- United States

- /

- Metals and Mining

- /

- NYSE:CSTM

Constellium (CSTM) Is Up 8.2% After Revenue Jumps 11% Despite Lower Earnings Per Share

Reviewed by Sasha Jovanovic

- In recent days, Constellium reported a downward trend in earnings per share alongside an 11% year-on-year increase in revenue, prompting a notable reaction from the market.

- This combination suggests investors may be focusing more on the company’s improving sales performance than on short-term profit declines.

- We'll examine how the recent revenue growth shapes Constellium’s investment narrative and outlook for long-term performance.

Find companies with promising cash flow potential yet trading below their fair value.

Constellium Investment Narrative Recap

To own shares in Constellium, it's important to believe in the growing global demand for lightweight, sustainable aluminum solutions and the company's ability to capitalize on this shift, particularly as it expands into packaging and high-performance materials. The recent 11% revenue increase paired with softer earnings per share has not materially shifted the company's biggest short-term catalyst, growing end-market adoption, though it does keep margin sensitivity and energy cost volatility at the forefront as the primary risk.

The extension of Constellium's long-term partnership with Embraer offers context for this quarter’s revenue growth, reinforcing sustained demand from the aerospace sector. This supports optimism around shipment volumes but keeps the focus tight on Constellium's exposure to possible demand weakness in its key end markets, especially as the industry outlook remains subject to rapid change.

In contrast, if shipment declines in the automotive or aerospace segments persist beyond current expectations, investors should be aware of how quickly revenue resilience might change…

Read the full narrative on Constellium (it's free!)

Constellium's narrative projects $9.9 billion revenue and $448.3 million earnings by 2028. This requires 9.3% yearly revenue growth and a $416.3 million earnings increase from $32.0 million today.

Uncover how Constellium's forecasts yield a $20.12 fair value, a 20% upside to its current price.

Exploring Other Perspectives

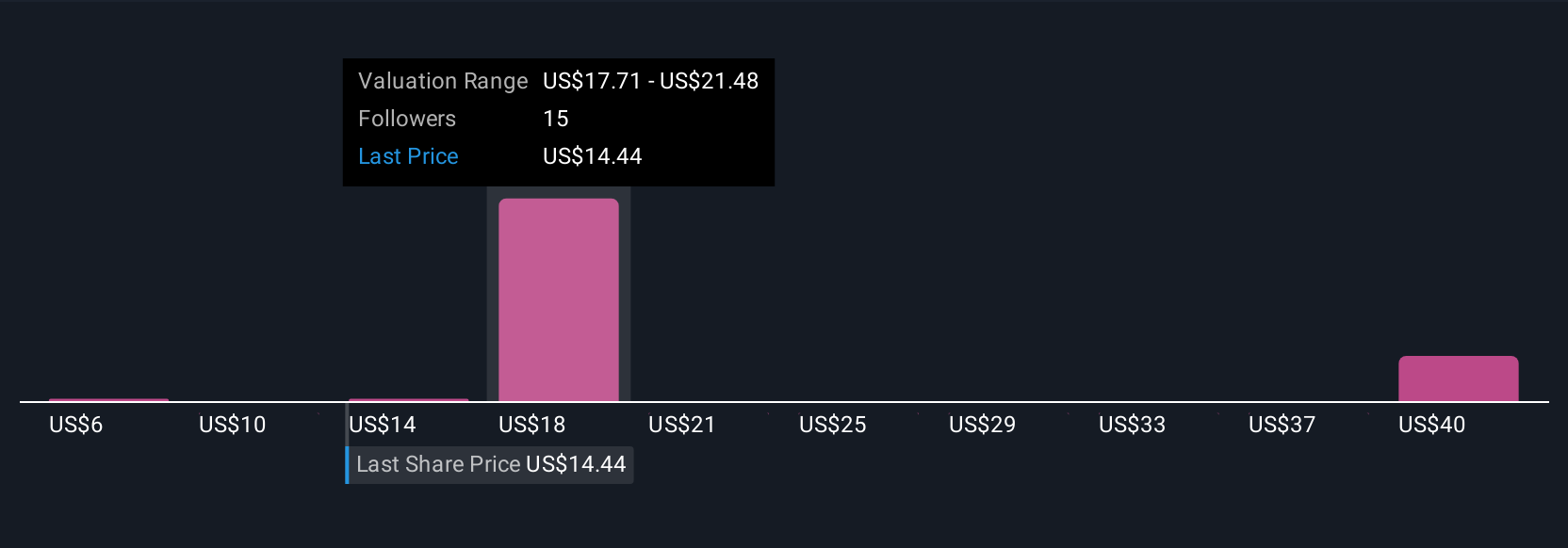

Four members of the Simply Wall St Community see Constellium's fair value between US$6.40 and US$42.24, with the highest estimate more than six times the lowest. In light of these wide opinions, remember that ongoing demand from markets like aerospace can shape Constellium's future risk and reward profile in ways each investor weighs differently.

Explore 4 other fair value estimates on Constellium - why the stock might be worth over 2x more than the current price!

Build Your Own Constellium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellium research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellium's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSTM

Constellium

Engages in the design, manufacture, and sale of rolled and extruded aluminum products for the aerospace, packaging, automotive, commercial transportation, general industrial, and defense end-markets.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026