- United States

- /

- Metals and Mining

- /

- NYSE:MP

A Look at MP Materials’s Valuation After DoD Deal and Apple Investment Boost Strategic Role

Reviewed by Simply Wall St

MP Materials (MP) has been making headlines lately, and for good reason. The company just announced a multi-billion-dollar deal with the Department of Defense and a $500 million investment from Apple, putting a huge spotlight on its role in securing rare-earth resources for the U.S. With China tightening control over global supplies, moves like these highlight just how crucial MP Materials could become for high-tech manufacturing and national security. For investors, these deals raise immediate questions about how much value the market is now placing on the company’s future growth and resilience.

Looking at the numbers, MP Materials’ stock has seen renewed momentum this year. Shares have climbed around 3.6% over the past year and delivered a strong 1.1% gain for the quarter, a positive swing after some recent volatility. The attention from these strategic partnerships comes on the heels of a tough month but fits into a broader story of rapid revenue and net income growth over the past year that has set the company apart from others in its sector.

So, after the recent run-up and headline-making deals, is MP Materials now trading at a premium, or is there still room for investors to capitalize on future upside?

Most Popular Narrative: 17.5% Undervalued

The most widely followed narrative sees MP Materials as notably undervalued, reflecting a significant disconnect between the company’s ambitious growth plans and its current share price. Analysts are highlighting robust catalysts that could drive valuation well above current levels if key assumptions play out as expected.

The company is expanding its vertically integrated processing and magnet manufacturing capacity with the "10X" plant and a modular recycling facility. Together with significant CapEx support from Apple and the DoD, this strategy is designed to capture more value-added margins and potentially improve net profit and operating leverage as downstream operations ramp up.

Want to know the future numbers fueling this bullish narrative? The heart of this analyst view is a rapid transformation in MP’s earnings power, backed by aggressive assumptions for profit margins and next-level revenue growth. Curious which financial leaps, not typically seen in the sector, support this price target? Find out how optimistic projections and powerful new partnerships drive the case for this undervaluation.

Result: Fair Value of $77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the company's ambitious expansion faces significant hurdles if new facilities encounter delays or if its heavy reliance on a few major customers becomes volatile.

Find out about the key risks to this MP Materials narrative.Another View: Is the Market Expecting Too Much?

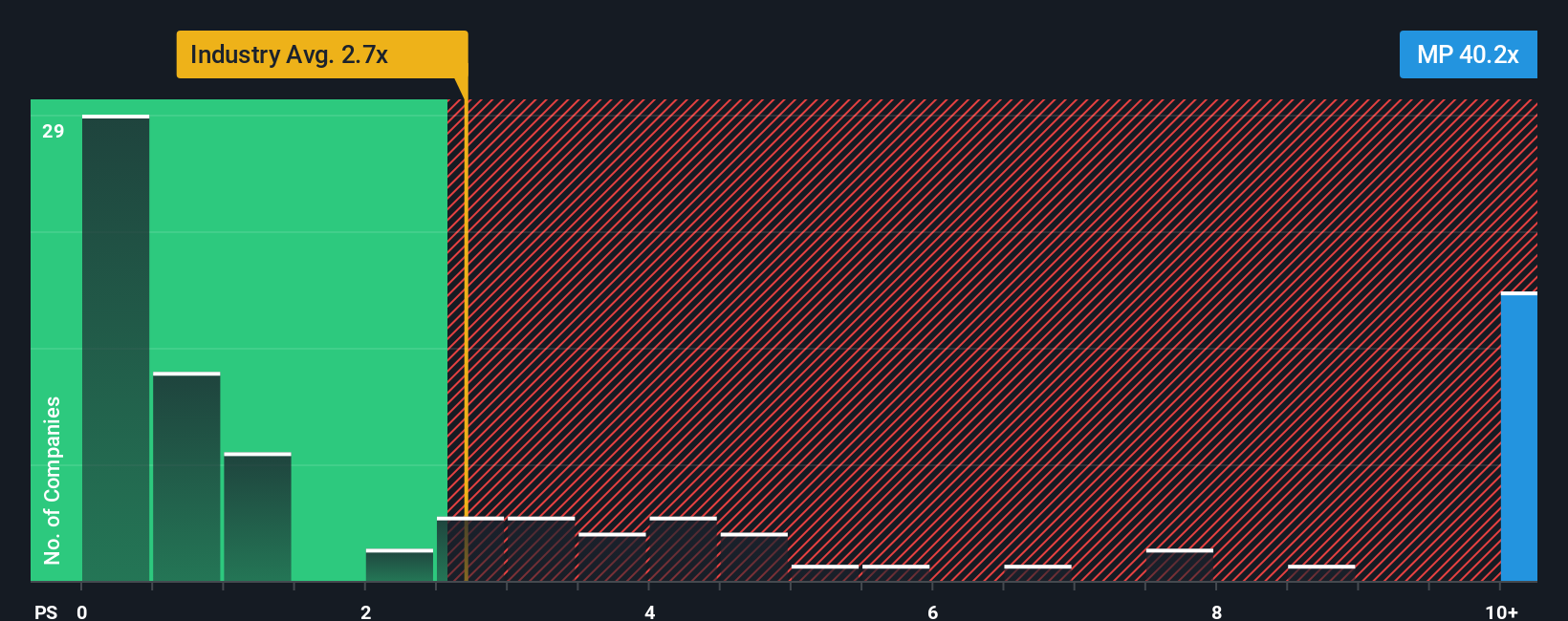

While the analyst consensus paints MP Materials as undervalued based on future growth, one key valuation metric shows the stock is trading well above others in its industry. Is the market pricing in too much optimism, or does something justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MP Materials Narrative

If you have a different perspective or want to dig deeper into the data, you can quickly craft your own narrative in under three minutes. Do it your way

A great starting point for your MP Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when countless innovative stocks are within reach. Use these powerful tools to take your investing to the next level:

- Uncover hidden value by scanning for companies that show strong financial health and appear mispriced based on cash flows with undervalued stocks based on cash flows.

- Tap into the future by seeking out fast-growing businesses advancing artificial intelligence breakthroughs with AI penny stocks.

- Secure reliable income and stability by finding shares that offer above-average yields using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026