- United States

- /

- Packaging

- /

- NYSE:GEF

Greif (GEF) Valuation in Focus as Investors Weigh Fundamentals After Recent Modest Trading

Reviewed by Simply Wall St

See our latest analysis for Greif.

Greif's latest share price of $56.89 reflects a gradual pullback, with a 1-year total shareholder return of -5.5% and multi-year results that remain solidly positive. Recent weakness suggests short-term momentum is fading, even as the company’s long-term fundamentals stay in focus for value-minded investors.

If you're curious about where else momentum and strong ownership could play out, now is a perfect time to discover fast growing stocks with high insider ownership

With shares hovering well below analyst price targets, investors are left to wonder whether Greif's current valuation signals an attractive entry point, or if the market is factoring in all future prospects and leaving little room for upside.

Most Popular Narrative: 22.9% Undervalued

Compared to its last close of $56.89, Greif's most popular narrative argues the shares should be worth significantly more. Analysts see a gap between today’s price and what they believe the company’s future earnings and margin trajectory could support.

The strategic divestment of Greif's lower-margin containerboard and timberland businesses is sharpening its focus on markets poised for structural growth, such as polymers and high-value industrial sectors. This enables improved capital efficiency and margin expansion, which should boost long-term net margins and free cash flow. Greif's aggressive cost optimization program, including SG&A reduction, operational efficiency improvements, and network rationalization, has already driven improved gross and EBITDA margins. As volume recovers, the operating leverage from these actions is expected to drive outsized future earnings growth.

What's powering this bullish valuation? The backbone of this narrative includes dramatic shifts in end-markets, key operational upgrades, and margin expansion, along with bold expectations for future profit multiples. Uncover which pivotal forecasts and efficiency bets are fueling analyst optimism. Click through for exclusive insights.

Result: Fair Value of $73.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft demand in key markets and execution challenges in new segments could put pressure on Greif's earnings recovery and hinder expected profit margin expansion.

Find out about the key risks to this Greif narrative.

Another View: Are Shares Really Cheap?

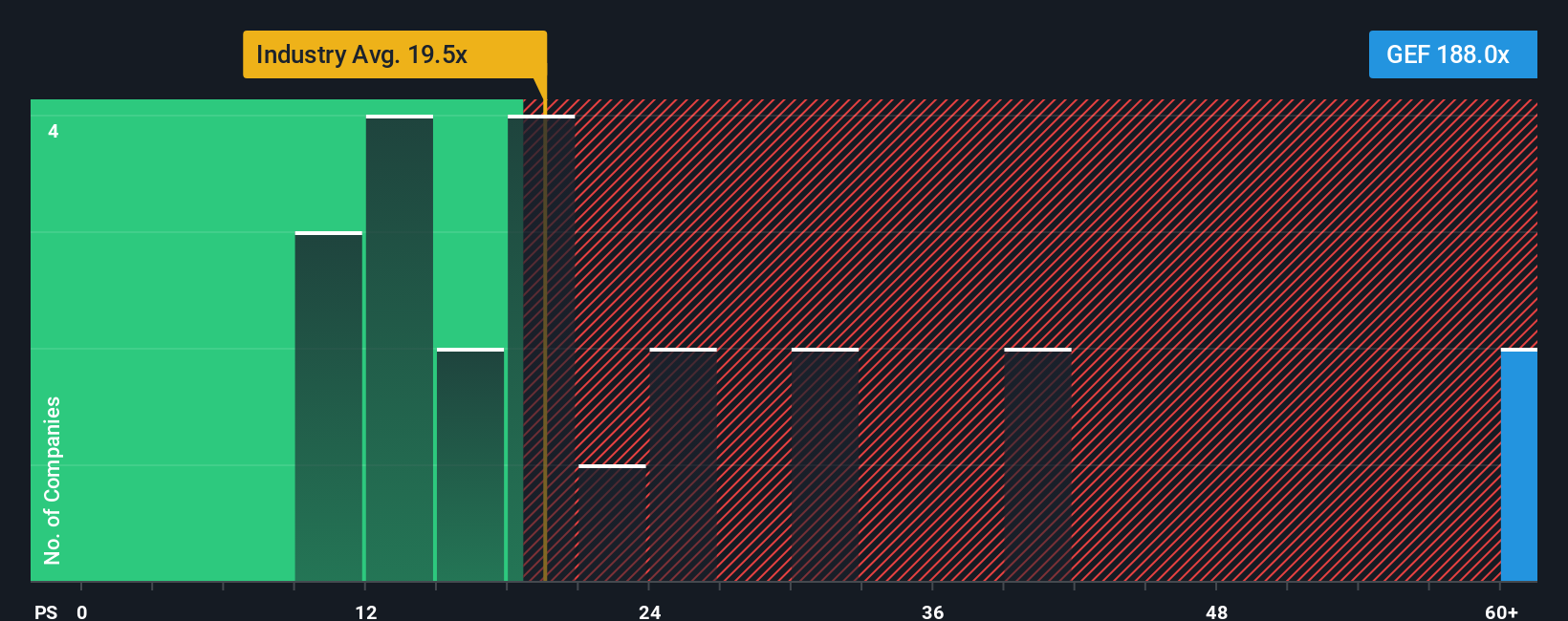

Looking at valuation through earnings ratios tells a more cautious story. Greif's price-to-earnings stands at 19.2 times, just above the industry average of 19 times and well above the global sector's 16 times. While analysts judge this as "expensive" versus peers, the fair ratio suggests the market could shift toward 22.9 times. This premium hints at a more limited margin of safety, and raises the question of whether the upside outweighs the risks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Greif Narrative

Every investor has their own angle. If you have a different take or want to test your own assumptions, you can shape a personalized view in just a few minutes with Do it your way

A great starting point for your Greif research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for Your Next Investment Advantage?

Don’t limit yourself to just one company when countless breakthrough opportunities are waiting. Uncover smarter strategies by targeting stocks poised for transformation and outperformance today.

- Unlock market-beating income with high-yield options using these 20 dividend stocks with yields > 3% and identify strong dividend payers ready to boost your returns.

- Capitalize on disruptive breakthroughs by starting with these 28 quantum computing stocks to access top innovators who are shaping the future of quantum computing.

- Accelerate your growth potential by seeking out these 843 undervalued stocks based on cash flows and find companies that the market is undervaluing right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEF

Greif

Produces and sells industrial packaging products and services worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026