- United States

- /

- Metals and Mining

- /

- NYSE:AU

AngloGold Ashanti (AU) Is Up 19.0% After Posting Strong Q3 Profit and Dividend – What's Changed?

Reviewed by Sasha Jovanovic

- AngloGold Ashanti plc recently reported its third-quarter 2025 results, revealing net income of US$669 million and gold production of 768,000 ounces, both showing significant growth year over year.

- The company also announced a US$0.91 per share interim dividend, highlighting continued robust cash flows and management's intent to reward shareholders.

- We'll examine how AngloGold Ashanti's higher gold production and strong earnings shape its investment narrative amid sector challenges.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

AngloGold Ashanti Investment Narrative Recap

To own AngloGold Ashanti today, an investor needs conviction in resilient gold demand, operational gains, and the company's ability to convert stronger production into lasting earnings growth, even as cost inflation and regulatory uncertainties remain influential. The surge in Q3 net income and a robust increase in gold output reinforce near-term momentum, but they do not materially offset the ongoing risk that persistent or rising all-in sustaining costs could weigh on future margins if macro pressures persist.

The latest interim dividend of US$0.91 per share, declared for Q3 2025, stands out as a concrete reflection of AngloGold Ashanti’s robust cash flow and management’s willingness to return capital to shareholders. While this signals balance sheet strength and confidence in current operations, it remains important for investors to contextualize such rewards against the backdrop of sustaining cost pressures and fluctuating gold prices that heavily influence the company’s earnings capacity.

Yet, despite recent production and earnings momentum, investors should be aware that continued inflation in operating costs could present...

Read the full narrative on AngloGold Ashanti (it's free!)

AngloGold Ashanti's outlook anticipates $9.5 billion in revenue and $3.0 billion in earnings by 2028. This reflects an annual revenue growth rate of 7.6% and a $1.2 billion increase in earnings from the current $1.8 billion.

Uncover how AngloGold Ashanti's forecasts yield a $88.29 fair value, a 9% upside to its current price.

Exploring Other Perspectives

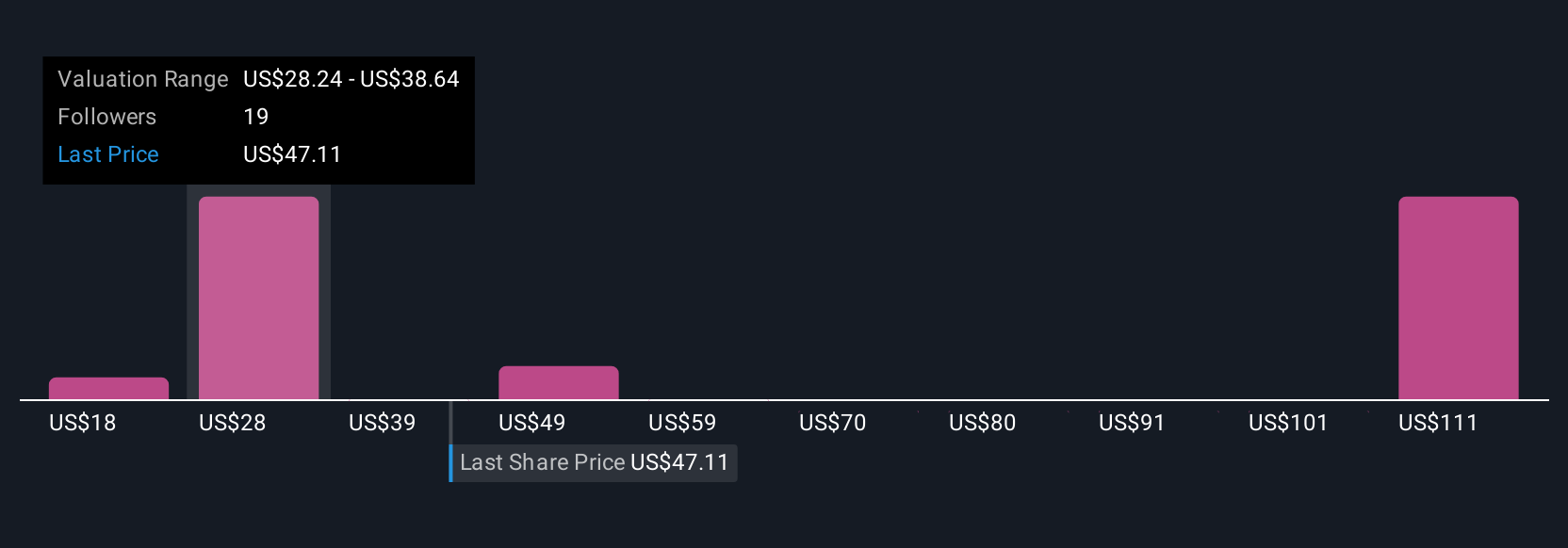

Twelve fair value estimates from the Simply Wall St Community stretch from US$17.84 to US$88.29 per share. While many see upside after recent earnings and dividend growth, diverging opinions reflect how future cost trends could shape the company’s results, explore several outlooks for broader insight.

Explore 12 other fair value estimates on AngloGold Ashanti - why the stock might be worth as much as 9% more than the current price!

Build Your Own AngloGold Ashanti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AngloGold Ashanti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AngloGold Ashanti's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives