- United States

- /

- Chemicals

- /

- NYSE:IFF

Assessing International Flavors & Fragrances (IFF) Valuation After Recent Share Price Rebound

Reviewed by Kshitija Bhandaru

See our latest analysis for International Flavors & Fragrances.

After a rocky start to the year, International Flavors & Fragrances has seen its share price rebound 7% over the past week, which may suggest shifting market sentiment. Even so, momentum remains muted overall, with the year-to-date share price return still down sharply compared to peers. The one-year total shareholder return also shows a much steeper loss. Investors are watching closely to see if this recent uptick develops into a sustained recovery or signals a change in risk perception.

If you're keen to see what else is gaining traction, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a noticeable discount to analyst targets, yet recent returns still lagging, the central question emerges: is International Flavors & Fragrances undervalued, or is the market fully factoring in its future potential?

Most Popular Narrative: 22.2% Undervalued

The most widely followed narrative signals upside potential, with the fair value set at $81.96 versus a last close of $63.75. This creates a notable gap, sharply focused by the narrative’s rationale and key drivers.

Ongoing investments in R&D and capacity (especially in Health & Biosciences, Taste, and Specialty Fragrance Ingredients) are strengthening the company's innovation pipeline; management expects these initiatives to accelerate revenue and profit growth beginning in 2026 and reaching full impact by 2027.

Curious how these bold forecasts stack up? The most popular narrative is built on outsized profit recovery, ambitious revenue targets, and a future earnings multiple that differs from today’s industry norms. Want to know which underlying assumptions could justify this optimistic price? Dive in for the inside track on what truly drives the $81.96 fair value.

Result: Fair Value of $81.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in key markets and the risk of underwhelming innovation remain significant hurdles. These factors could challenge this upbeat outlook.

Find out about the key risks to this International Flavors & Fragrances narrative.

Another View: What Do Market Ratios Say?

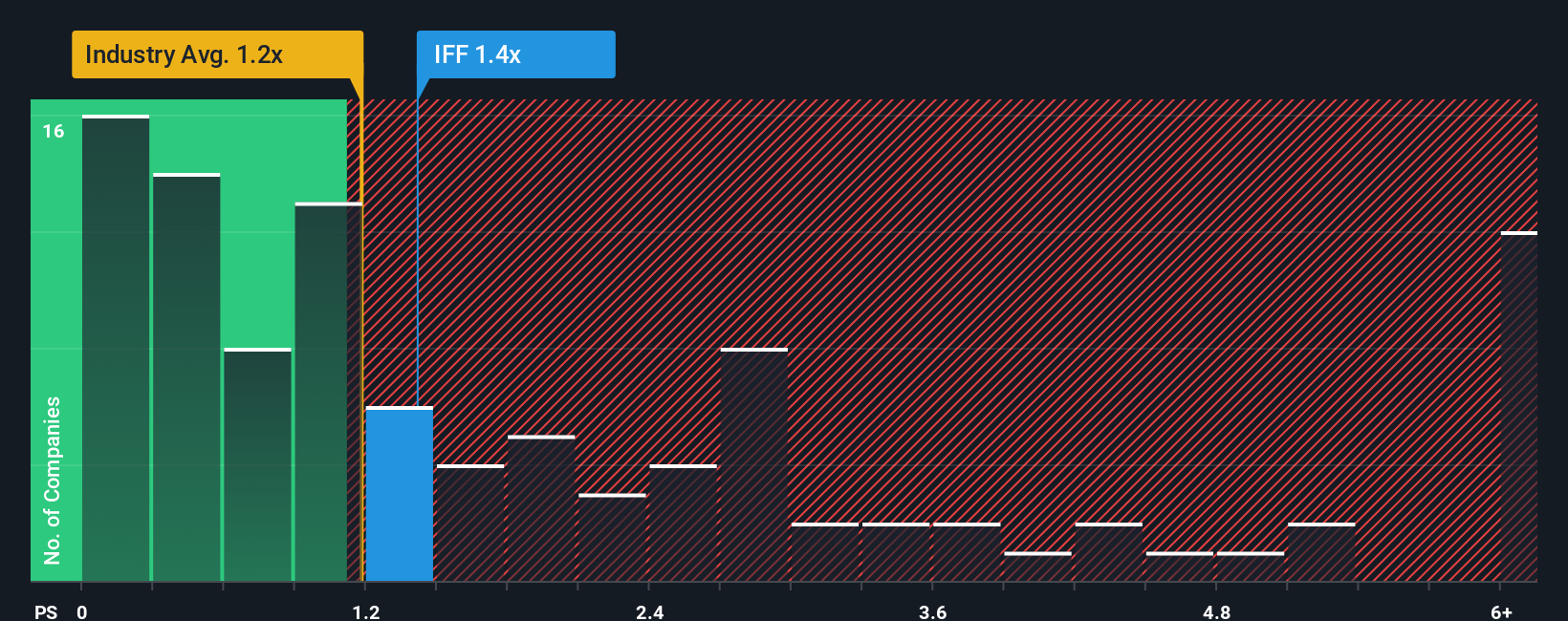

Looking at valuation from a different angle, International Flavors & Fragrances trades at a price-to-sales ratio of 1.4x. This is slightly above the US Chemicals industry average of 1.2x, but below the peer average of 2.1x. The fair ratio, based on our analysis, sits at 1.7x. This suggests the market could eventually re-rate the stock higher, but it also signals some market skepticism right now. Is this a hidden opportunity or a warning about lingering risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Flavors & Fragrances Narrative

If you want to dig deeper, you can analyze the numbers yourself and craft a narrative of your own in just a few minutes. Do it your way

A great starting point for your International Flavors & Fragrances research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities like these don’t wait around. Take the next step to expand your investing strategy. The market is full of potential, and with the right tools, you can make smarter choices today.

- Spot undervalued opportunities before the crowd by checking out these 878 undervalued stocks based on cash flows chosen for their strong cash flows and potential upside.

- Strengthen your portfolio’s income stream and stability by scanning these 18 dividend stocks with yields > 3% delivering yields above 3%.

- Fuel your curiosity about the fastest-growing tech trends with these 24 AI penny stocks harnessing artificial intelligence for game-changing innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IFF

International Flavors & Fragrances

Manufactures and markets food, beverage, health and biosciences, scent, pharma solutions, and complementary adjacent products in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives