- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab (ECL): Evaluating Valuation as Shares Hover Near All-Time Highs

Reviewed by Simply Wall St

Ecolab (ECL) shares have been relatively steady this week, trading near $262 after a slight gain of just over 1% in the past month. Investors tracking Ecolab may be weighing recent performance trends as they look for the company’s next catalyst.

See our latest analysis for Ecolab.

Looking more broadly, Ecolab’s year-to-date share price return sits at a solid 13.5%, while its total shareholder return for the past twelve months is a respectable 6.6%. Over three years, long-term investors have enjoyed a strong 77% total return. This underscores steady compounding, even as recent momentum has cooled a bit.

If Ecolab’s long-haul growth story has you interested in what else is out there, now’s a great moment to seek out fast growing stocks with high insider ownership

With shares hovering near all-time highs and annual growth slowing, investors now face a familiar question: Is Ecolab attractively valued for future gains, or is the market already factoring in its next chapter?

Most Popular Narrative: 9.7% Undervalued

Ecolab’s most closely followed narrative points to a fair value calculation meaningfully above the latest close. The current trading price lags the fair value derived from bullish projections, setting the stage for some potentially surprising drivers.

Investments in digital technologies have led to improved productivity, resulting in a 190-basis-point increase in operating income margin. Continued investment in these technologies is anticipated to enhance earnings and operating margins further.

Want to see why digital innovations and bold margin targets define this outlook? The secret sauce of this valuation lies in strong future growth and ambitious profitability assumptions. Which core financial levers shape the market's top fair value estimate? Crack open the full narrative to uncover the key numbers and big bets driving this price target.

Result: Fair Value of $290.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer industrial demand or rising supplier costs could compress margins and challenge the optimistic outlook analysts have set for Ecolab’s future growth.

Find out about the key risks to this Ecolab narrative.

Another View: High Price Ratio Raises Questions

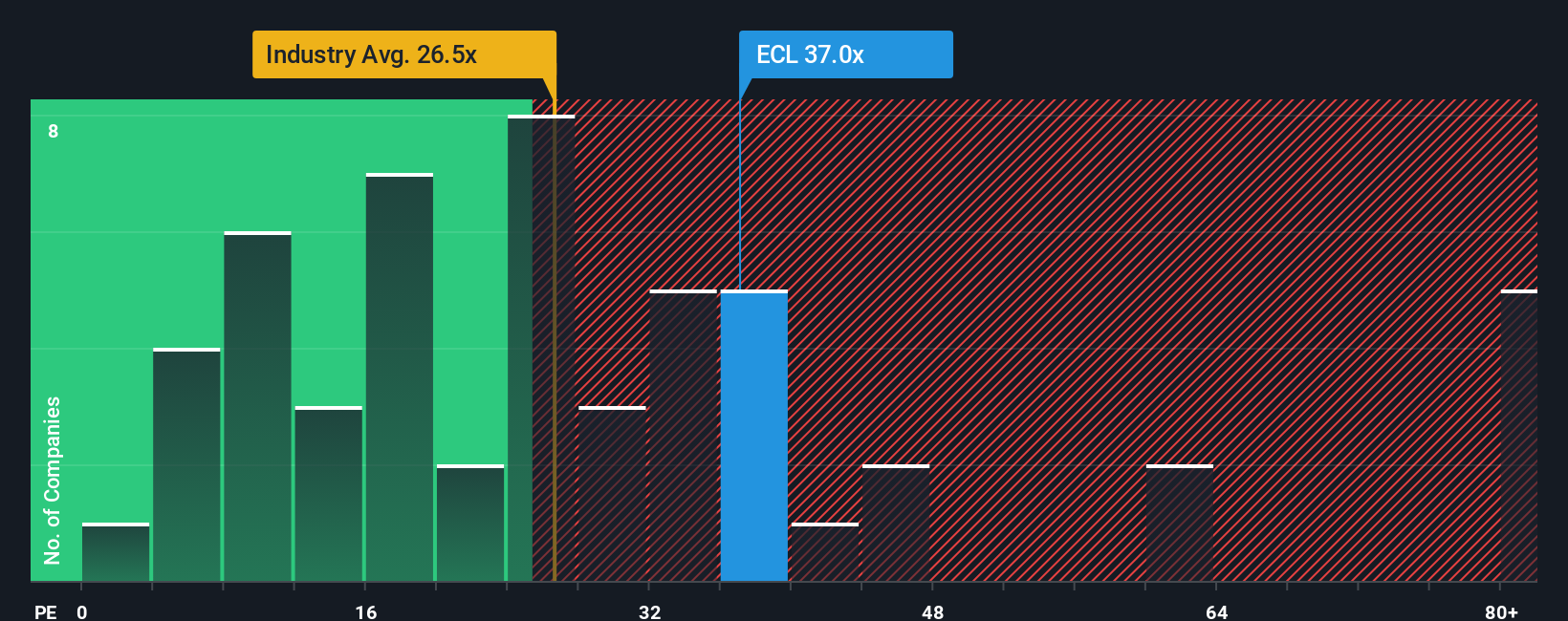

Our price-to-earnings comparison tells a different story. Ecolab shares trade at 37.4 times earnings, well above the US Chemicals industry average of 23.2 and even pricier than its peer average of 23.4. The fair ratio, based on market trends, lands at just 25.1 times earnings. This wide gap means investors are paying a hefty premium for future growth. Are those expectations really baking in the right level of risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ecolab Narrative

If the numbers or story here don’t match your take, dive into the data yourself and build a narrative in just a few minutes. Do it your way

A great starting point for your Ecolab research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that focused research can open doors to exciting opportunities. Go beyond the obvious and set yourself up to spot tomorrow’s standout performers.

- Unlock the growth potential of artificial intelligence by checking out these 25 AI penny stocks, which are shaking up established industries and outpacing the competition with cutting-edge innovation.

- Target steady income streams by reviewing these 15 dividend stocks with yields > 3%, offering robust yields greater than 3% and built for reliable long-term returns.

- Get ahead of fast-moving trends in digital assets by sizing up these 82 cryptocurrency and blockchain stocks, making waves in blockchain and crypto markets before the mainstream catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives