- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Kaiser Aluminum (KALU): Revisiting Valuation After Zacks’ Strong Buy Rating and Upbeat Earnings Outlook

Reviewed by Simply Wall St

Fresh research coverage has put Kaiser Aluminum (KALU) in the spotlight after Zacks tagged it as a Strong Buy, highlighting its value metrics and earnings expectations compared with peers.

See our latest analysis for Kaiser Aluminum.

That optimism has been showing up in the trading tape too, with Kaiser Aluminum’s share price at $104.62 and a 90 day share price return of 35.13 percent feeding into a 48.88 percent year to date rise. Its 1 year total shareholder return of 35.27 percent suggests momentum is firmly building rather than fading.

If this kind of cyclical upswing has your attention, it could also be a good moment to explore aerospace and defense stocks for other potential materials and aerospace linked ideas.

With analysts seeing nearly 20 percent intrinsic upside but the share price already hovering close to consensus targets, the real question is whether Kaiser Aluminum still offers a fresh buying opportunity or if the market is already pricing in its next leg of growth.

Price to Earnings of 19.7x: Is it justified?

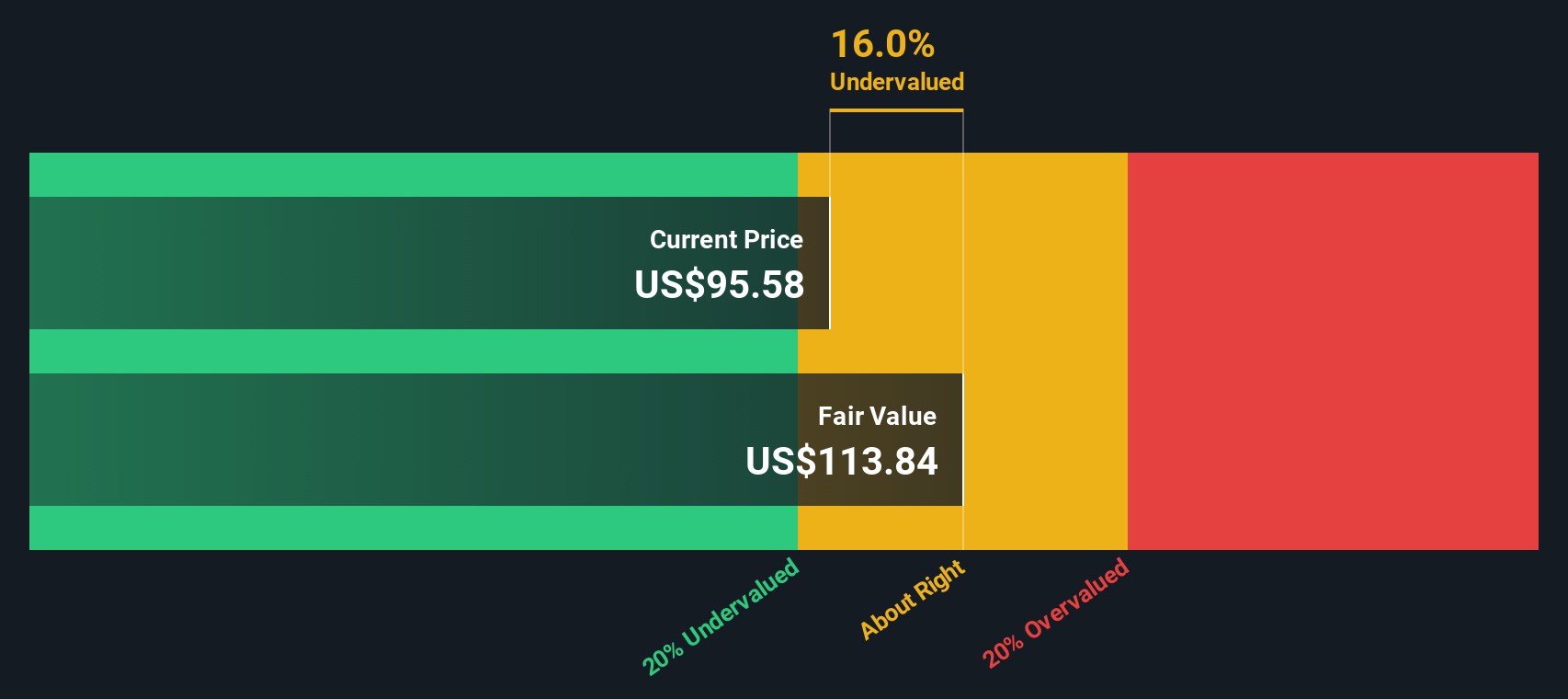

Kaiser Aluminum screens as undervalued at its last close of $104.62 when set against both our fair value estimate and peer price to earnings benchmarks.

The price to earnings ratio compares what investors pay for each dollar of current earnings, a core lens for cyclically exposed, cash generative metals and materials businesses. For Kaiser Aluminum, a 19.7 times multiple sits below our estimated fair price to earnings ratio of 20.1 times and far below the 45.3 times peer average. This suggests the market is not fully crediting its earnings power or growth profile.

Against the broader US Metals and Mining industry average of 22.6 times, Kaiser Aluminum’s lower multiple looks even more striking. This implies investors are paying a clear discount despite the company trading at 19.5 percent below our $130.03 fair value estimate from the SWS DCF model. That gap hints at room for the market to move closer to the fair ratio level if current earnings momentum and forecast growth are sustained.

Explore the SWS fair ratio for Kaiser Aluminum

Result: Price-to-Earnings of 19.7x (UNDERVALUED)

However, margin pressure from softer aerospace demand or a downturn in beverage packaging volumes could quickly challenge both earnings momentum and the undervaluation thesis.

Find out about the key risks to this Kaiser Aluminum narrative.

Another Angle on Value

Our SWS DCF model paints a similar picture, with a fair value estimate of $130.03 versus the current $104.62, implying roughly 19.5 percent upside. That supports the idea of mispricing, but also raises a key question: how long can earnings stay strong enough for that gap to close?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaiser Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaiser Aluminum Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a complete narrative in minutes with Do it your way.

A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market’s next shift passes you by, use the Simply Wall St Screener to uncover focused opportunities that match your strategy and strengthen your portfolio.

- Target capital growth by hunting for underappreciated cash machines through these 906 undervalued stocks based on cash flows that could re rate sharply as sentiment catches up to fundamentals.

- Ride powerful structural trends by scanning these 26 AI penny stocks for companies using artificial intelligence to build durable competitive advantages and scalable earnings.

- Lock in potential income streams by reviewing these 15 dividend stocks with yields > 3% that may support long term total returns with attractive, recurring payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026