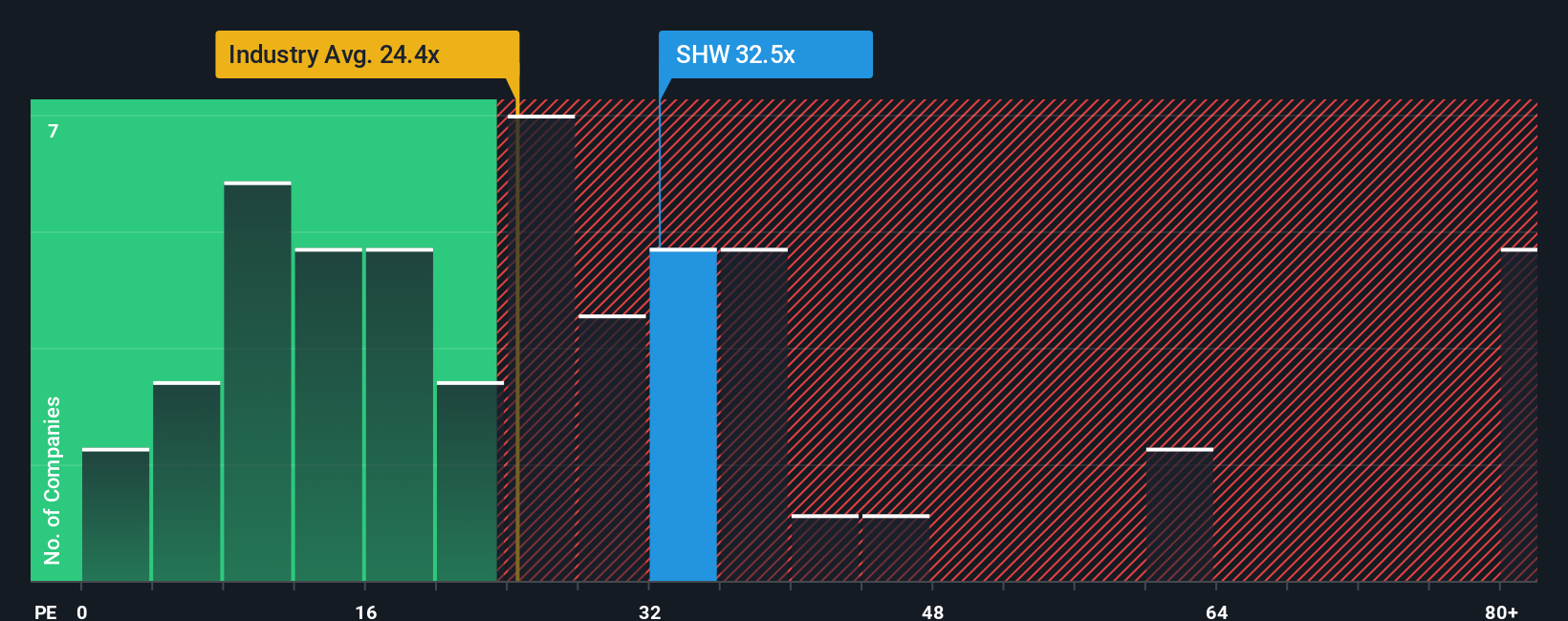

While the narrative argues Sherwin-Williams is undervalued, a closer look at the price-to-earnings ratio tells a different story. The shares trade at 32.7 times earnings, which is markedly higher than the US Chemicals industry average of 23 times and above the fair ratio of 24.5. This premium means investors are paying a considerable markup, which could pose a risk if growth stalls or expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sherwin-Williams Narrative

If these perspectives don't quite match your own, or you prefer doing your own digging, you’re free to analyze the data and build a unique narrative in just a few minutes. Do it your way.

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big opportunity pass you by, especially when investing trends are shifting fast. Use the Simply Wall Street Screener to move ahead of the curve and uncover standout stocks across hot market segments.

- Turbocharge your portfolio with high-yield picks by scanning these 14 dividend stocks with yields > 3% that consistently deliver strong returns above 3%.

- Spot the most promising tech innovators by checking out these 25 AI penny stocks as they transform industries with advancements in artificial intelligence.

- Capitalize on tomorrow’s financial leaders by tracking these 923 undervalued stocks based on cash flows and discovering hidden value based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SHW

Sherwin-Williams

Engages in the development, manufacture, distribution, and sale of paint, coatings, and related products to professional, industrial, commercial and retail customers.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026