- United States

- /

- Basic Materials

- /

- NYSE:CRH

CRH (CRH) Is Up 6.2% After S&P 500 Inclusion Speculation and Buyback Expansion - What's Changed

Reviewed by Sasha Jovanovic

- In recent days, CRH plc emerged as a top candidate for inclusion in the S&P 500 during the index's upcoming rebalancing, while also updating shareholders on its voting rights and launching further share buybacks as part of its capital management program.

- This potential S&P 500 inclusion is significant, as it often attracts considerable passive investment, prompting renewed attention on the company’s global positioning in construction materials and investor flows.

- With widespread anticipation of S&P 500 inclusion, we'll explore how this heightened index attention could shape CRH's current investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

CRH Investment Narrative Recap

To be a CRH shareholder today, one needs to believe in the resilience and growth potential of publicly funded infrastructure, especially in the US, and management’s ability to navigate political and industry shifts. The recent S&P 500 inclusion speculation reinforces near-term optimism by drawing index fund flows, but doesn’t materially change the key catalyst, continued visibility on US infrastructure spending, or the biggest risk, which remains potential changes in government funding priorities or economic slowdowns impacting major end markets.

Among recent announcements, CRH’s ongoing share buyback program, set to repurchase up to US$300 million in shares by February 2026, stands out as particularly relevant. It aligns with the company’s broader goal to enhance shareholder value while index attention is heightened, though the buyback itself does not meaningfully impact the underlying political risk tied to infrastructure spending in the US.

Yet, despite robust capital initiatives, investors should be aware of the possibility that shifts in federal or state infrastructure funding priorities could...

Read the full narrative on CRH (it's free!)

CRH's outlook anticipates $43.1 billion in revenue and $4.9 billion in earnings by 2028. This projection implies a 5.9% annual revenue growth rate and a $1.6 billion increase in earnings from the current $3.3 billion.

Uncover how CRH's forecasts yield a $134.46 fair value, a 12% upside to its current price.

Exploring Other Perspectives

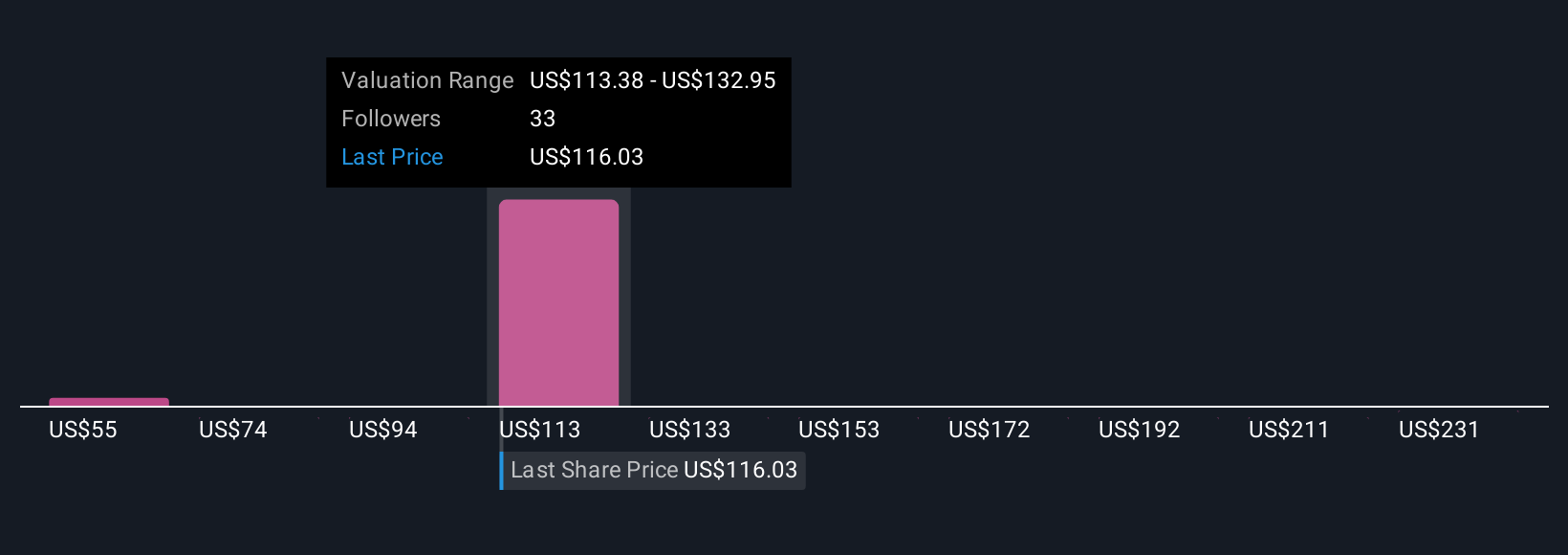

Simply Wall St Community fair value estimates for CRH range widely from US$54.67 to US$250.38, with seven perspectives included. Against that backdrop, the critical exposure to US infrastructure policy means shifts in funding could influence outcomes far beyond today’s consensus, inviting you to explore what others expect next.

Explore 7 other fair value estimates on CRH - why the stock might be worth over 2x more than the current price!

Build Your Own CRH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRH research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CRH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRH's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRH

CRH

Provides building materials solutions in Ireland, the United States, the United Kingdom, rest of Europe, and internationally.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026