- United States

- /

- Metals and Mining

- /

- NYSE:MP

Why MP Materials (MP) Is Up 12.1% After Striking Rare Earth Refining Deal With Saudi Arabia and US

Reviewed by Sasha Jovanovic

- MP Materials Corp. recently announced a partnership with the U.S. Department of War and the Saudi Arabian Mining Company to form a joint venture that will establish a rare earth refinery in Saudi Arabia, in line with a cooperation framework signed between the United States and Saudi Arabia.

- This collaboration aims to enhance the stability of global rare earth supply chains, leveraging Saudi Arabia's resources and infrastructure while ensuring significant U.S. oversight and strategic alignment.

- We'll explore how this joint venture with U.S. government backing expands MP Materials' international reach and impacts its investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

MP Materials Investment Narrative Recap

To be a shareholder in MP Materials, you need to believe in the company's push to secure global supply chains for rare earths, its ability to expand internationally with government support, and that execution of new facilities will drive growth. The recent joint venture in Saudi Arabia could support MP's goal to become a credible global player, but it does not directly address the key short-term catalyst: successfully ramping up downstream production and maintaining revenue predictability. The largest current risk, execution and cost control across multiple simultaneous expansions, remains, with this news adding further complexity rather than reducing risk exposure. Among recent announcements, the multibillion-dollar public-private partnership with the U.S. Department of Defense to build a second domestic magnet manufacturing facility stands out as most relevant. Like the Saudi venture, it aims to boost MP's integrated processing capacity and deepen state-backed support, reinforcing the importance of reliable execution as both an ongoing catalyst and a risk. These moves suggest management is focused on capturing more margin across the supply chain, but investors should watch closely how quickly new projects turn operational without disruption. Yet, while global partnerships broaden MP's reach, investors should be aware of the heightened risk that comes if any major expansion encounters unexpected...

Read the full narrative on MP Materials (it's free!)

MP Materials' narrative projects $1.0 billion in revenue and $236.3 million in earnings by 2028. This requires 61.3% yearly revenue growth and a $337.7 million increase in earnings from the current level of -$101.4 million.

Uncover how MP Materials' forecasts yield a $79.11 fair value, a 28% upside to its current price.

Exploring Other Perspectives

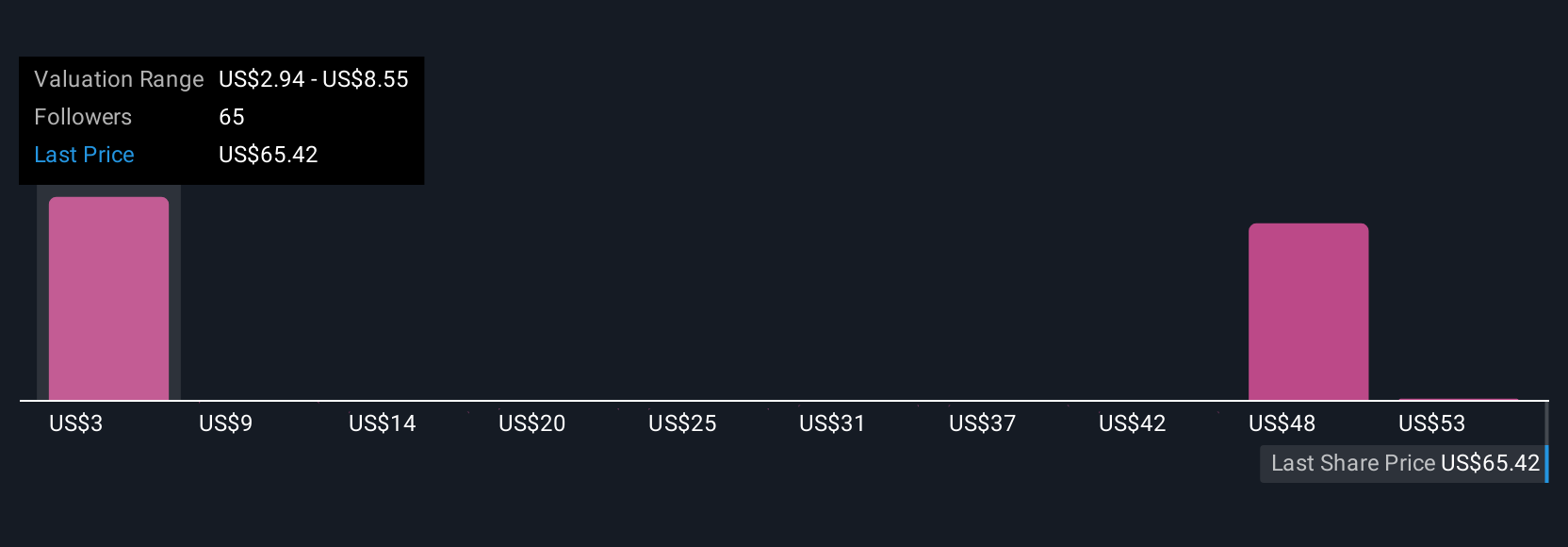

Twenty members of the Simply Wall St Community calculated MP Materials’ fair value estimates between US$8.87 and US$85, reflecting dramatically different expectations. With multiple projects underway, strong execution will likely remain central to the debate as you compare these diverse viewpoints.

Explore 20 other fair value estimates on MP Materials - why the stock might be worth less than half the current price!

Build Your Own MP Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MP Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MP Materials' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026