- United States

- /

- Packaging

- /

- NYSE:PKG

Packaging Corp of America (PKG): Exploring Valuation After Recent Momentum Shift

Reviewed by Simply Wall St

See our latest analysis for Packaging Corporation of America.

After a stretch of relatively steady trading, Packaging Corporation of America’s 1-year share price return has now landed at negative 12.7%, and its total shareholder return for the same period is down 15.4%. The stock’s three- and five-year total shareholder returns remain impressive and well above market averages. However, recent momentum has clearly faded as investors weigh the company’s valuation and growth outlook.

If you’re interested in finding stocks with fresh momentum or untapped potential, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and recent growth stalling, the key question becomes whether Packaging Corporation of America is now undervalued or if the market has already accounted for the company’s potential going forward.

Most Popular Narrative: 12.6% Undervalued

Packaging Corporation of America’s most widely followed valuation narrative points to a fair value target that is noticeably above its recent closing price. This contrast has sparked fresh debate about the drivers behind the gap.

The successful startup of the new efficient box plant in Glendale, Arizona, is expected to increase productivity, reduce costs, and enhance service capabilities. This development could potentially improve net margins and earnings in future quarters. Anticipation of stronger box shipments in the second half of the year, resulting from sustained demand and customer inventory restocking, could lead to higher revenue growth.

There is more to this story than plant upgrades and cost controls. The narrative leans on bold growth forecasts and rising profit margins to reach its valuation call. Want to see which sharply higher earnings and revenue assumptions analysts are betting on? Dive into the full narrative for the numbers powering this target.

Result: Fair Value of $224.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic uncertainty and rising operational costs could challenge Packaging Corporation of America’s profit outlook and put pressure on future earnings growth.

Find out about the key risks to this Packaging Corporation of America narrative.

Another View: Market Ratios Paint a Different Picture

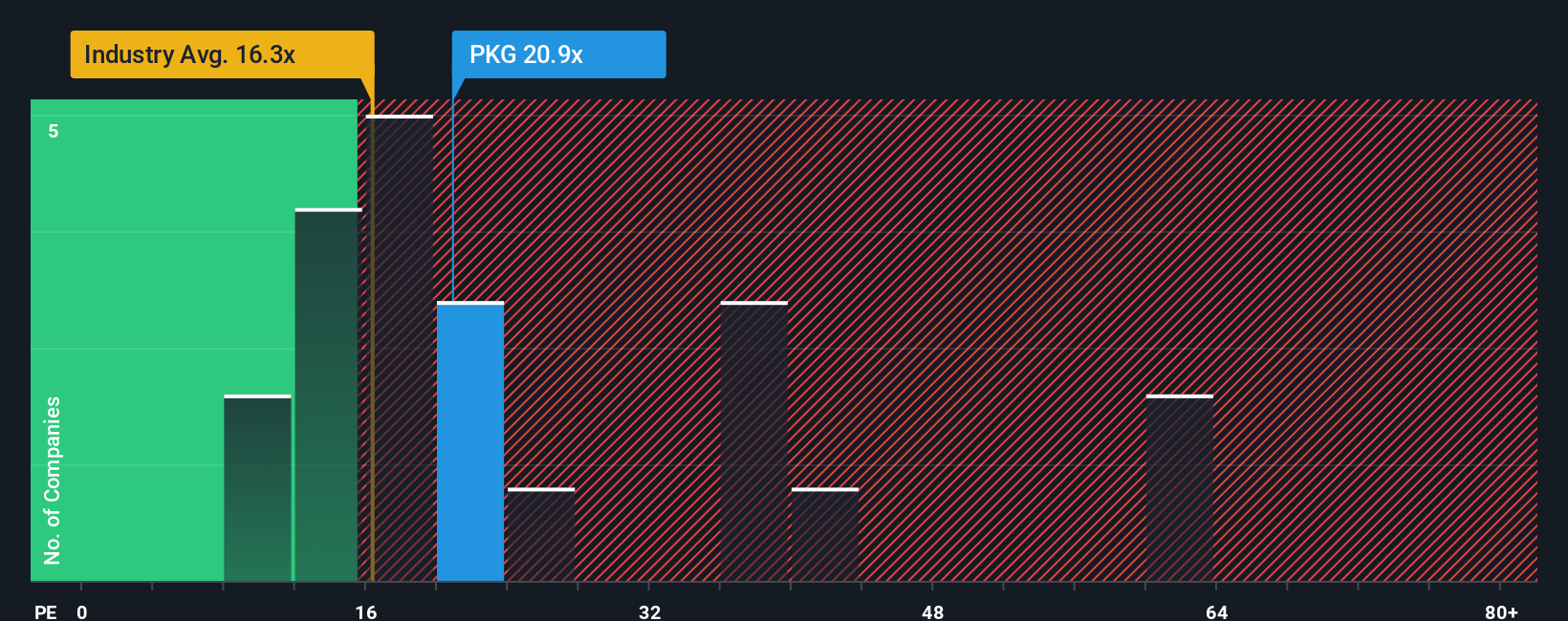

Looking at Packaging Corporation of America through the lens of the price-to-earnings ratio, the story changes. The company trades at 19.8x earnings, making it a bit more expensive than the North American packaging sector at 19x. However, it is cheaper than its peer group average at 22.9x. Compared to a fair ratio of 21.3x, there is still some room for optimism, but the premium pricing does introduce valuation risk if growth stalls. Could the market be overestimating its future prospects, or will steady earnings growth justify these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Packaging Corporation of America Narrative

If the current valuation story does not reflect your perspective, or you want to look deeper into the numbers yourself, you can easily craft your own view in just a few minutes with Do it your way.

A great starting point for your Packaging Corporation of America research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for the obvious plays when opportunities are waiting in every corner of the market? Power up your research and sharpen your edge by checking out these standout themes:

- Capture long-term income potential by checking out these 18 dividend stocks with yields > 3%, which delivers solid yields above 3% for income-focused investors.

- Ride the AI wave with these 27 AI penny stocks, making breakthroughs in machine learning, automation, and next-generation intelligence.

- Tap into the growth of healthcare innovation by researching these 31 healthcare AI stocks, transforming care with advanced technology and medical insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PKG

Packaging Corporation of America

Manufactures and sells containerboard and uncoated freesheet (UFS) paper products in North America.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026