- United States

- /

- Metals and Mining

- /

- NasdaqGS:STLD

Is Steel Dynamics (STLD) Using Debt Refinancing to Enhance Financial Flexibility or Signal Caution?

Reviewed by Sasha Jovanovic

- In November 2025, Steel Dynamics, Inc. completed a debt financing transaction, issuing US$650 million of 4.000% Notes due 2028 and US$150 million of 5.250% Notes due 2035, with proceeds to redeem US$400 million of 5.000% Notes due 2026 and for other corporate purposes.

- The additional 2035 Notes were issued above par and combined with existing 2035 debt, reflecting active management of the company's capital structure amid recent credit market conditions.

- We'll examine how Steel Dynamics' recent debt refinancing may affect its investment case and outlook on balance sheet flexibility.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Steel Dynamics Investment Narrative Recap

To be a shareholder in Steel Dynamics, investors need confidence in the company's ability to capitalize on growing U.S. infrastructure and manufacturing demand, while effectively managing its capital investments in aluminum and biocarbon expansion. The recent debt refinancing is not expected to meaningfully impact the most immediate catalyst, rising domestic steel demand, or the ongoing risk from operating losses and higher costs as new ventures scale up.

Among recent announcements, the October launch of BIOEDGE™ and EDGE™ low-carbon steel products stands out, aligning with growing sustainability requirements and potential pricing power for greener materials. This product development supports Steel Dynamics' efforts to differentiate in key sectors like automotive and industrial, reinforcing the core near-term catalyst amid heightened market competition.

By contrast, investors should also be aware of the short-term pressure on free cash flow from ramping up these new operations, especially if market adoption or volume growth lags...

Read the full narrative on Steel Dynamics (it's free!)

Steel Dynamics' narrative projects $21.6 billion revenue and $2.6 billion earnings by 2028. This requires 8.1% yearly revenue growth and a $1.6 billion earnings increase from $1.0 billion currently.

Uncover how Steel Dynamics' forecasts yield a $167.42 fair value, in line with its current price.

Exploring Other Perspectives

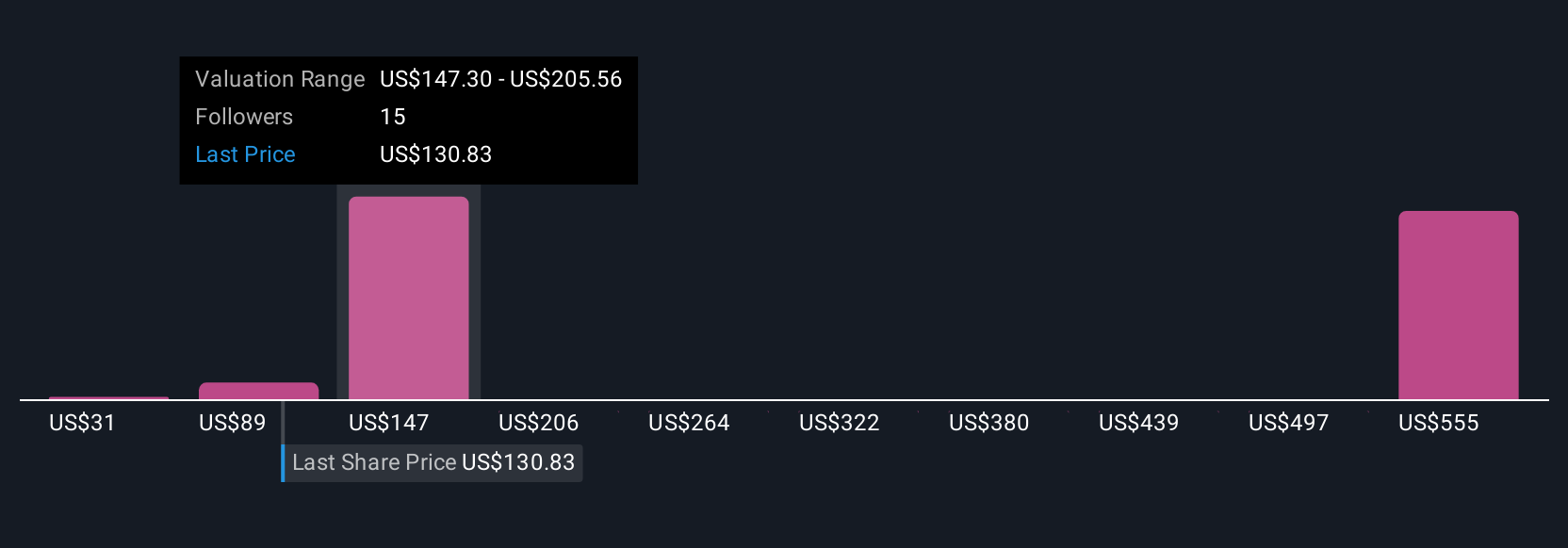

Fair value estimates from the Simply Wall St Community range from US$95 to US$291.81, reflecting a wide range of investor perspectives based on five separate analyses. While optimism around growth persists, significant capital investments that increase interest expenses could challenge cash generation and profitability, making it essential for you to review multiple viewpoints before making any decisions.

Explore 5 other fair value estimates on Steel Dynamics - why the stock might be worth 43% less than the current price!

Build Your Own Steel Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Steel Dynamics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Steel Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Steel Dynamics' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STLD

Steel Dynamics

Operates as a steel producer and metal recycler in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026