- United States

- /

- Chemicals

- /

- NYSE:FUL

Evaluating H.B. Fuller (FUL): Is the Recent Pullback a Value Opportunity for Investors?

Reviewed by Simply Wall St

Shares of H.B. Fuller (FUL) have edged lower recently, catching investors’ attention with a mild pullback of around 2% over the past month. Investors may be pondering what is behind the current movement and where value now stands.

See our latest analysis for H.B. Fuller.

This recent pullback in H.B. Fuller’s share price is part of a broader trend, following a challenging year that saw the one-year total shareholder return fall over 23%. While the recent dip hints at waning momentum in the short term, the longer view suggests investors remain cautious as the company balances growth potential with shifting market sentiment.

If you want to see what’s catching investor attention beyond the materials sector, it could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares down for the year and trading at a noticeable discount to analyst price targets, the key question is whether H.B. Fuller’s current valuation offers a compelling entry point or if the market already reflects its future prospects.

Most Popular Narrative: 16.7% Undervalued

With H.B. Fuller's most-watched narrative assigning a fair value of $68.83, the latest close at $57.36 points to a sizable gap between market price and narrative projections. This disparity invites a closer look at what is driving optimism among narrative followers.

The company's strategic initiatives, such as optimizing the portfolio mix and streamlining the manufacturing cost structure, aim to drive the business toward a greater than 20% EBITDA margin target. These efforts could enhance profitability and earnings. H.B. Fuller's work in leveraging its unique operating model to reduce exposure to currency fluctuations and tariffs is designed to maintain a competitive edge and support margin expansion, which can improve net margins and financial stability.

Curious about how these bold strategic bets could play out? The story behind this narrative centers on powerful margin ambitions and a blueprint for transformation that could remake H.B. Fuller's valuation. Interested in the financial projections anchoring this price target? Unlock the full narrative for the catalysts and numbers driving the bullish case.

Result: Fair Value of $68.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges in the solar segment and higher raw material costs could threaten H.B. Fuller's profitability and slow anticipated margin improvements.

Find out about the key risks to this H.B. Fuller narrative.

Another View: What Do Multiples Say?

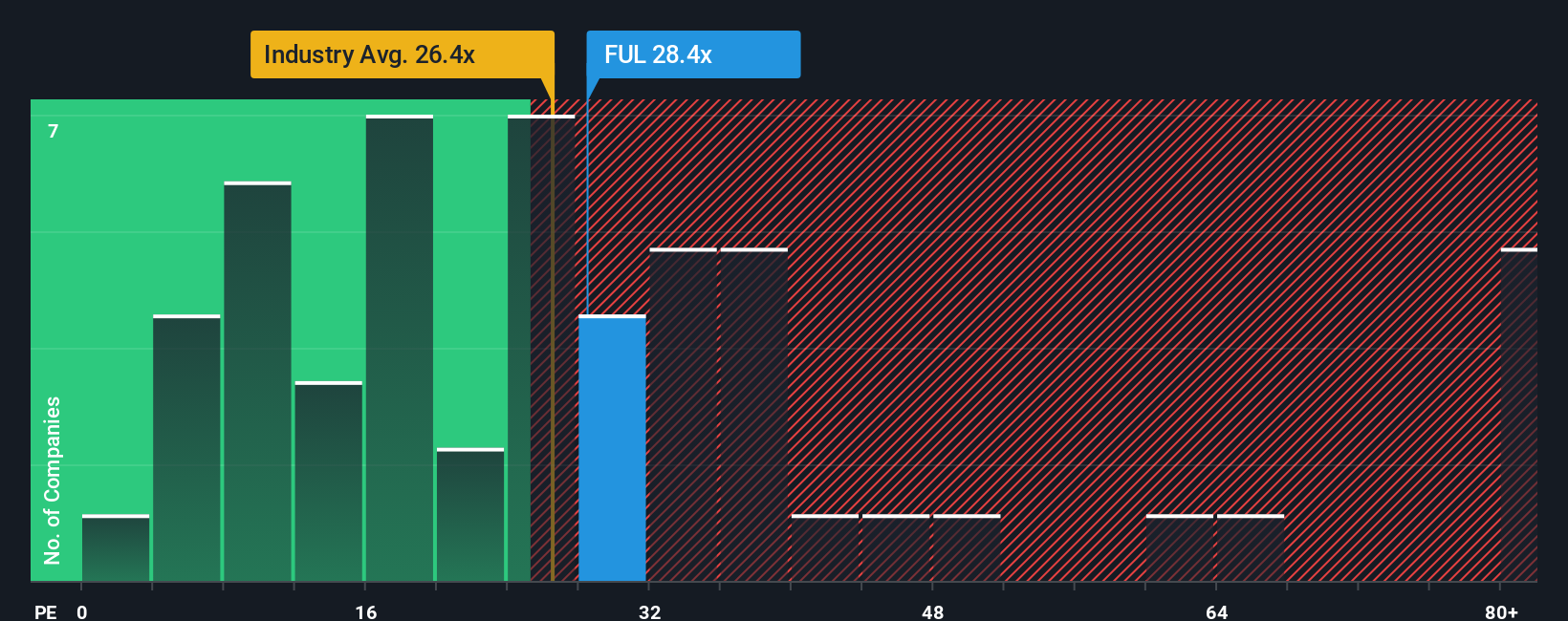

Taking a look at H.B. Fuller’s price-to-earnings ratio offers a different perspective. The shares trade at 27 times earnings, making them more expensive than both the US Chemicals industry average of 22.9x and the fair ratio estimate of 24.4x. This premium puts the spotlight on future earnings expectations, raising the question of whether the current price demands too much or if justified growth could narrow the gap.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own H.B. Fuller Narrative

If you see things differently or want to dive deeper into the data, you can build your own H.B. Fuller story in just a few minutes. Do it your way.

A great starting point for your H.B. Fuller research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass by. There are standout investments waiting for smart investors to act now, and the best ones are just a click away.

- Tap into reliable income streams and find attractive yields above 3% through these 16 dividend stocks with yields > 3%, helping you build a more rewarding portfolio.

- Spot the next breakthroughs in artificial intelligence by charting your path with these 25 AI penny stocks, and get in early on rapidly growing, innovative companies.

- Capitalize on potential market mispricings and maximize future upside with these 886 undervalued stocks based on cash flows, offering solid businesses currently overlooked by most investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H.B. Fuller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUL

H.B. Fuller

H.B. Fuller Company, together with its subsidiaries, formulates, manufactures, and markets adhesives, sealants, coatings, polymers, tapes, encapsulants, additives, and other specialty chemical products.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives