- United States

- /

- Chemicals

- /

- NYSE:DD

How Investors Are Reacting To DuPont (DD) Breaking Ground on a New Lubricants Plant in China

Reviewed by Sasha Jovanovic

- DuPont de Nemours recently broke ground on a new MOLYKOTE specialty lubricants manufacturing plant in Zhangjiagang, Jiangsu Province, China, with the facility expected to be operational by early 2027.

- This move highlights DuPont’s focus on expanding production capabilities and innovation in high-demand markets, particularly within transportation, industrial, energy, and electronics segments in China.

- We'll now explore how the launch of DuPont's new lubricants plant in China could influence its future growth outlook and investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

DuPont de Nemours Investment Narrative Recap

To become a DuPont de Nemours shareholder, you need conviction in its ability to balance long-term innovation in specialty chemicals with near-term financial discipline and portfolio management. The launch of the new MOLYKOTE plant in China underscores a focus on regional growth and product innovation, but this development does not materially shift the near-term catalyst, which remains centered on the restructuring of DuPont’s electronics segment and the potential sale of key assets.

The most relevant recent announcement is DuPont’s tender offer for its senior notes, one step in reshaping its capital structure following the planned electronics separation. This move is directly aligned with the company's need to reinforce balance sheet strength and optimize for future investments, which is crucial as DuPont manages both portfolio transformation and legal risk exposure.

By contrast, investors should be mindful that ongoing PFAS-related legal liabilities could weigh on future earnings and cash flow stability if...

Read the full narrative on DuPont de Nemours (it's free!)

DuPont de Nemours' outlook projects $14.0 billion in revenue and $1.7 billion in earnings by 2028. This forecast is based on an annual revenue growth rate of 3.7% and an earnings increase of $1.629 billion from the current earnings of $71.0 million.

Uncover how DuPont de Nemours' forecasts yield a $47.25 fair value, a 19% upside to its current price.

Exploring Other Perspectives

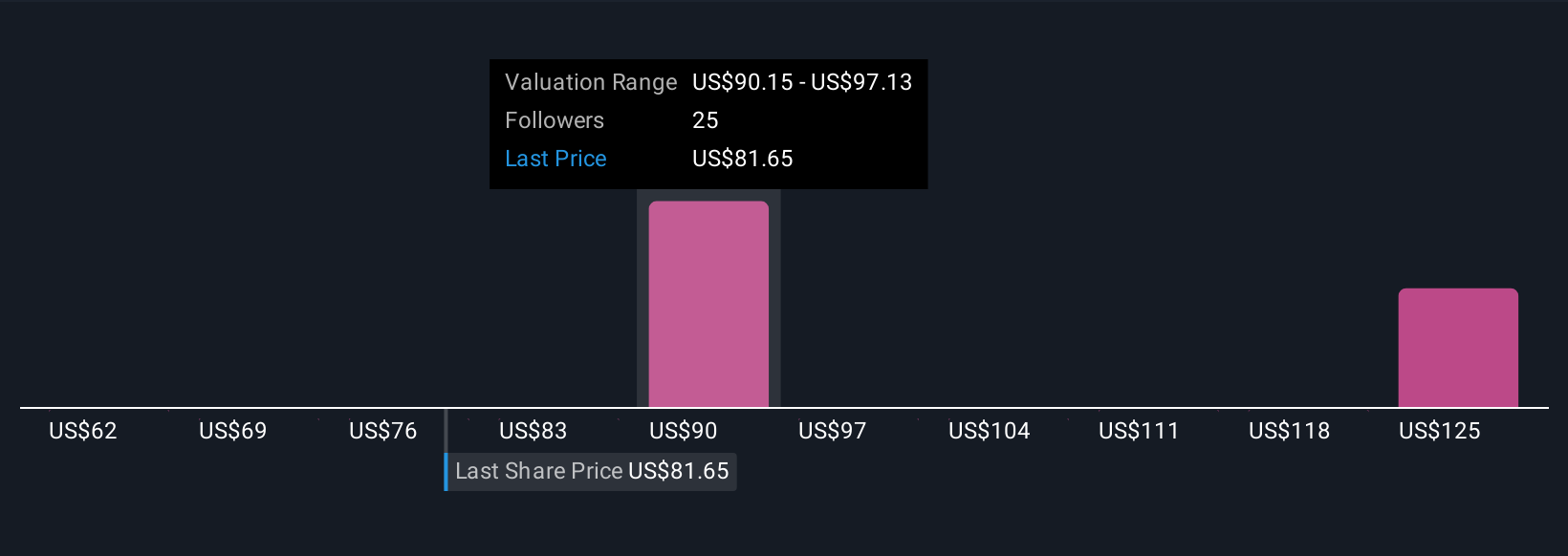

Four Simply Wall St Community members estimate DuPont’s fair value between US$41.45 and US$62.26 per share, reflecting sharply differing opinions. While many see innovation as a key driver, unresolved environmental settlements continue to add uncertainty to DuPont’s earnings outlook, making it worthwhile to review other viewpoints.

Explore 4 other fair value estimates on DuPont de Nemours - why the stock might be worth as much as 57% more than the current price!

Build Your Own DuPont de Nemours Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DuPont de Nemours research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free DuPont de Nemours research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DuPont de Nemours' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026