- United States

- /

- Packaging

- /

- NYSE:PKG

Packaging Corporation of America (NYSE:PKG) Names New President Announces US$1.25 Dividend

Reviewed by Simply Wall St

Packaging Corporation of America (NYSE:PKG) recently announced significant leadership changes as Thomas A. Hassfurther stepped into the role of President, bringing over four decades of experience to the helm, alongside the CFO transition of Kent A. Pflederer set for May. While the market remains challenged amidst broader concerns about economic health and fresh tariff announcements impacting major indices, PCA managed to secure a slight 0.21% increase in its share price over the past week. This modest gain occurred despite the Dow Jones Industrial Average rising 0.7% and tech-heavy sectors seeing declines. The announcement of a quarterly dividend of $1.25 per share reinforces PCA's commitment to shareholder value. The company's resilience in the face of mixed market conditions and new executive appointments suggests a measured investor response to its strategic focus amid current uncertainties.

Get an in-depth perspective on Packaging Corporation of America's performance by reading our analysis here.

Over the past five years, Packaging Corporation of America (NYSE:PKG) has delivered a total shareholder return of 164.91%, factoring in both share price appreciation and dividends. This significant return indicates a positive long-term investment environment despite periodic challenges in the broader market. The company’s recent performance over the past year has also outshined the US Packaging industry, which recorded a return of 12.8%, highlighting PCA's relative strength.

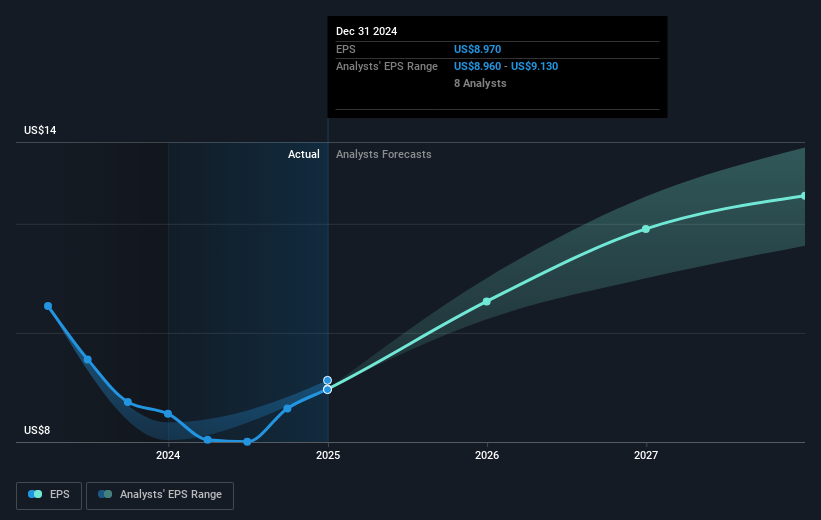

Several factors may have contributed to this performance. During this period, PCA consistently declared quarterly dividends, reinforcing its commitment to shareholder value. Moreover, substantial earnings growth reported in Q3 2024, with sales reaching US$2.18 billion and a net income of US$238.1 million, signals effective financial management. Additionally, the share buyback program launched in 2022, accumulating over 4.32 million repurchased shares, likely provided support for shareholder returns by enhancing earnings per share. Recent executive changes may also set the stage for strategic realignment and future growth.

- Learn how Packaging Corporation of America's intrinsic value compares to its market price with our detailed valuation report.

- Understand the uncertainties surrounding Packaging Corporation of America's market positioning with our detailed risk analysis report.

- Already own Packaging Corporation of America? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PKG

Packaging Corporation of America

Manufactures and sells containerboard and corrugated packaging products in the United States.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives