- United States

- /

- Metals and Mining

- /

- NYSE:CMC

Commercial Metals (CMC): One-Off $368.5M Loss Drives Margin Downturn, Challenges Bullish Narratives

Reviewed by Simply Wall St

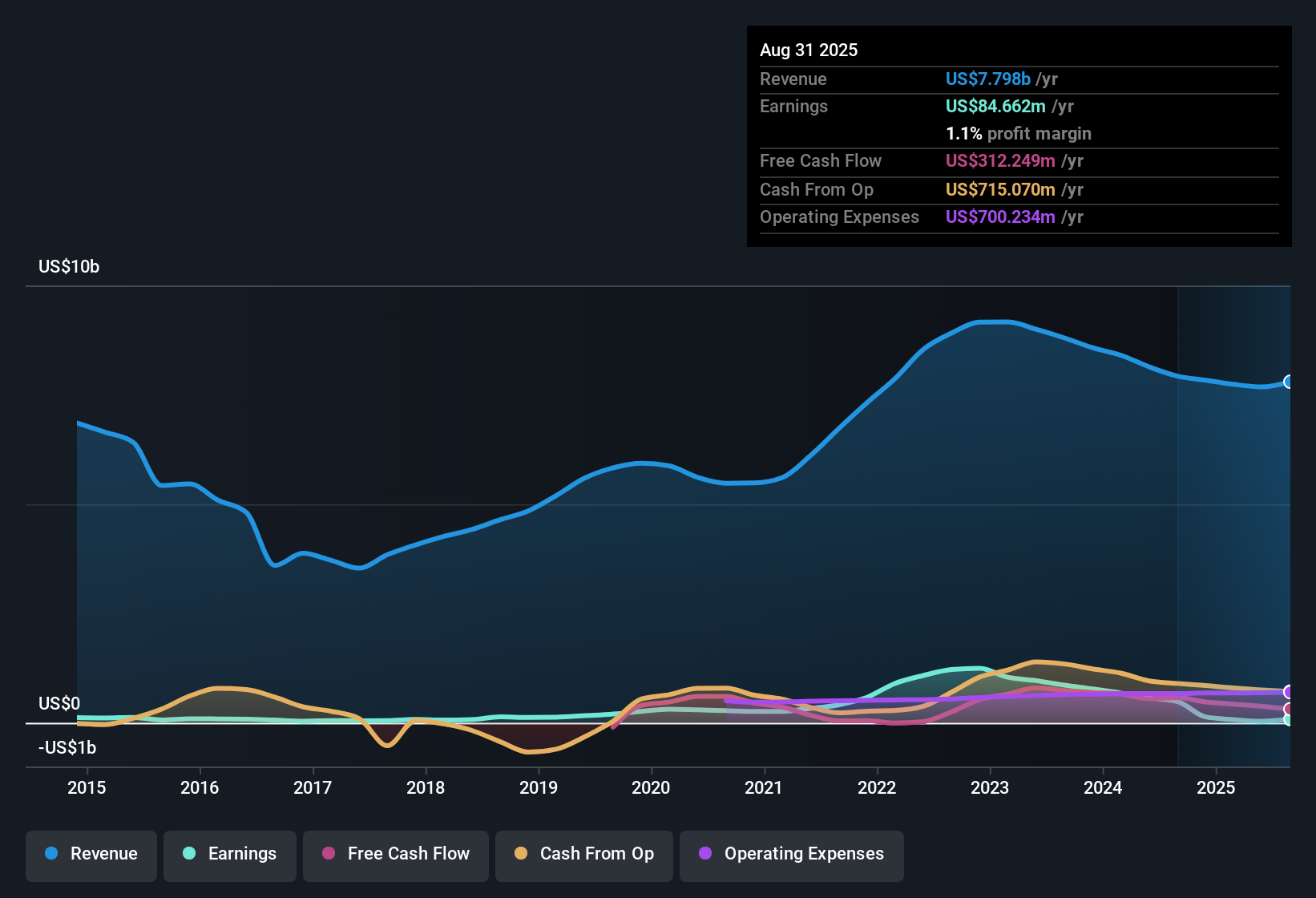

Commercial Metals (CMC) posted a significant one-off loss of $368.5 million for the twelve months ending August 31, 2025, which weighed heavily on its earnings picture. Net profit margins dropped to 0.5%, well below last year’s 7%, and annual earnings have declined at an average rate of 4% per year over the last five years. Despite this, CMC’s price-to-sales ratio stands at just 0.8x, comfortably below industry and peer averages, and shares are trading at $55.35, a notable discount to the estimated fair value of $75.83. Investors face a clear contrast between depressed profitability and attractive valuation multiples as they digest the recent results.

See our full analysis for Commercial Metals.Next, we will compare these financial results to the dominant market narratives, highlighting where consensus aligns and where the latest numbers prompt a rethink.

See what the community is saying about Commercial Metals

Margin Expansion Remains Analysts' Focus

- Analysts project CMC's profit margins will increase from today's 0.5% to 10.3% over the next three years, reversing the recent slide visible after the $368.5 million one-off loss.

- According to the consensus narrative, long-term cost savings and new production capacity are central to this margin improvement.

- Strategic investments including the TAG program and upcoming mill expansions are aimed at raising earnings by capturing economies of scale and operational efficiencies.

- Consensus narrative notes these efforts could permanently lift margins and bring annual net profits from $36.8 million today closer to $948.4 million by 2028 if all goes to plan.

Curious how analysts think CMC’s profit margins will stack up in the coming years? 📈 Read the full Commercial Metals Consensus Narrative.

Risks from Expansion and Market Shifts

- CMC’s major projects, like the Arizona 2 micro mill and Steel West Virginia site, promise growth but also carry operational risks. Startup inefficiencies and delays may affect profitability as noted in the consensus narrative.

- Analysts highlight several risks. Rising interest rates could slow construction demand, increased competition may limit pricing power, and revenue from new capacity remains sensitive to global trade tensions.

- Bears would point to potential for higher costs related to weather or supply chain hiccups, and the company’s reliance on improvement in the European segment amid geopolitical uncertainty.

- Consensus narrative calls out that the influx of industry-wide rebar supply could pressure margins, challenging the view that expansion alone guarantees earnings upside.

Valuation Still Attractive versus Peers

- CMC's price-to-sales ratio is just 0.8x, well below the sector average of 3.4x and the peer average of 1.5x. Shares are priced at $55.35, a 27% discount to DCF fair value ($75.83).

- Consensus narrative views this deep discount as both a potential opportunity and a recognition of current profitability challenges.

- Analysts pin a consensus price target near the current share price, suggesting the market already factors in both the upside from margin recovery and the near-term headwinds.

- The valuation gap remains compelling for investors who believe in management’s turnaround and expansion strategy, but caution persists due to earnings volatility seen in recent years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Commercial Metals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your unique perspective and shape your own interpretation in just a few minutes by participating here: Do it your way.

A great starting point for your Commercial Metals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

While Commercial Metals offers an appealing valuation, recent results highlight profit volatility, margin pressure from expansion risks, and earnings setbacks compared to steadier peers.

If you’d prefer to target reliable growth and proven stability, use stable growth stocks screener (2097 results) to find companies consistently delivering strong results regardless of economic swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives