- United States

- /

- Chemicals

- /

- NYSE:DOW

A Look at Dow’s Valuation as Cost-Cutting and Closures Reshape Industry Outlook

Reviewed by Simply Wall St

Dow (DOW) has found itself front and center as recent coverage points to industry-wide belt-tightening, with plant closures and strict cost controls shaping investor expectations. These moves signal ongoing efforts to balance supply and demand, while significant cash reserves keep Dow in a position of strength during the downturn.

See our latest analysis for Dow.

Dow’s share price has struggled, with a year-to-date decline of nearly 40%, reflecting both soft demand and ongoing industry challenges. Management is taking decisive action to shore up the company’s position. Despite the recent 5.9% gain over the week, long-term total shareholder returns present a clear picture of the difficulties faced. A five-year total return of -41% suggests momentum remains subdued and sentiment has yet to shift decisively in Dow’s favor.

If you’re exploring what’s next and interested in broadening your investment approach, now’s the perfect time to discover fast growing stocks with high insider ownership.

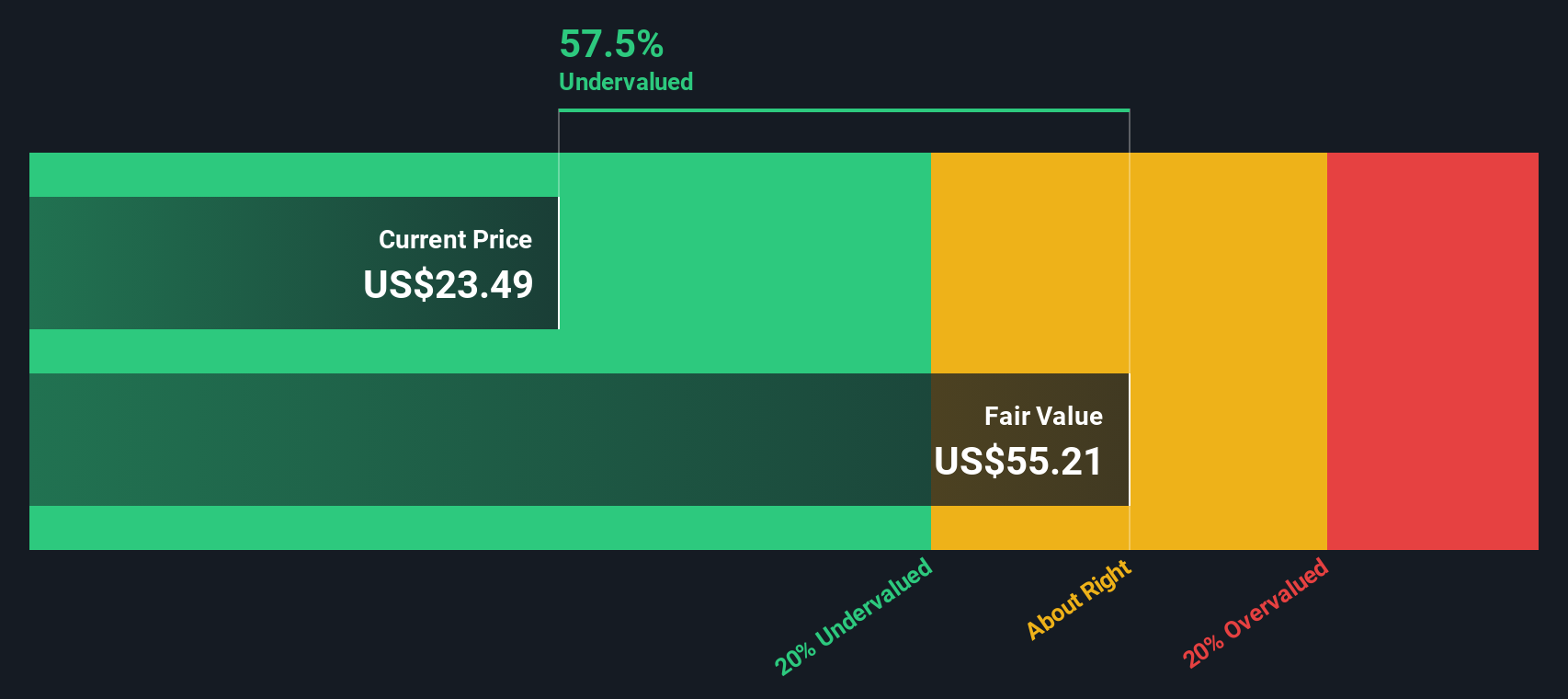

With recent cost cuts and supply adjustments stirring optimism, investors are left to wonder: is Dow’s beaten-down share price a sign of undervaluation and potential upside, or has the market already priced in any future recovery?

Most Popular Narrative: 14.3% Undervalued

The most widely tracked narrative places Dow’s fair value at $27.82, which is a notable premium to its last closing price of $23.85. Recent analyst conversations and updates have focused on key operational catalysts, setting the stage for changes that could meaningfully impact valuation.

Dow is targeting at least $1 billion in annual cost reductions by 2026, focusing on areas such as purchased services and contract labor. These cost-cutting measures aim to improve net margins and bolster earnings despite a challenging macroeconomic environment.

Wondering what’s driving this bullish price target? The main factors are transformative cost reduction initiatives and future profit projections that may stand out to some observers. Find out what the consensus believes could influence Dow's performance—are the underlying estimates ambitious, or simply reasonable?

Result: Fair Value of $27.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and sluggish macroeconomic growth remain significant hurdles. This casts doubt on a swift turnaround in Dow’s outlook.

Find out about the key risks to this Dow narrative.

Another View: What About Discounted Cash Flow?

While the current narrative focuses on price targets and operational catalysts, the SWS DCF model takes a different approach. According to our DCF analysis, Dow actually trades above its estimated fair value of $13.87. This suggests the stock may be overvalued by this measure. With such a stark contrast between the two methods, one might ask if the market’s expectations are running ahead of Dow’s real cash flow outlook.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dow for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dow Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own Dow narrative in under three minutes. Do it your way.

A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next opportunity to slip by. Use the Simply Wall Street Screener to uncover stocks poised for growth in sectors with high potential.

- Spot game-changing advancements by jumping into these 28 quantum computing stocks and see which innovators are at the forefront of quantum computing breakthroughs.

- Boost your income possibilities by tapping into these 15 dividend stocks with yields > 3%, featuring companies with attractive, reliable dividend yields above 3%.

- Capitalize on the future of healthcare advancements through these 30 healthcare AI stocks and reveal the firms transforming medicine with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026