- United States

- /

- Metals and Mining

- /

- NasdaqGS:TMC

Astera Labs And 2 Other Top Growth Companies With Significant Insider Stakes

Reviewed by Simply Wall St

As the U.S. stock market navigates a challenging start to December, with major indices like the Dow Jones and Nasdaq experiencing declines amid risk-off sentiment, investors are increasingly focused on companies where insiders hold significant stakes. In such volatile times, growth companies with high insider ownership can offer a measure of confidence, as these insiders often have a vested interest in steering their firms toward long-term success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

We'll examine a selection from our screener results.

Astera Labs (ALAB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $27.90 billion.

Operations: Astera Labs generates revenue primarily from its semiconductor segment, which accounted for $723.04 million.

Insider Ownership: 11.9%

Revenue Growth Forecast: 27% p.a.

Astera Labs shows strong growth potential with earnings forecasted to increase significantly, outpacing the US market. Recent product announcements, such as the Leo CXL Smart Memory Controllers, highlight its innovative edge in addressing memory-intensive workloads. Despite high volatility and significant insider selling over the past quarter, Astera Labs' strategic alliances and robust revenue growth projections underscore its position as a dynamic player in AI infrastructure development.

- Click to explore a detailed breakdown of our findings in Astera Labs' earnings growth report.

- According our valuation report, there's an indication that Astera Labs' share price might be on the expensive side.

Roku (ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

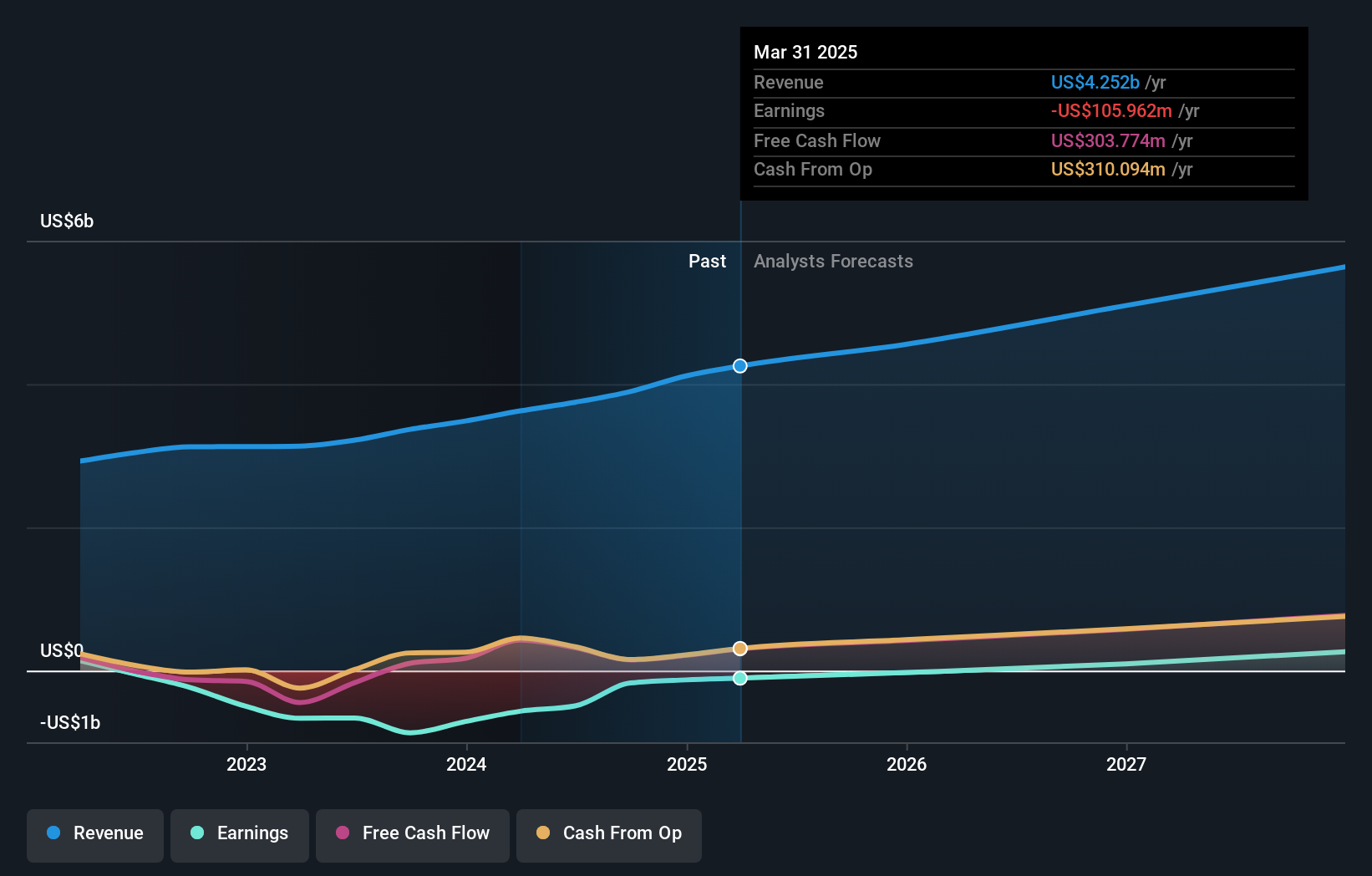

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of $14.26 billion.

Operations: The company's revenue is derived from two main segments: Devices, contributing $587.13 million, and Platform, generating $3.96 billion.

Insider Ownership: 11.9%

Revenue Growth Forecast: 10.8% p.a.

Roku demonstrates robust growth potential, with revenue forecasted to outpace the US market. Recent earnings reveal a positive turnaround, transitioning from losses to net income of US$24.81 million in Q3 2025. Strategic partnerships, like those with DoubleVerify and FreeWheel, enhance its advertising capabilities and fraud protection measures. Despite trading below fair value estimates and no significant insider trading activity recently, Roku's innovative product launches continue to strengthen its market presence.

- Click here and access our complete growth analysis report to understand the dynamics of Roku.

- Upon reviewing our latest valuation report, Roku's share price might be too pessimistic.

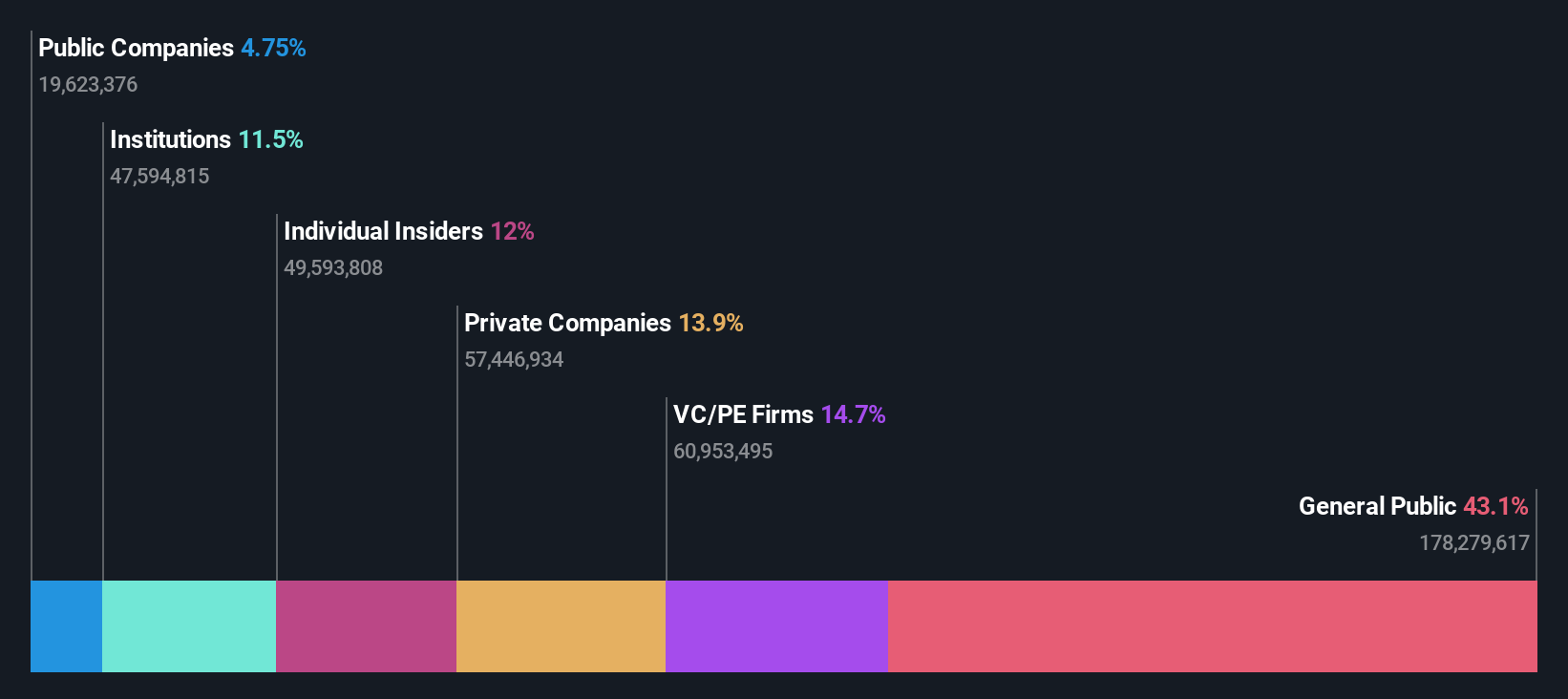

TMC the metals (TMC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TMC the metals company Inc. is a deep-sea minerals exploration company that specializes in collecting, processing, and refining polymetallic nodules from the seafloor in California, with a market cap of approximately $2.60 billion.

Operations: TMC focuses on the exploration and development of deep-sea minerals, specifically targeting the collection, processing, and refining of polymetallic nodules from the seafloor in California.

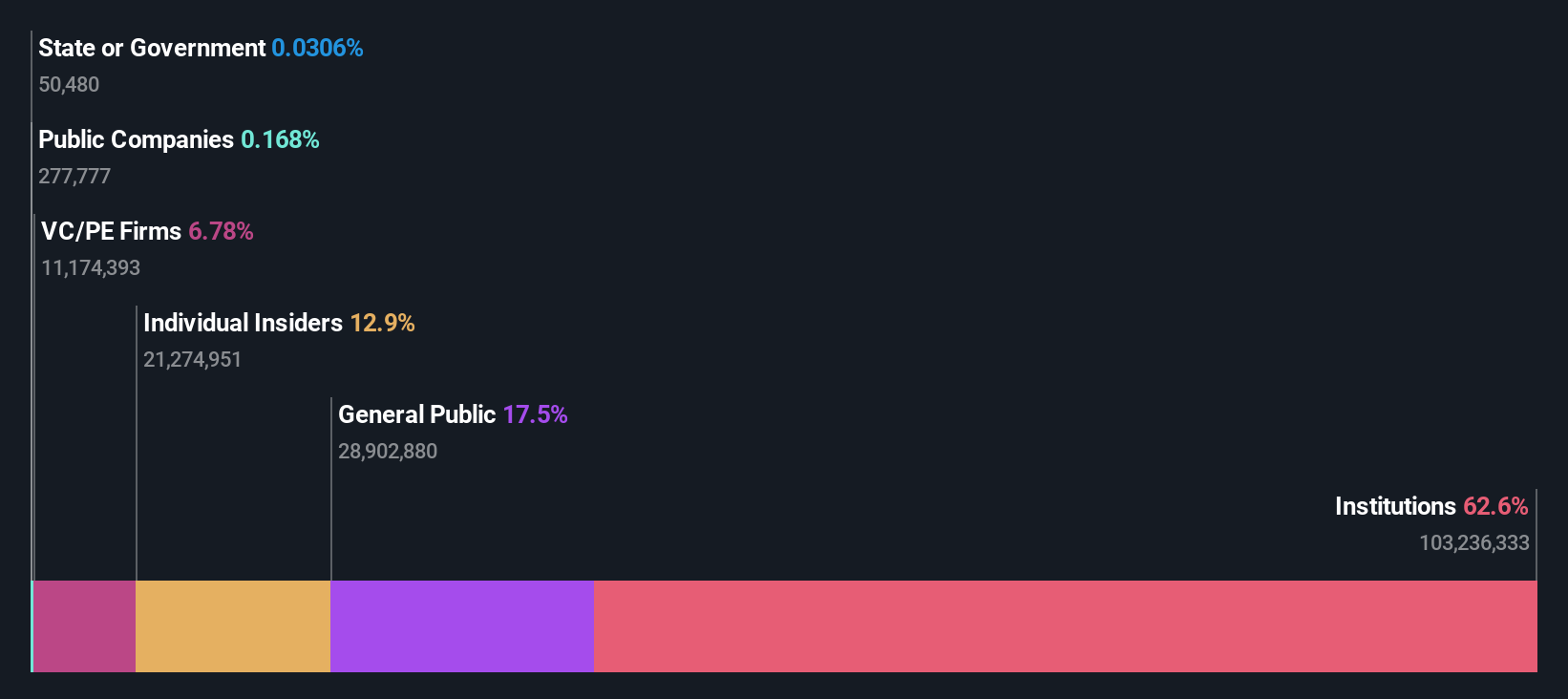

Insider Ownership: 13.3%

Revenue Growth Forecast: 63.7% p.a.

TMC the metals company faces challenges with negative equity and a volatile share price, yet it holds potential for significant profit growth, forecasted to reach a high return on equity of 112.6% in three years. Despite no expected revenue next year, insider trading activity shows more selling than buying recently. The company completed a follow-on equity offering of US$20.22 million in October 2025, indicating efforts to bolster its financial position amidst ongoing losses.

- Take a closer look at TMC the metals' potential here in our earnings growth report.

- Our expertly prepared valuation report TMC the metals implies its share price may be too high.

Where To Now?

- Click here to access our complete index of 200 Fast Growing US Companies With High Insider Ownership.

- Curious About Other Options? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TMC the metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMC

TMC the metals

A deep-sea minerals exploration company, focuses on the collection, processing, and refining of polymetallic nodules found on the seafloor in California.

Moderate risk with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

The "Rare Disease Monopoly" – Commercial Execution Play

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026