- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Does Grasberg Mine Shutdown and Safety Lawsuits Alter the Investment Story for Freeport-McMoRan (FCX)?

Reviewed by Sasha Jovanovic

- In recent days, Freeport-McMoRan disclosed a temporary suspension of mining operations at its Grasberg Block Cave mine in Indonesia following a fatal incident involving trapped workers. Multiple class action lawsuits have since been filed claiming the company failed to disclose safety deficiencies and the resulting regulatory, litigation, and reputational risks.

- This wave of legal action and renewed scrutiny highlights how operational safety issues can rapidly escalate into broader financial and governance concerns for a global mining company.

- We’ll explore how this heightened regulatory and legal risk may influence Freeport-McMoRan’s investment narrative and outlook going forward.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Freeport-McMoRan Investment Narrative Recap

To own Freeport-McMoRan shares, investors typically need to believe in the crucial role of copper in global electrification and infrastructure, as well as the company’s ability to manage complex international operations, especially at the Indonesia-based Grasberg mine. The recent suspension at Grasberg due to safety incidents elevates immediate regulatory and legal risks and could materially affect production and cost structures, making operational continuity at Grasberg the most important short-term catalyst and key risk.

Among the company’s recent announcements, the fatal incident and resulting class action lawsuits tied directly to operational safety at the Grasberg Block Cave mine are most relevant here. This situation underscores the heightened scrutiny Freeport faces, potentially affecting both its ability to maximize production from its Indonesian assets and its regulatory relationships, central points for those monitoring the company's near-term prospects.

But while copper demand trends may support optimism, investors should be aware of how regulatory, legal, and reputational risks emerging from incidents at Grasberg could...

Read the full narrative on Freeport-McMoRan (it's free!)

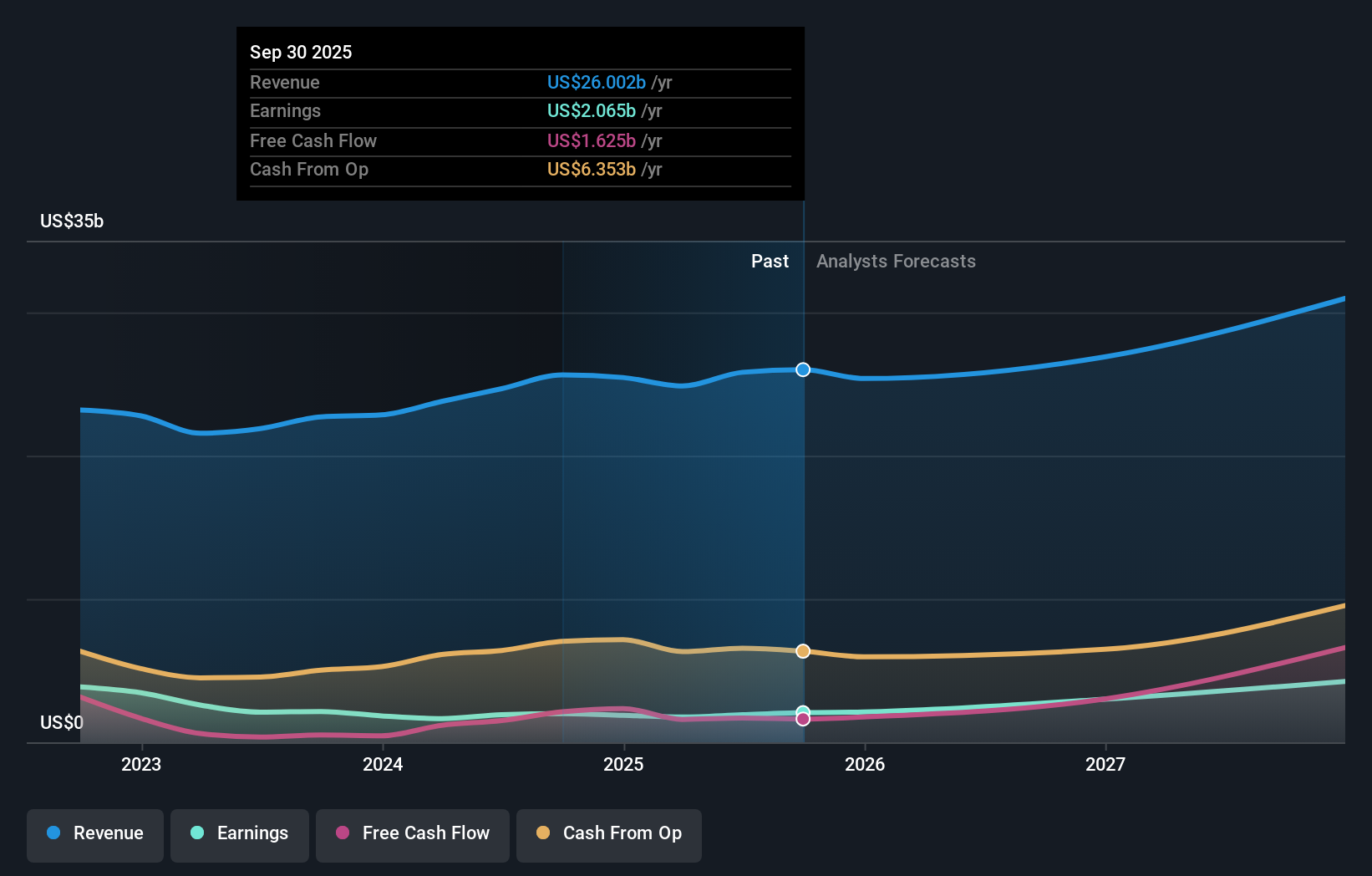

Freeport-McMoRan's outlook suggests $31.1 billion in revenue and $3.3 billion in earnings by 2028. This scenario is based on analysts forecasting a 6.4% annual revenue growth rate and a $1.4 billion increase in earnings from the current $1.9 billion level.

Uncover how Freeport-McMoRan's forecasts yield a $47.87 fair value, a 11% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community has submitted 9 fair value estimates for Freeport-McMoRan, with figures ranging widely from US$25.40 to over US$110.80 per share. These differing views reflect investor focus on both operational setbacks like those recently seen in Indonesia and the longer-term potential tied to copper’s global role, explore these alternative assessments for a fuller picture.

Explore 9 other fair value estimates on Freeport-McMoRan - why the stock might be worth over 2x more than the current price!

Build Your Own Freeport-McMoRan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freeport-McMoRan research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Freeport-McMoRan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freeport-McMoRan's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026