- United States

- /

- Chemicals

- /

- NYSE:CBT

Will Cabot (CBT) Balance Expansion and Sector Pressures After Bridgestone Acquisition Deal?

Reviewed by Sasha Jovanovic

- Cabot Corporation recently reported fourth quarter and full year results, revealing declines in sales and net income compared to the previous year, and announced an agreement to acquire Bridgestone’s reinforcing carbon plant in Mexico, expected to close in the second fiscal quarter.

- This acquisition, combined with ongoing sector challenges in Cabot’s core segments, underscores the company’s focus on both addressing current headwinds and expanding its capabilities in key industrial markets.

- We’ll explore how the Bridgestone acquisition agreement and sector challenges are influencing Cabot’s current investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Cabot's Investment Narrative?

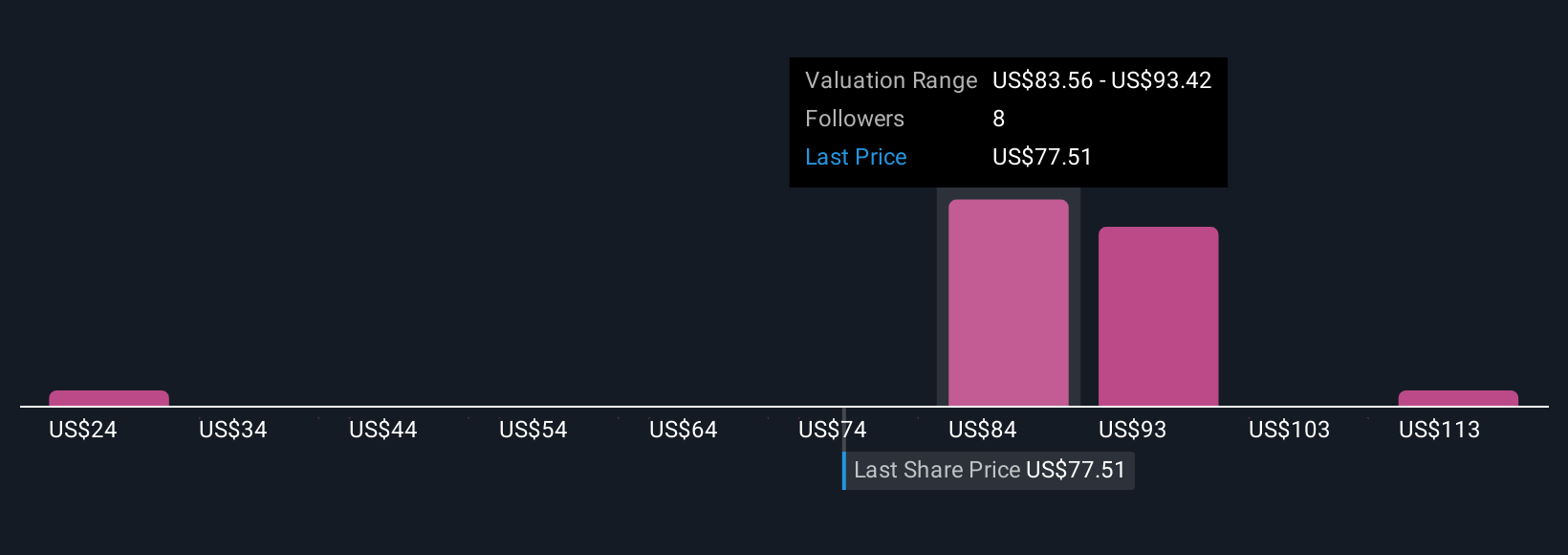

Cabot’s investment story is built on its specialized role in industrial materials, disciplined capital allocation, and margin focus, but the latest quarter was marked by declining sales and net income, as well as stubborn headwinds in core segments like Reinforcement Materials. The recent Bridgestone plant acquisition agreement reflects the company’s intent to build on its industrial footprint and could become an important short-term catalyst if it delivers operational or financial benefits in fiscal 2026, as management expects. However, overall sector softness and strong competitive pressures, particularly from increased tire imports in Western markets, remain critical risks, and recent price declines suggest the market is weighing these challenges carefully. Continued share buybacks and steady dividends show commitment to shareholder returns, but the earnings contraction and global demand trends cannot be ignored when assessing Cabot's risk-reward outlook.

On the flip side, sector declines and global competitive pressure could disrupt margin recovery efforts, something investors need to watch.

Exploring Other Perspectives

Explore 5 other fair value estimates on Cabot - why the stock might be worth less than half the current price!

Build Your Own Cabot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cabot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cabot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cabot's overall financial health at a glance.

No Opportunity In Cabot?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBT

Cabot

Operates as a specialty chemicals and performance materials company.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives