- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF): Assessing Valuation After $951M Equity Raise and New POSCO Partnership

Reviewed by Simply Wall St

Cleveland-Cliffs (CLF) just completed a $951 million equity offering and unveiled a strategic partnership with POSCO. These moves signal efforts to boost its capital position and expand within the evolving U.S.-Korea industrial landscape.

See our latest analysis for Cleveland-Cliffs.

Shares of Cleveland-Cliffs have seen some wild swings lately, down more than 21% over the past month, as investors digested the substantial equity raise and evolving industrial partnerships. Despite short-term volatility, the company’s 8% year-to-date share price return shows momentum is building, even though its one-year total shareholder return remains in negative territory.

If these bold strategic moves have you curious about what else is changing in the market, it might be the perfect time to discover fast growing stocks with high insider ownership.

With shares trading below analyst targets, recent capital moves and partnerships raise the question: Is Cleveland-Cliffs an undervalued play on future growth, or has the market already priced in the upside?

Most Popular Narrative: 19% Undervalued

With Cleveland-Cliffs trading at $10.32, the most widely followed narrative places its fair value much higher at $12.76. This gap highlights a potential opportunity, driven by bold assumptions about the company’s profit trajectory and strategic moves.

Asset sales and ongoing working capital reductions are set to accelerate deleveraging and unlock latent value. Proceeds from noncore divestitures provide additional flexibility for debt paydown, lowering interest costs and improving both net margins and financial resilience.

Ever wonder what’s powering this bullish price target? The narrative leans hard on major margin gains and an ambitious recovery in earnings. The real intrigue lies in the aggressive forecasts for future profits and just how much the market needs to re-rate Cleveland-Cliffs for those targets to hold up. The math behind this valuation may surprise you.

Result: Fair Value of $12.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks that could shift the story, such as softening U.S. steel tariffs or delayed recovery in automotive demand.

Find out about the key risks to this Cleveland-Cliffs narrative.

Another View: What About Multiples?

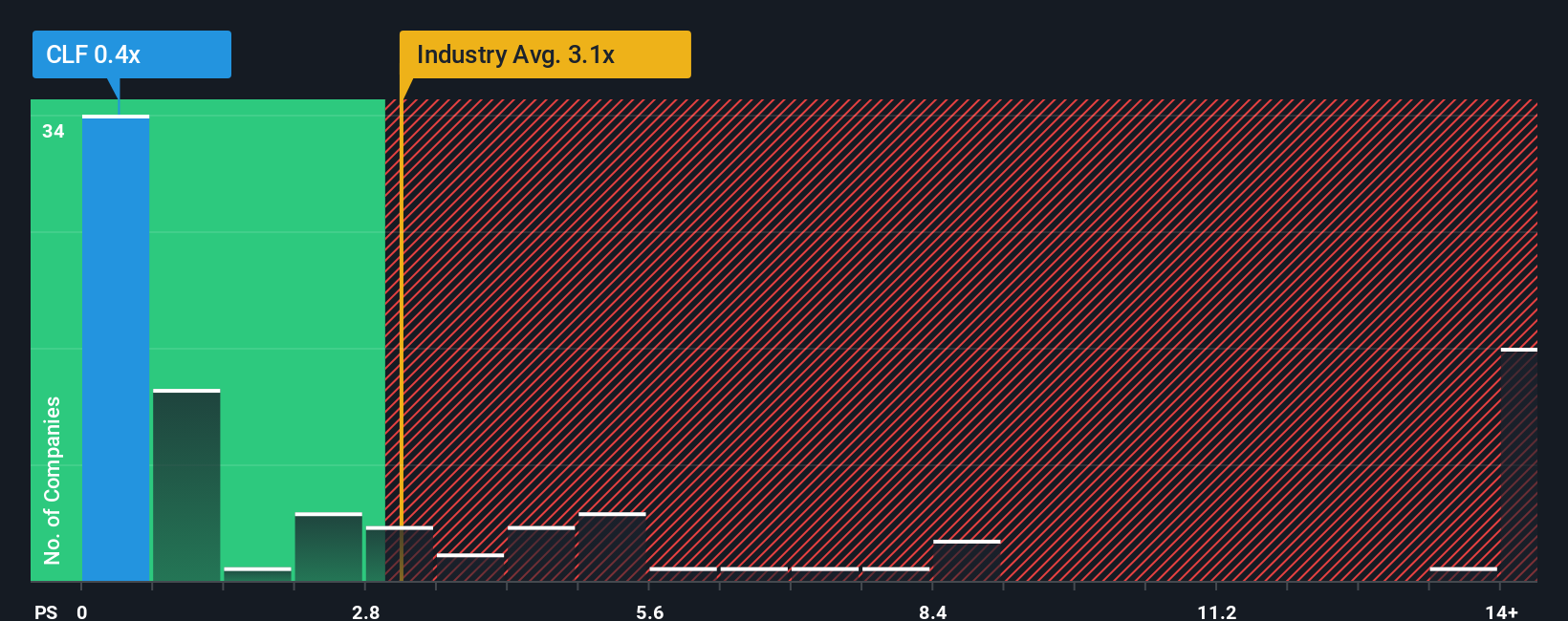

While fair value estimates point to upside, Cleveland-Cliffs is trading at just 0.3 times sales, which is far below the US Metals and Mining industry average of 2.8 times and the peer average of 1.9 times. Even compared to its fair ratio of 0.5, the discount stands out. This deep gap begs the question: Is the market missing an opportunity, or are risk factors holding shares back?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cleveland-Cliffs for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cleveland-Cliffs Narrative

If you’re not convinced by these takes or want to see what your own research uncovers, it’s easy to build a fresh narrative in just minutes. Do it your way.

A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Some of the market’s most exciting opportunities are just a click away. If you want to get ahead, don’t let these powerful stock ideas pass you by.

- Unlock growth by targeting tech innovators reshaping our digital future. Start with these 24 AI penny stocks and see which companies are changing the game.

- Capture strong cash flow potential and remarkable discounts with these 865 undervalued stocks based on cash flows, focusing on businesses where valuations are set for a turnaround.

- Tap into reliable income streams by checking out these 16 dividend stocks with yields > 3% and find stocks offering attractive yields above 3% for portfolio stability and returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives