- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

A Look at Louisiana-Pacific (LPX) Valuation After Sharp Earnings Estimate Cuts and Zacks Rank Downgrade

Reviewed by Simply Wall St

Louisiana-Pacific (LPX) just landed on Zacks.com’s most searched list after analysts sharply cut current quarter earnings estimates. This move pushed the stock into a Zacks Rank 5, a signal many investors treat as a tactical warning.

See our latest analysis for Louisiana-Pacific.

Those weaker earnings revisions arrive after a choppy stretch, with a 90 day share price return of around minus 17 percent and a one year total shareholder return of roughly minus 31 percent. This suggests that momentum is clearly fading for now.

If analyst caution around Louisiana Pacific has you reassessing your watchlist, this could be a smart moment to scan the market for fast growing stocks with high insider ownership.

Yet with shares still about 24 percent below the average analyst target and long term returns solidly positive, should investors treat LPX’s pullback as a mispriced value setup, or as a stock that already reflects its future growth?

Most Popular Narrative: 22.4% Undervalued

With the narrative fair value sitting at about $105.88 versus a last close of $82.19, the implied upside hinges on a demanding growth path.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.1x on those 2028 earnings, down from 22.4x today. This future PE is lower than the current PE for the US Forestry industry at 22.4x.

Want to see how steady revenue expansion, rising margins, and richer earnings combine to support that valuation reset? The full narrative unpacks every assumption driving that upside case.

Result: Fair Value of $105.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still meaningful risk that prolonged housing weakness and persistently low OSB pricing could undercut the growth and margin story behind that potential upside.

Find out about the key risks to this Louisiana-Pacific narrative.

Another Lens on LPX’s Valuation

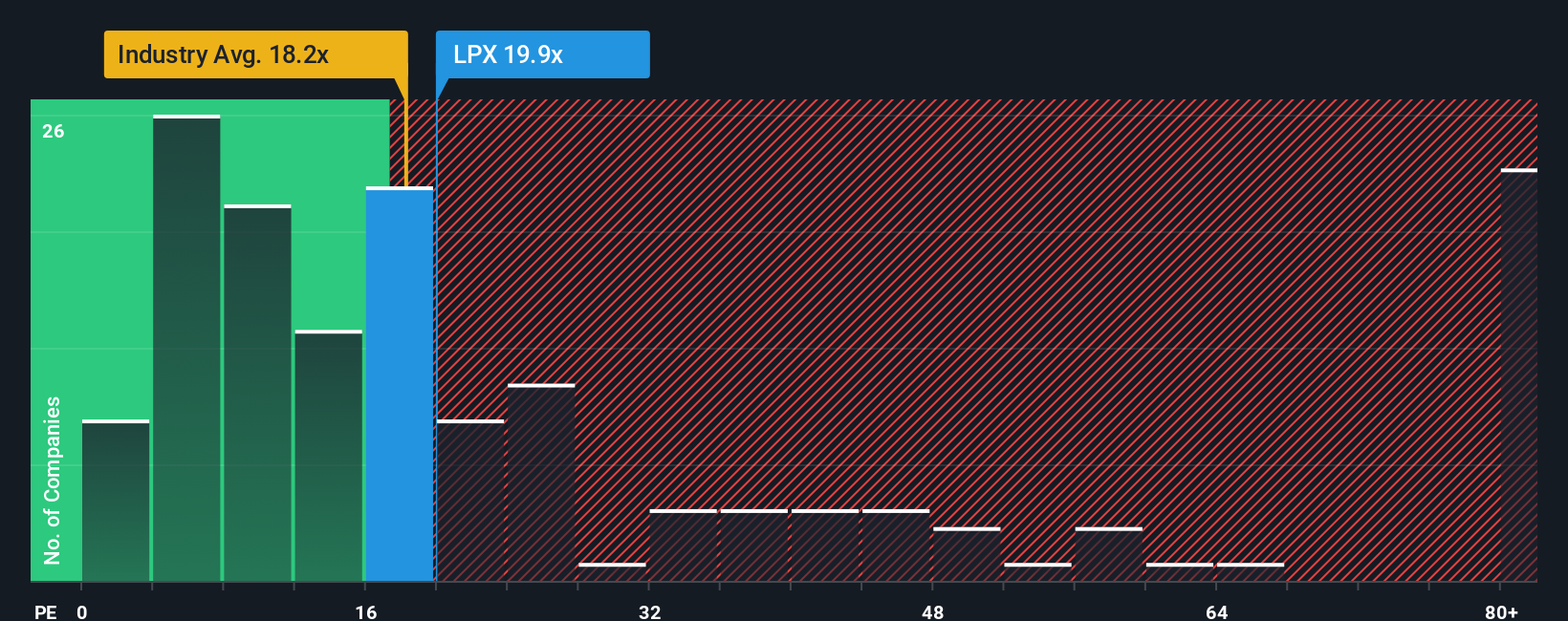

While the narrative fair value points to upside, our ratio work tells a sharper story. LPX trades on a 26.5x price to earnings ratio, richer than the global forestry average of 18.5x and even above its 25.6x fair ratio. This hints at a slimmer margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Louisiana-Pacific Narrative

If you want to challenge this outlook and dig into the numbers on your own terms, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Louisiana-Pacific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one stock when the market offers entire universes of opportunity ready for you to evaluate with data, structure, and confidence.

- Target reliable cash flow by reviewing these 15 dividend stocks with yields > 3%, where consistent payouts and sustainable balance sheets can anchor a long term income strategy.

- Capitalize on growth potential by scanning these 26 AI penny stocks, focusing on companies turning artificial intelligence into real competitive advantages.

- Position yourself ahead of the crowd by assessing these 81 cryptocurrency and blockchain stocks, highlighting businesses building the infrastructure and services behind digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026