- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

How Expedited Deep-Sea Mining Permissions Could Influence TMC the metals (TMC) Investors

Reviewed by Sasha Jovanovic

- In April 2025, President Trump signed an executive order designed to expedite deep-sea mining permissions, prompting The Metals Company's U.S. subsidiary to apply for exploration licenses and commercial recovery permits under the new framework.

- This policy shift reduces regulatory uncertainty for companies pursuing critical battery materials, potentially reshaping the outlook for U.S. deep-sea resource development.

- To assess how expedited mining permissions could influence TMC's investment narrative, we'll focus on the impact of easier access to exploration permits.

Find companies with promising cash flow potential yet trading below their fair value.

What Is TMC the metals' Investment Narrative?

For someone considering TMC as an investment, the core thesis is about believing in the future of deep-sea mining for battery metals, despite today’s losses and zero revenue. The executive order signed in April 2025 to expedite mining permissions could significantly alter the company’s risk profile. Historically, the biggest risks for TMC were regulatory uncertainty, ongoing legal matters, and the challenge of commercializing unproven mining technology, all of which weighed heavily on the timeline for any revenue. With the U.S. policy shift and TMC’s prompt application for exploration licenses, a major overhang, regulatory uncertainty around permits, may ease, transforming what was the largest short-term risk into a potential near-term catalyst. Still, risks remain: the company is unprofitable, has ongoing class action litigation, faces balance sheet dilution, and must prove it can turn permits into profitable operations.

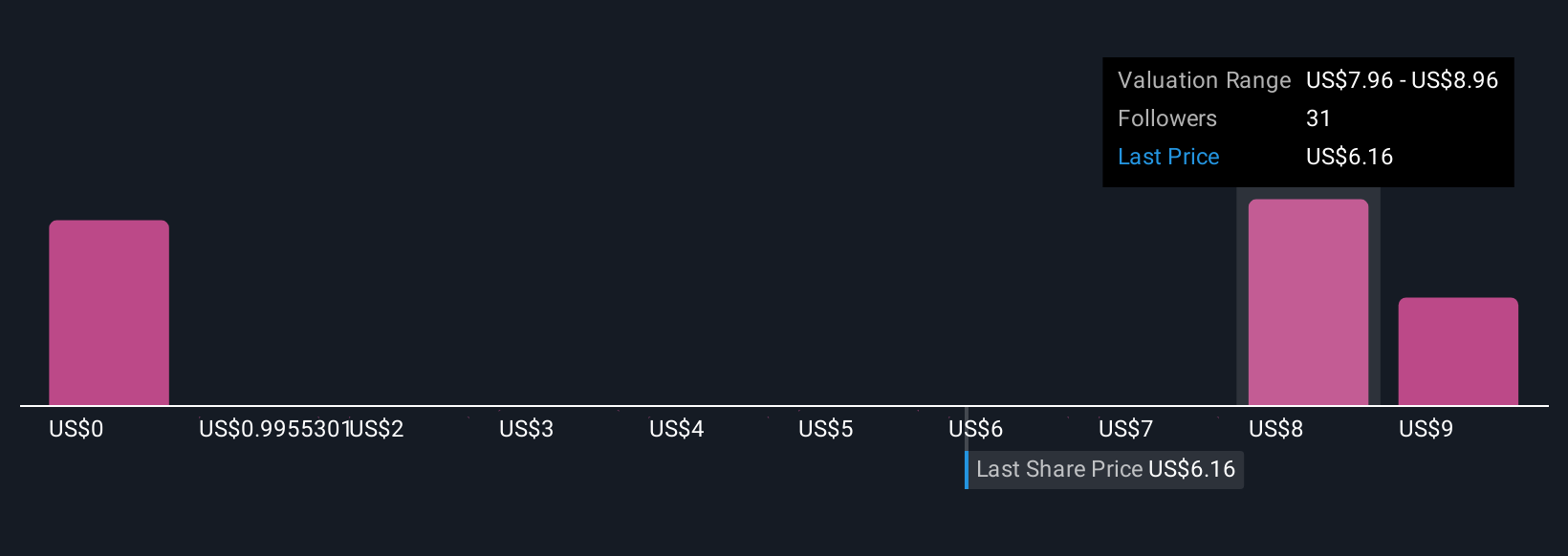

But despite these positive headlines, regulatory approvals are just the first step, commercial viability is not guaranteed. Insights from our recent valuation report point to the potential overvaluation of TMC the metals shares in the market.Exploring Other Perspectives

Explore 33 other fair value estimates on TMC the metals - why the stock might be worth less than half the current price!

Build Your Own TMC the metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TMC the metals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free TMC the metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TMC the metals' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives