- United States

- /

- Basic Materials

- /

- NYSE:MLM

How Investors May Respond To Martin Marietta Materials (MLM) Upward Earnings Guidance and Asset Swap Strategy

Reviewed by Sasha Jovanovic

- Martin Marietta Materials recently announced robust third-quarter earnings, with sales rising to US$1.85 billion and net income reaching US$414 million, and raised its full-year 2025 earnings guidance to reflect a more positive outlook.

- Additionally, Martin Marietta continued to optimize its business by swapping cement and concrete assets for aggregates, a move highlighted by analysts as potentially enhancing the company's market position amid ongoing infrastructure and non-residential construction activity.

- We'll take a closer look at how the company's upward earnings guidance revision influences its overall investment narrative and future outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Martin Marietta Materials Investment Narrative Recap

Owning Martin Marietta Materials means believing in sustained infrastructure investment and recovery in nonresidential construction, with aggregates at the heart of this thesis. The recent increase in guidance demonstrates management’s confidence but does not materially change the central near-term catalyst: infrastructure funding. The main risk remains unchanged, potential delays or cutbacks in government infrastructure spending, which could adversely impact order volumes and revenue growth given the company’s heavy exposure to these projects.

The most relevant recent announcement is the company’s raised 2025 earnings guidance, reflecting expectations for higher revenues and improved earnings. This outlook supports optimism around strong demand for aggregates, even as uncertainty around infrastructure funding continues to linger as the biggest risk to near-term results.

Yet, it’s important for investors to remember that in contrast, changes in fiscal policy or project funding can...

Read the full narrative on Martin Marietta Materials (it's free!)

Martin Marietta Materials' narrative projects $8.4 billion revenue and $1.6 billion earnings by 2028. This requires 7.9% yearly revenue growth and a $0.5 billion earnings increase from $1.1 billion today.

Uncover how Martin Marietta Materials' forecasts yield a $663.65 fair value, a 8% upside to its current price.

Exploring Other Perspectives

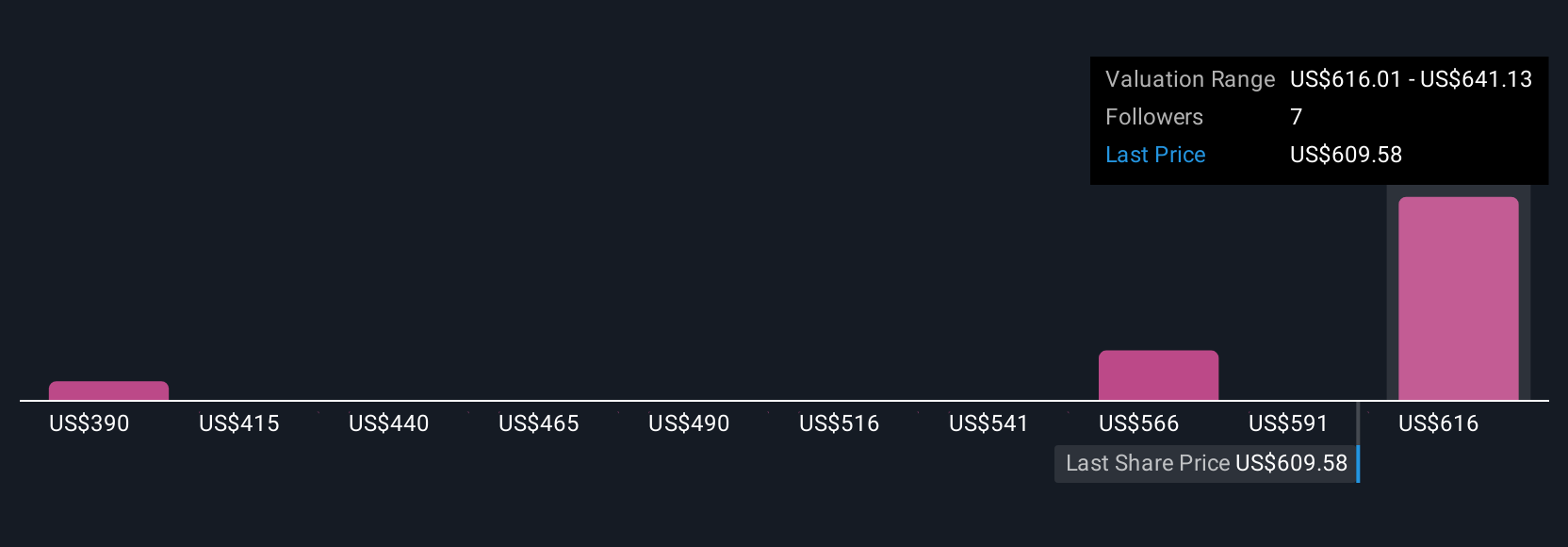

Simply Wall St Community members have issued fair value estimates for Martin Marietta ranging from US$527.96 to US$700, with three perspectives represented. While optimism surrounds future earnings and revenue, uncertainty in government infrastructure spending could play a critical role in the company’s performance, see what other investors are thinking here.

Explore 3 other fair value estimates on Martin Marietta Materials - why the stock might be worth 14% less than the current price!

Build Your Own Martin Marietta Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Martin Marietta Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Martin Marietta Materials' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives