- United States

- /

- Metals and Mining

- /

- NYSE:AA

Alcoa (AA): Assessing Valuation as ELYSIS Carbon-Free Aluminum Launches With Ball and Unilever Collaboration

Reviewed by Simply Wall St

Alcoa (NYSE:AA) just teamed up with Ball Corporation and Unilever to debut ELYSIS carbon-free aluminum in personal and home care packaging. This collaboration aligns their innovation with climate goals as COP30 approaches.

See our latest analysis for Alcoa.

Alcoa’s breakthrough on carbon-free aluminum is just the latest in a series of value-focused moves. Recent talk of strategic acquisitions aims to unlock synergy. Momentum is building, with a strong 28% share price return over the last 90 days. However, the one-year total shareholder return remains flat, highlighting both near-term excitement and the work ahead for sustainable long-term growth.

If innovations like ELYSIS have sparked your curiosity, this could be the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With innovation grabbing headlines and shares posting a strong recent run, is Alcoa’s current price reflecting all of its future growth prospects, or is there still an opportunity for investors to buy in before the market catches up?

Most Popular Narrative: Fairly Valued

With Alcoa closing at $40.03 and the narrative’s fair value at $39.63, there’s minimal divergence. This sets up a head-to-head between current sentiment and the collective analyst perspective. What’s actually driving that consensus?

Ongoing tariff volatility, regulatory pressures, operational bottlenecks, and limited production flexibility could compress margins and elevate future costs.

Want to know why analysts hold the line so close to today’s price? Their assumptions about future margins and profit direction might surprise you. If you’re curious which precise financial forecasts justify this side-by-side valuation, the full narrative lays it out in black and white. See what’s keeping this price target locked in.

Result: Fair Value of $39.63 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global decarbonization efforts and accelerating electric vehicle adoption could drive aluminum demand higher, challenging the current consensus outlook.

Find out about the key risks to this Alcoa narrative.

Another View: What Does the SWS DCF Model Say?

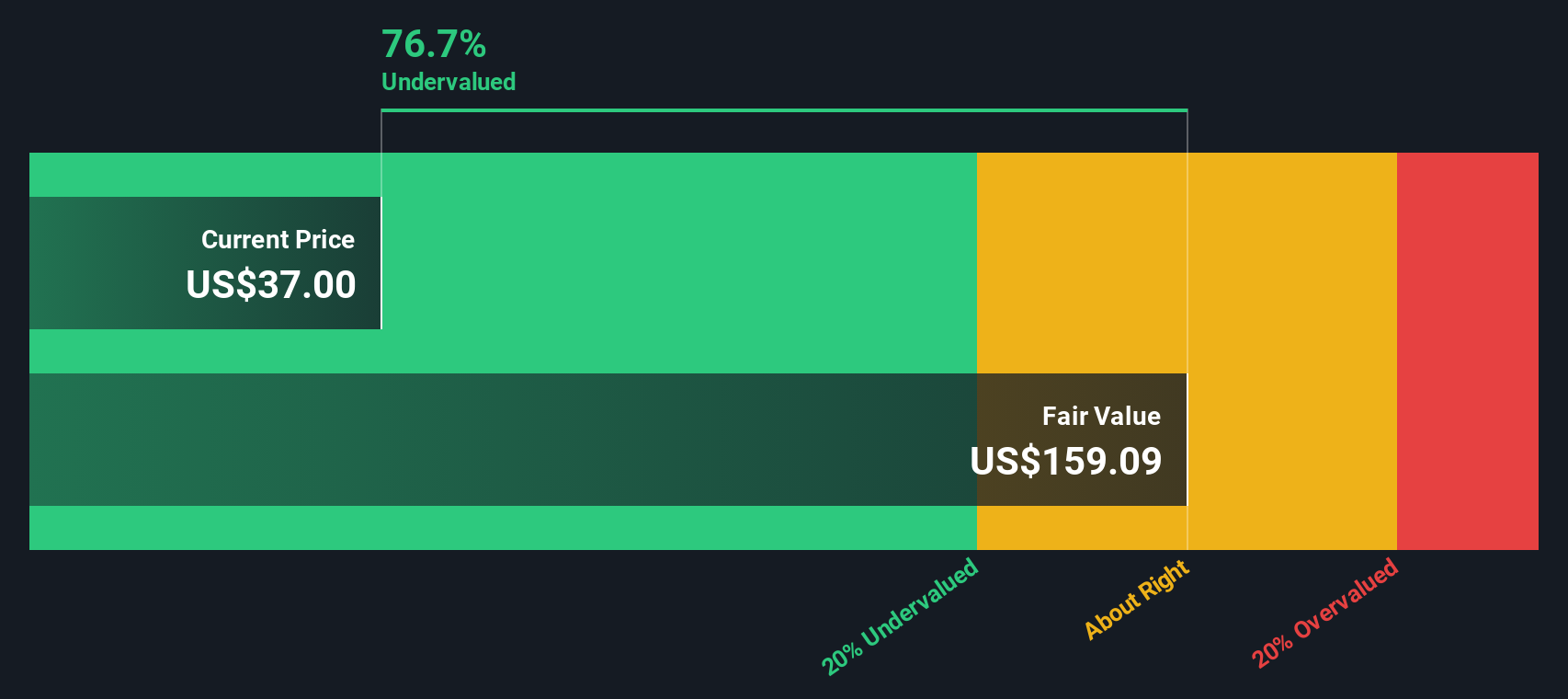

While market valuations based on profit multiples show Alcoa trading at a discount to both peers and the wider industry, our SWS DCF model tells a different story. With shares trading above the model’s estimated fair value of $38.30, Alcoa may be slightly overvalued on a cash flow basis. Is this a sign the market is too optimistic, or just reflecting faith in future growth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alcoa Narrative

If you want to dig deeper or see the numbers from your own perspective, it’s easy to build your case in just minutes. Do it your way

A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the next opportunity slip by you. Simply Wall Street’s tailored screeners put exceptional stocks at your fingertips. Here are three unmissable routes you can take right now:

- Spot fast-growing companies by checking out these 882 undervalued stocks based on cash flows that are flying under the radar and trading below their intrinsic value.

- Capture the potential of artificial intelligence with these 27 AI penny stocks shaping tomorrow’s industries and redefining how we work and live.

- Target consistent income streams when you scan these 14 dividend stocks with yields > 3% offering robust yields above 3% and the potential for regular returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives