- United States

- /

- Metals and Mining

- /

- NYSE:AU

Will AngloGold Ashanti's (AU) Dubai Strategy Unveil New Strengths in Its Competitive Position?

Reviewed by Sasha Jovanovic

- AngloGold Ashanti plc presented at the 121 Dubai Mining Investment Conference on November 26, 2025, in the United Arab Emirates, sharing its latest updates with investors and industry leaders.

- This conference is recognized as a prominent platform for mining companies to outline strategy and new developments, often sparking greater investor attention.

- We’ll assess how AngloGold Ashanti’s fresh perspectives from the Dubai conference may influence its investment outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

AngloGold Ashanti Investment Narrative Recap

To be a shareholder in AngloGold Ashanti, you need to believe in the long-term value of gold and management’s ability to contain costs and navigate regulatory hurdles. The recent Dubai conference offered management a global stage, but it did not materially change the near-term catalyst of strong operational earnings or address the primary risk of supply cost pressures, which remain crucial for margin preservation. Among recent announcements, the Q3 2025 earnings release stands out: AngloGold Ashanti reported net income of US$669 million, a significant improvement year-on-year, reflecting higher gold production and elevated prices. This solid operational result supports the short-term earnings narrative, although long-term risks around production costs and jurisdictional challenges remain relevant in the wake of management’s updates. In contrast, investors need to be aware that even with positive news flow and rising profits, persistent inflationary pressures on total cash costs could still...

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's outlook anticipates $9.5 billion in revenue and $3.0 billion in earnings by 2028. This is based on a 7.6% annual revenue growth rate and represents a $1.2 billion increase in earnings from the current level of $1.8 billion.

Uncover how AngloGold Ashanti's forecasts yield a $89.71 fair value, a 5% upside to its current price.

Exploring Other Perspectives

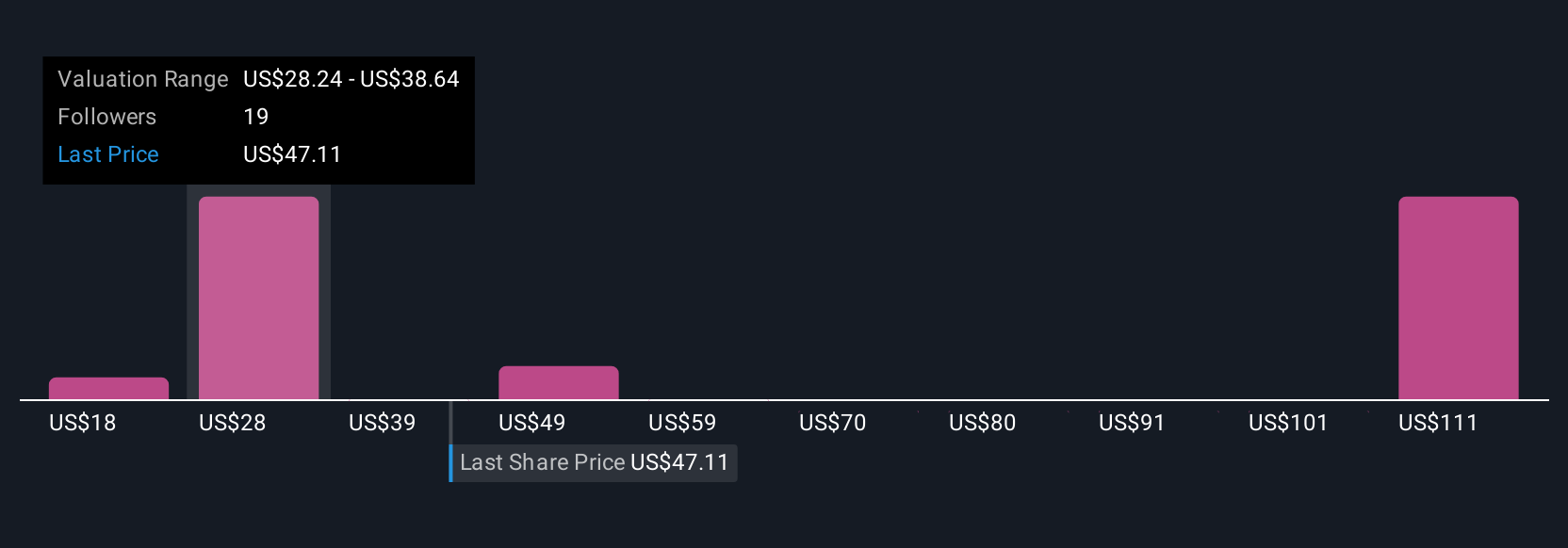

Fair value estimates from 11 Simply Wall St Community members span a wide range, from US$18.63 to US$89.71 per share. With cost inflation as an ongoing risk, these varied viewpoints hint at many ways to weigh AngloGold Ashanti’s future, take time to compare different scenarios for yourself.

Explore 11 other fair value estimates on AngloGold Ashanti - why the stock might be worth less than half the current price!

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026