- United States

- /

- Basic Materials

- /

- NYSE:KNF

Knife River (KNF): Valuation Perspectives Following Record Q3 Results and Upbeat Management Outlook

Reviewed by Simply Wall St

Knife River (KNF) stock got a boost after the company reported record third quarter results, highlighting higher revenue and steady execution in the face of several industry challenges. Recent acquisitions and dynamic pricing strategies played a key role.

See our latest analysis for Knife River.

Knife River’s stock has staged a sharp rebound recently, jumping 17.4% over the past week as investors responded to record third quarter results and upbeat guidance. However, the year-to-date share price return remains deep in the red at -29.3%. That surge follows upbeat management commentary, strong infrastructure funding signals, and a series of analyst upgrades, breathing new life into what had been a fading narrative for much of this year.

If you’re interested in seeing what other fast-moving stories the market is serving up, now’s a great time to explore fast growing stocks with high insider ownership.

So with shares rebounding but still well below earlier highs, is Knife River an undervalued infrastructure play primed for further gains, or is the recent rally already factoring in all of the company's future growth potential?

Most Popular Narrative: 30% Undervalued

The widely followed narrative sees Knife River as dramatically mispriced, with a fair value estimate far above the recent closing price of $70.99. This setup has piqued market interest, as new risk factors are beginning to clash with record backlog and upbeat forecasts.

Knife River's record $1.3 billion backlog and exposure to public infrastructure projects, supported by robust, multiyear federal and state Department of Transportation funding (including 60% of IIJA funds still to be spent), positions the company for strong, sustained revenue growth well into 2026 and beyond.

Curious why this fair value assumes the company can hold a premium valuation, despite market volatility? The secret ingredient is a future earnings trajectory and margin expansion plan that most wouldn’t expect from an infrastructure business. Want to know the bold growth projections and pricing power packed into this narrative? The details behind the math may surprise you.

Result: Fair Value of $102.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including ongoing regional funding delays and disruptive weather events. Either of these factors could threaten Knife River’s growth trajectory and profitability.

Find out about the key risks to this Knife River narrative.

Another View: Is the Market Overpricing Knife River?

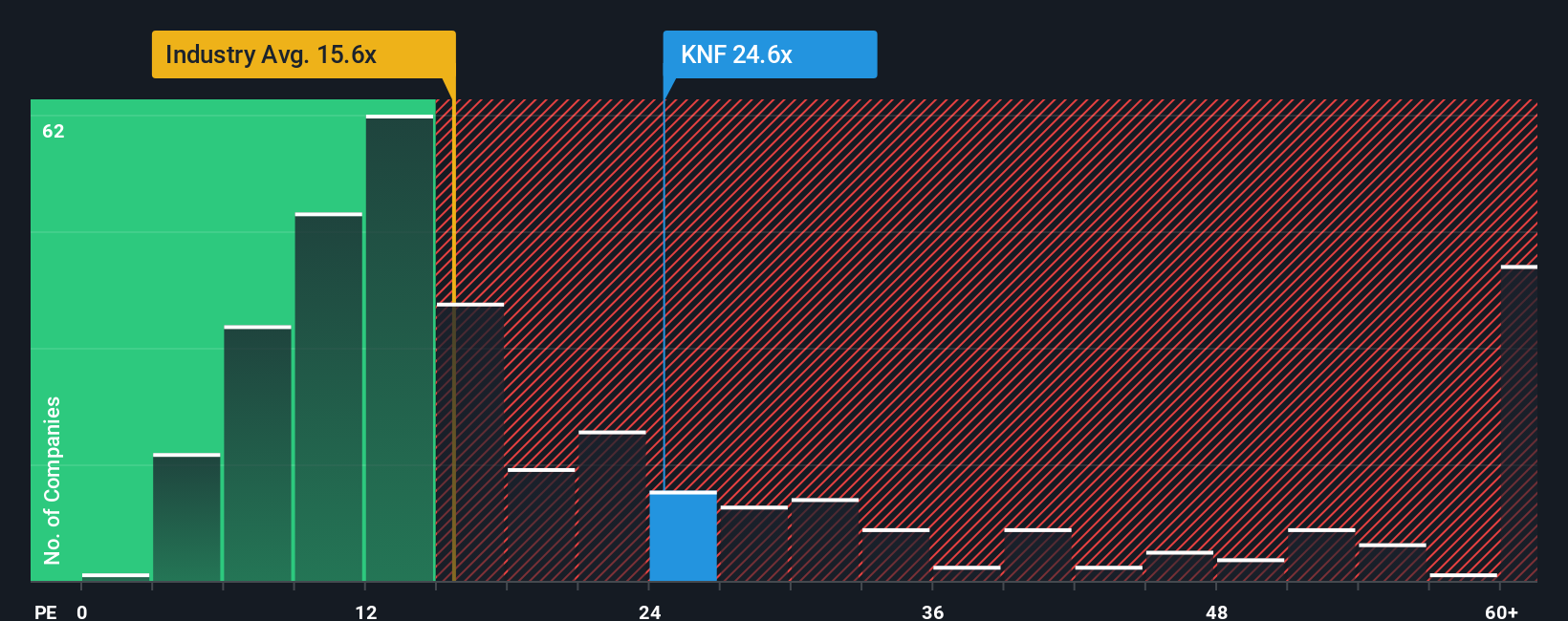

While one view sees significant upside, looking at the company’s price-to-earnings ratio tells a different story. Knife River trades at 27.1x earnings, far above the global industry average of 15x, its peers at 22.9x, and a fair ratio of just 20.7x. This premium raises real questions about how much future growth is already priced in. Could valuation risk outweigh opportunity here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Knife River Narrative

Prefer to follow your own instincts or challenge these assumptions? Dive into the numbers, review the facts, and build your story in just minutes with Do it your way.

A great starting point for your Knife River research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock more smart opportunities beyond Knife River by tapping into stocks with distinct advantages and long-term growth potential on Simply Wall Street’s powerful screener.

- Capitalize on stable income streams by checking out these 16 dividend stocks with yields > 3%, which features top companies offering yields above 3% and resilient dividend track records.

- Get ahead of technological innovation by reviewing these 25 AI penny stocks, where cutting-edge AI-driven businesses are transforming the landscape and creating new market leaders.

- Jump on rare value opportunities in the current market by searching these 874 undervalued stocks based on cash flows, which spotlights stocks trading below their cash flow-based fair values.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knife River might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNF

Knife River

Provides aggregates-led construction materials and contracting services in the United States.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives