- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM): Valuation in Focus After Record Quarter and Major Project Progress

Reviewed by Simply Wall St

Agnico Eagle Mines (NYSE:AEM) just turned in another record-setting quarter, showcasing impressive production and tight cost management. These results, powered by positive exploration and strong project progress, seem to be drawing fresh attention to the stock.

See our latest analysis for Agnico Eagle Mines.

Momentum has really kicked in for Agnico Eagle Mines, with shares climbing 3.1% on the day and soaring over 111% year-to-date as total shareholder return hits a standout 131% for the past twelve months. The combination of record-breaking results and progress on major projects like Odyssey and San Nicolas has clearly shifted market sentiment and signals that investors are re-rating the company’s growth prospects higher.

If this wave of growth has you thinking about what other miners could be catching momentum, now’s the perfect chance to discover fast growing stocks with high insider ownership

With this surge in performance and optimism around future growth projects, the real question is whether Agnico Eagle Mines is still trading at an attractive valuation or if the recent rally means investors have already priced in what comes next.

Most Popular Narrative: 8.3% Undervalued

The most widely followed narrative assigns a fair value of $188.80 for Agnico Eagle Mines, which is higher than the last close price of $173.10. This perspective is shaped by high gold prices and growth prospects, fueling analyst optimism for further upside. Here is a core catalyst driving this view.

Exploration success and rapid reserve expansion near key long-life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth. This supports a long runway of high-quality, low-risk volume expansion that can drive top-line revenue growth and production leverage.

Want to know what powers this compelling valuation? The narrative’s secret sauce is bold growth forecasts and surprisingly ambitious assumptions about future production and earnings. Get the full breakdown and see why this estimate bucks the usual mining sector expectations.

Result: Fair Value of $188.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, gold price volatility or unexpected project delays could quickly challenge the bullish case and alter sentiment regarding Agnico Eagle's valuation outlook.

Find out about the key risks to this Agnico Eagle Mines narrative.

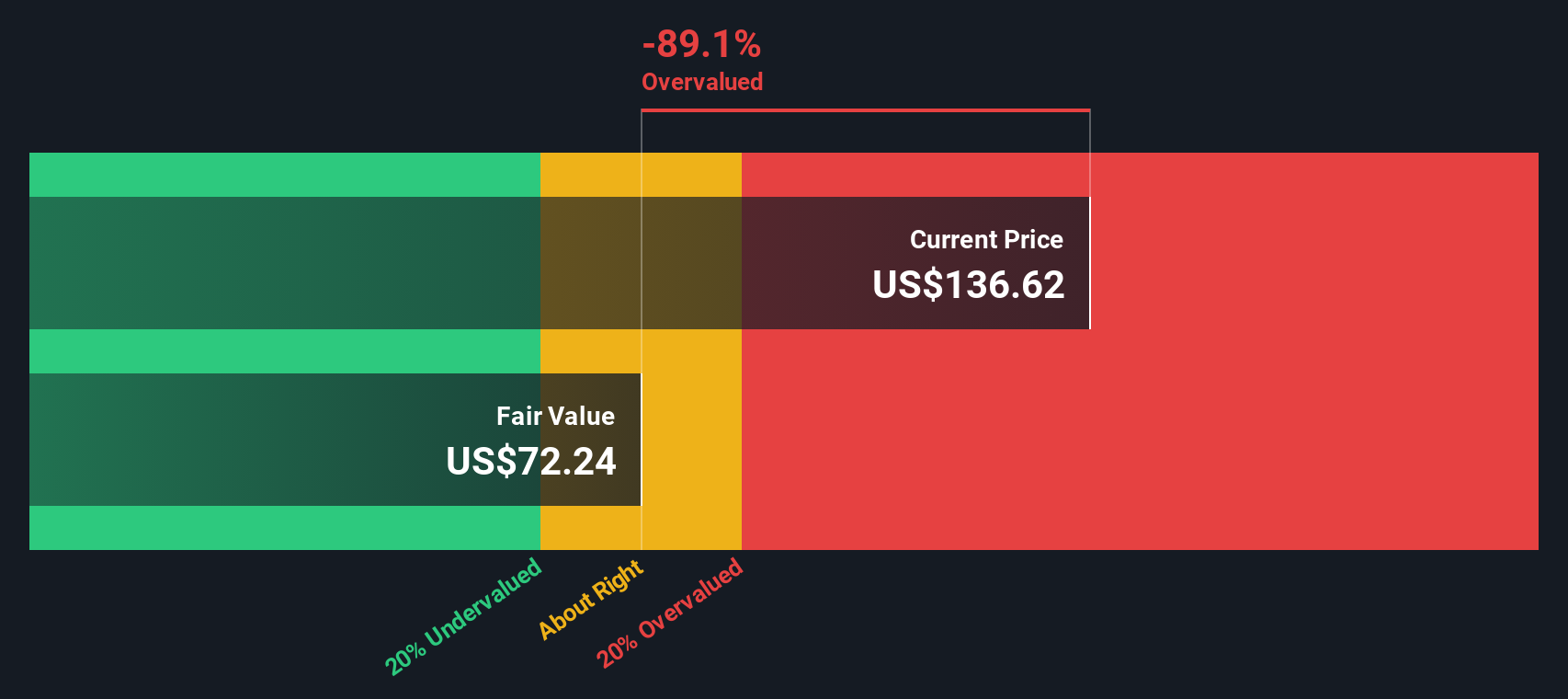

Another View: Our DCF Model Paints a Different Picture

While multiples suggest Agnico Eagle might still have room to run, our DCF model offers a different perspective. Using this approach, the stock is actually trading above its intrinsic value of $71.23 per share, indicating it may be overvalued by the market right now. Should investors rely on traditional multiples, or is the DCF warning worth a second look?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Agnico Eagle Mines Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own thesis in just minutes. Do it your way

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity rarely waits twice. Broaden your horizons and get ahead of the trends by finding stocks set to outpace the crowd. Don’t let these ideas pass you by.

- Capitalize on big returns as you scan these 3585 penny stocks with strong financials poised for breakout performance with strong financials and proven momentum.

- Unlock tomorrow's winners by targeting these 883 undervalued stocks based on cash flows identified as top bargains based on future cash flows and growth outlook.

- Connect with the future of medicine as you identify these 32 healthcare AI stocks transforming patient care through innovation and smart health technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives