- United States

- /

- Chemicals

- /

- NYSE:CTVA

Corteva (CTVA) Profit Margin Surge Reinforces Bullish Narratives Despite Slower Growth Forecasts

Reviewed by Simply Wall St

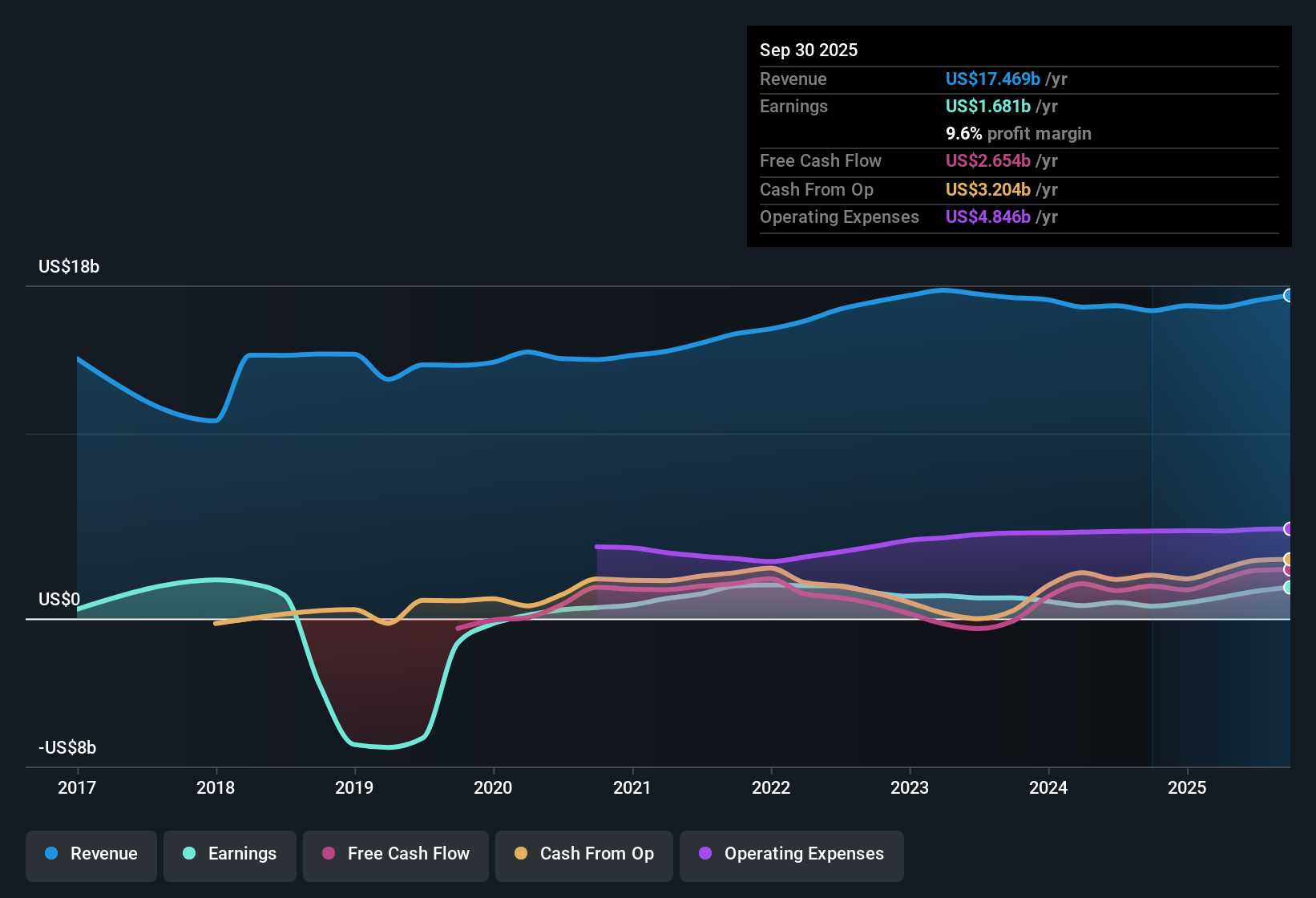

Corteva (CTVA) posted a sharp turnaround in profitability this quarter, with net profit margins reaching 8.6% compared to last year’s 5.2%, and EPS outcome reflecting 68.1% growth over the past twelve months. Despite this rebound, forward-looking forecasts show earnings expected to grow at 12.1% per year and revenue at 2.7% per year, both trailing wider US market growth expectations. The current share price of $63.67 still sits below an internal fair value estimate of $94.37. Investors are likely to focus on the higher earnings quality and improved margin profile this season, weighing these against the stock’s relatively high price-to-earnings multiple and moderate future growth outlook.

See our full analysis for Corteva.The next section breaks down how these latest numbers compare to the market’s narratives, highlighting where the consensus view gets reinforced and where it might need a rethink.

See what the community is saying about Corteva

Margins Expand Amid Cost Initiatives

- Net profit margins reached 8.6%, well above last year’s 5.2%. This marks one of the strongest improvements in recent years and highlights successful cost optimization efforts.

- Analysts' consensus view points to margin expansion driven by strategic moves such as digitalization and penetration into high-growth regions. However, they caution that continued margin gains will depend on maintaining operational discipline.

- Margin expansion is forecasted to rise further, with analysts projecting an increase to 12.2% over the next three years. Achieving this goal will require steady gains from product mix and operational leverage.

- Critics note that any slowdown in cost savings or disruption from competition could limit how far margins can actually expand, despite the recent quick rebound.

- Surpassing historical trends, earnings have grown 68.1% over the past twelve months, following a five-year stretch that saw average declines of 4.6% annually. This growth is notable given the past negative momentum.

Consensus leans positive, but the real debate is whether today’s margin jump is sustainable or a one-off effect. See how analysts weigh both sides in the full consensus narrative. 📊 Read the full Corteva Consensus Narrative.

Growth Forecasts Trail Market Hopes

- Future revenue is forecasted to grow by 2.7% per year and earnings at 12.1% annually. Both figures fall short of broader US market expectations, which raises questions about how much of the recent momentum will carry forward.

- Analysts' consensus view is optimistic on new technologies and resilient seed demand fueling growth, yet flags increased competition and limited pricing power as headwinds that could cap long-term expansion.

- Demand for premium traits, biologicals, and gene editing tech is seen as a driver for future growth. However, consensus warns that changing consumer preferences and regulatory hurdles could limit gains in some product lines.

- Market share improvements in regions like Latin America and Asia-Pacific look promising, but volatility in global crop prices and currency fluctuations remain persistent risks to hitting those growth targets.

Premium Valuation Despite Modest Growth

- Corteva trades at a price-to-earnings ratio of 29.4x, higher than the US Chemicals industry average of 26.4x and peers at 25.9x. Its share price of $63.67 currently lags both the consensus analyst target of $77.90 and DCF fair value of $94.37.

- Analysts' consensus view sees the valuation premium as justified by high-quality earnings and margin upside, but urges investors to reassess forecasts and notes that relying on ongoing multiple expansion is risky if sector growth remains muted.

- Bulls point to the gap between today’s share price and DCF fair value as an opportunity, with the 8.6% margin and improving trends supporting optimism.

- On the other hand, consensus questions whether a PE multiple this far above peers can persist if revenue and earnings growth remain slower than the sector average.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Corteva on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different angle on the numbers? Jump in and craft your own story of Corteva’s performance. Bring your perspective to life in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Corteva.

See What Else Is Out There

Corteva’s premium valuation and slower forecasted growth raise concerns about whether current optimism can last if earnings momentum fades.

If you prefer companies trading at more attractive valuations with stronger growth potential, compare your options using our these 836 undervalued stocks based on cash flows while the opportunity is still out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives