- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Royal Gold (RGLD) Is Up 6.8% After Announcing a 6% Dividend Increase for 2026

Reviewed by Sasha Jovanovic

- On November 18, 2025, Royal Gold announced that its Board of Directors approved an approximately 6% increase in the company's annual common stock dividend to US$1.90 per share for 2026, with the first quarterly payment scheduled for January 16, 2026.

- This move highlights Royal Gold's commitment to enhancing shareholder returns through consistent dividend growth, signaling confidence in its cash flow stability and future prospects.

- We'll explore how the recently announced dividend increase could reinforce Royal Gold's investment case for stable and growing shareholder returns.

Find companies with promising cash flow potential yet trading below their fair value.

Royal Gold Investment Narrative Recap

To be a Royal Gold shareholder, you need to believe that gold will remain attractive as a strategic asset and that royalty streaming offers stable, growing cash flows even as mining sector risks shift. While the recent 6% dividend increase underlines management’s confidence in future cash flows, it does not materially change short-term catalysts, which are mostly tied to the success of the Sandstorm Gold and Horizon Copper acquisitions. The big risk remains gold price volatility, as revenue is still deeply tied to the commodity’s performance, and the dividend hike does little to offset that exposure.

Among this year’s developments, the planned Sandstorm Gold and Horizon Copper acquisitions stand out as most relevant to the latest dividend news. These deals could meaningfully diversify Royal Gold’s cash flow sources, helping reinforce the company’s ability to sustain and potentially grow dividend payments by reducing reliance on any single mine or operator.

However, investors should be equally aware that despite ongoing dividend growth, disruptions at key mines could challenge Royal Gold’s earnings consistency and long-term payout potential...

Read the full narrative on Royal Gold (it's free!)

Royal Gold's outlook forecasts $1.4 billion in revenue and $877.9 million in earnings by 2028. This implies a 21.4% annual revenue growth rate and a $428.4 million increase in earnings from the current $449.5 million.

Uncover how Royal Gold's forecasts yield a $248.18 fair value, a 22% upside to its current price.

Exploring Other Perspectives

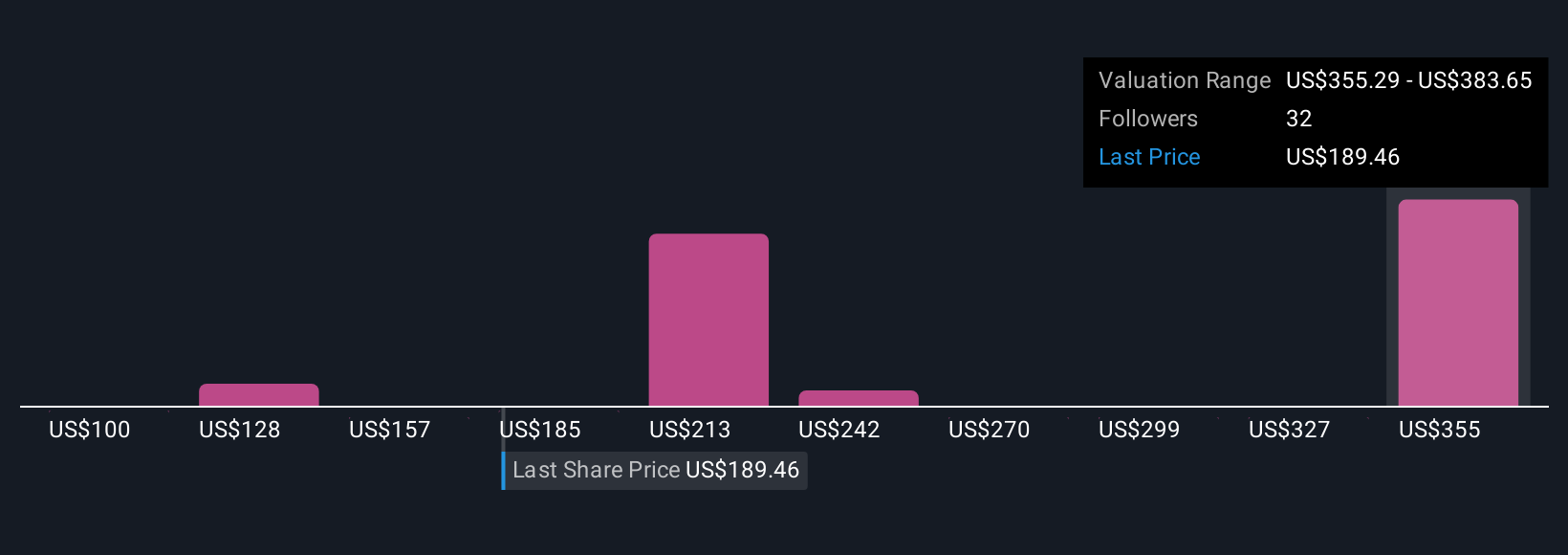

Simply Wall St Community members produced 10 different fair value estimates for Royal Gold, ranging from US$143.73 to US$266.61 per share. With revenue growth still strongly dependent on gold prices, it’s vital you explore why these outlooks differ and what they mean for your own view.

Explore 10 other fair value estimates on Royal Gold - why the stock might be worth 29% less than the current price!

Build Your Own Royal Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Royal Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Royal Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Royal Gold's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026