- United States

- /

- Chemicals

- /

- NYSE:FMC

Will Dividend Cut and Leadership Change Amid Losses Shift FMC's (FMC) Investment Narrative?

Reviewed by Sasha Jovanovic

- FMC Corporation recently reported a significant year-over-year revenue decline and a net loss of US$569.3 million for the third quarter of 2025, and announced a quarterly dividend cut and the upcoming departure of its president, Ronaldo Pereira, while director Carol Anthony Davidson increased her stake in the company through open-market share purchases.

- This series of developments highlights both the severity of FMC’s operational and financial challenges and the confidence shown by certain insiders amid analyst downgrades and earnings uncertainty.

- We’ll explore how FMC’s dividend reduction, aimed at debt prioritization, could reshape the company’s investment narrative moving forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

FMC Investment Narrative Recap

The core belief for an FMC shareholder centers on the company's ability to manage cyclical headwinds in crop protection through innovation, cost controls, and successful launches of new proprietary products. The recent sharp revenue decline and dividend cut bring added urgency to restoring profitability, elevating near-term execution risk around cash flow stabilization and debt reduction efforts. The primary short-term catalyst remains operational turnaround, while elevated leverage and market share loss in key regions stand out as the most significant threats, this news directly intensifies both, rather than signaling any material relief.

Among recent developments, the Board’s decision to reduce the quarterly dividend to US$0.08 per share is the most impactful in the near term. This move, aimed at prioritizing debt reduction over shareholder payouts, ties directly to both the urgent need for financial flexibility and the company’s ability to withstand continued margin pressure, both of which are under the microscope as revenue shrinks and losses mount.

Yet, in contrast to expectations of a near-term rebound, investors should be aware that FMC's high net leverage could further constrain future options if...

Read the full narrative on FMC (it's free!)

FMC's narrative projects $4.8 billion in revenue and $542.8 million in earnings by 2028. This requires 5.5% annual revenue growth and a $413.1 million increase in earnings from the current $129.7 million.

Uncover how FMC's forecasts yield a $27.44 fair value, a 97% upside to its current price.

Exploring Other Perspectives

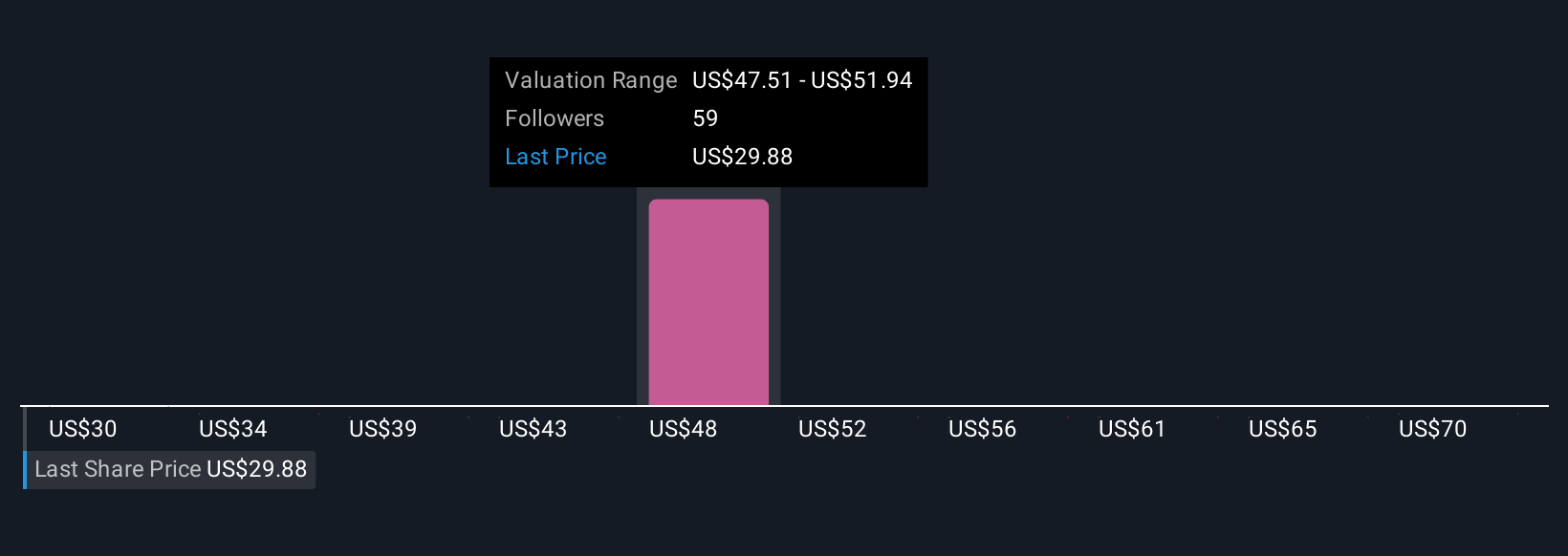

Seven members of the Simply Wall St Community see FMC's fair value spanning from US$27.44 to US$74.11 per share. Set this range against the ongoing risk of margin pressure from pricing declines and regulatory hurdles as you consider your own outlook on FMC’s performance.

Explore 7 other fair value estimates on FMC - why the stock might be worth just $27.44!

Build Your Own FMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FMC research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FMC's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives