- United States

- /

- Basic Materials

- /

- NYSE:CRH

CRH (NYSE:CRH): Assessing Valuation Following Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for CRH.

After a strong rally earlier in the year, CRH's share price has given back a bit of momentum recently, with a 2% dip over the past month. Still, the stock is firmly in positive territory for 2024, and its impressive 3-year total shareholder return of over 260% continues to underscore the company's long-term growth story.

If you're curious to see what other companies have been gaining ground, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With CRH’s strong multi-year returns and recent price consolidation, investors may be wondering if the company is trading at a bargain level now, or if current prices already reflect all of its growth potential.

Most Popular Narrative: 13% Undervalued

CRH's most widely followed narrative points to the stock trading well below its consensus fair value, as the last close price trails the estimated target. This sets up deeper insights into why expectations for future growth are supporting a substantially higher price target.

The ongoing rollout of U.S. federal infrastructure funding (less than 40% of the IIJA highway funds have been spent), and an encouraging outlook for the next highway bill, create a substantial, multi-year runway for demand in CRH's core public infrastructure segments. This offers the prospect for sustained revenue growth and backlog visibility.

Curious what key financial drivers are bold enough to justify this gap between current price and future target? There are aggressive profit forecasts, an earnings growth pathway, and a margin expansion story that only become clear once you break down the underlying narrative assumptions. You’ll want to see which projection makes or breaks that 13% upside.

Result: Fair Value of $133.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, CRH’s exposure to shifts in public infrastructure funding and the challenges of integrating acquisitions could disrupt its earnings outlook and future growth trajectory.

Find out about the key risks to this CRH narrative.

Another View: Comparing Market Ratios

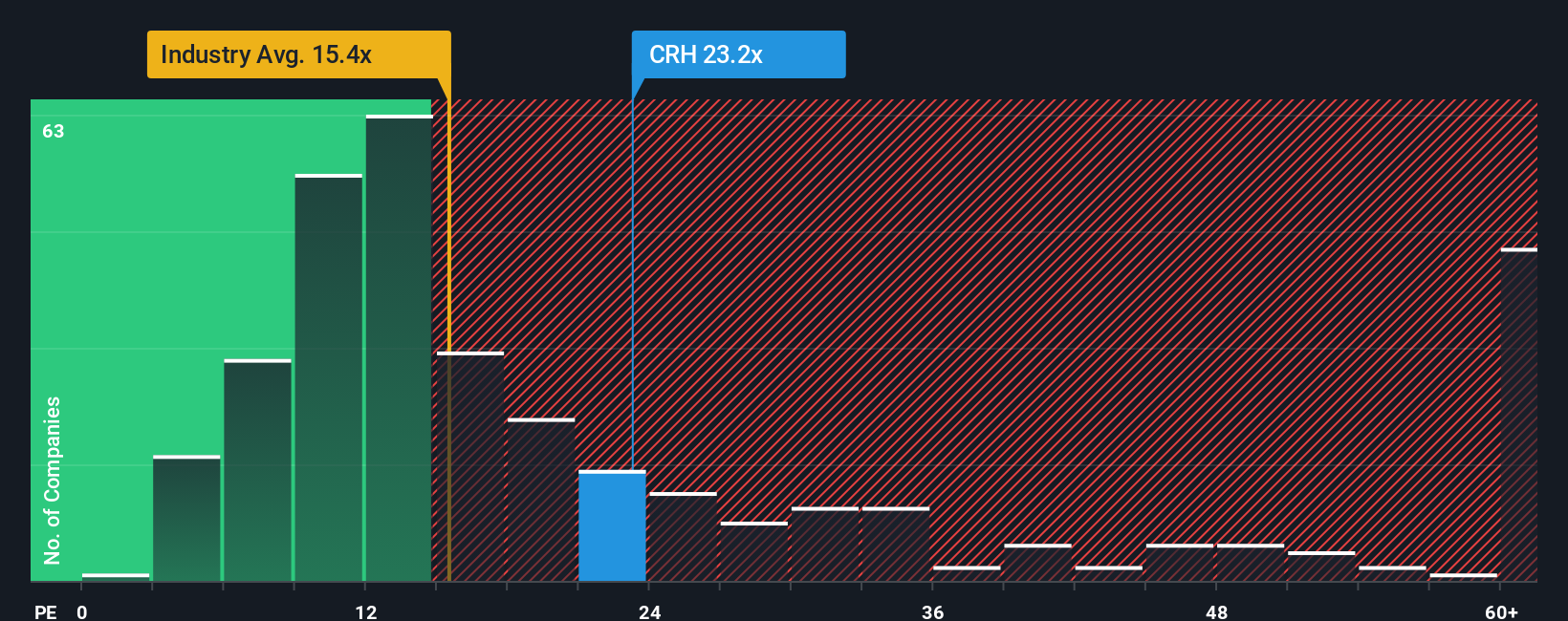

While the earlier valuation leans on future earnings, a look at CRH's price-to-earnings ratio shows a different angle. At 23.7x, CRH trades above the sector average of 15.1x but below peer averages (26.8x) and its fair ratio of 26.2x. This gap highlights both valuation risk and upside room depending on which level the market focuses on next. Is the company expensively priced or does the market see untapped potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRH Narrative

If you think the numbers tell a different story or want to shape your own view, you can dive into the data and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your CRH research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Expand your options and get ahead of the market by putting Simply Wall Street’s expert screeners to work. Don’t let the next big winner pass you by!

- Grab steady income opportunities and secure your portfolio with these 20 dividend stocks with yields > 3%, featuring companies yielding over 3%.

- Catch the AI boom early by tapping into these 25 AI penny stocks, which includes companies at the forefront of artificial intelligence breakthroughs.

- Unlock missed value with these 840 undervalued stocks based on cash flows, where strong cash flows can signal potential bargains that others may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRH

CRH

Provides building materials solutions in Ireland, the United States, the United Kingdom, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives