- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

How Investors Are Reacting To Linde (LIN) Issuing €1.75B in Multi-Tranche Euro Notes

Reviewed by Sasha Jovanovic

- On November 20, 2025, Linde plc issued €1.75 billion in new euro-denominated notes maturing in 2027, 2032, and 2038 to support general corporate purposes, with the securities admitted to the Luxembourg Stock Exchange.

- This multi-tranche debt issuance highlights Linde's ongoing access to international capital markets and its ability to secure flexible financing options through its established European debt program.

- We'll explore how Linde's ongoing ability to access diverse funding markets may reinforce its investment narrative amid recent analyst upgrades.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Linde Investment Narrative Recap

To be a Linde shareholder, you need to believe in the company’s role as a global leader in industrial gases and engineering, with growth driven by long-term contracts, innovation in clean energy, and its ability to manage through industrial cycles. The recent €1.75 billion euro-denominated debt issuance demonstrates continued market access, but does not materially change the key short-term catalyst: ongoing project conversion from a robust backlog in clean energy and infrastructure. The major risk remains Europe’s industrial demand weakness, which could threaten medium-term volumes and profitability.

Among recent announcements, the October 2025 earnings report stands out, with Linde posting higher net income and profit margins compared to last year, even as volumes faced pressure in some markets. This earnings resilience, together with flexible financing options from the new euro note issuance, provides financial room to sustain investments in project backlogs and potentially buffer impacts from fluctuating demand and pricing pressures.

By contrast, investors should be aware that persistent deindustrialization in Europe poses a structural risk for Linde if demand…

Read the full narrative on Linde (it's free!)

Linde's narrative projects $38.9 billion revenue and $9.1 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $2.4 billion earnings increase from $6.7 billion.

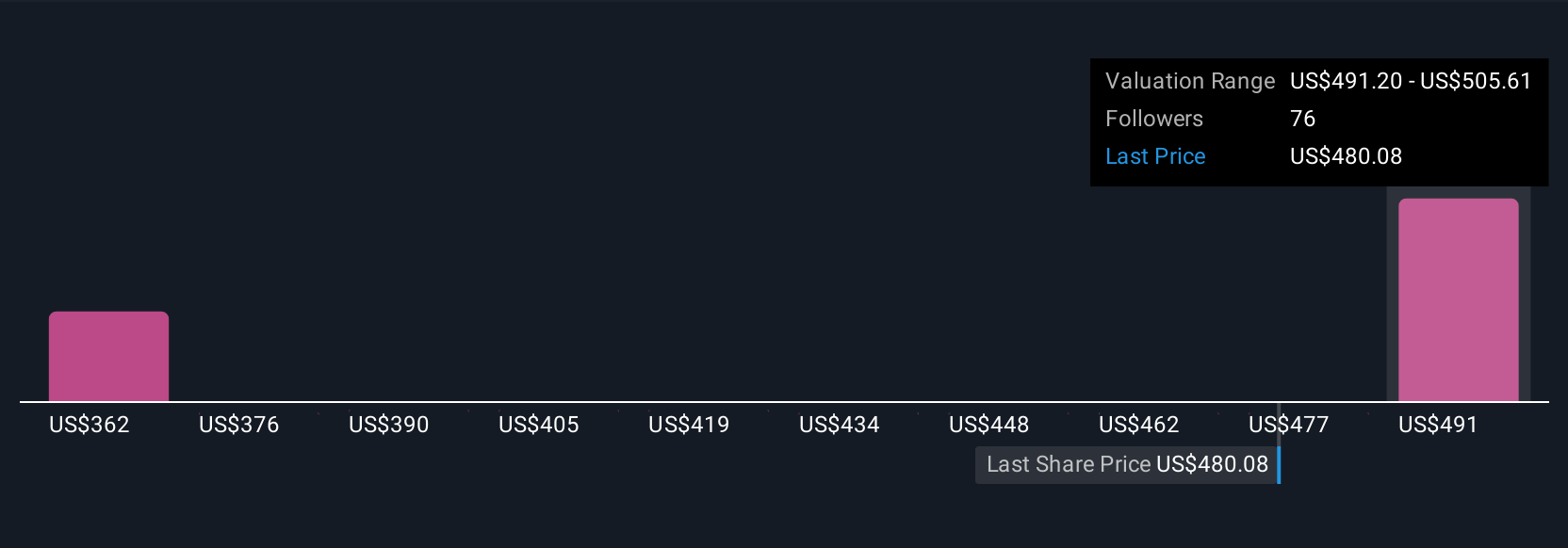

Uncover how Linde's forecasts yield a $505.61 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community fair value estimates span US$300 to US$505 per share, reflecting a broad range of views. Persistent European industrial weakness, a key short-term risk, could significantly affect those assumptions about future returns.

Explore 7 other fair value estimates on Linde - why the stock might be worth as much as 23% more than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026