- United States

- /

- Insurance

- /

- NYSE:RYAN

Ryan Specialty Holdings (RYAN): Assessing Valuation Following Key Leadership Transition and Ongoing Organizational Shifts

Reviewed by Kshitija Bhandaru

Ryan Specialty Holdings has named Stephen P. Keogh and Brendan M. Mulshine as Co-Presidents, stepping in for Jeremiah Bickham, who now serves as a strategic advisor. This executive change arrives as the company navigates ongoing organizational challenges.

See our latest analysis for Ryan Specialty Holdings.

Recent leadership changes are grabbing headlines, but the market has been less enthusiastic. Ryan Specialty Holdings’ share price slipped 4.6% in the past day and is down 11.2% year-to-date. With a one-year total shareholder return of -20.5%, momentum has clearly faded, even as strategic acquisitions and growth initiatives continue in the background. Over the longer term, the company still boasts a three-year total return of nearly 35%, which is a reminder that organizational shifts aren’t the only story in play.

If you’re reviewing leaders and laggards in today’s market, now’s an ideal time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading at a nearly 27% discount to analyst targets and recent earnings growth outperforming expectations, investors are left to wonder if this is a prime entry point or if the market is already anticipating a turnaround.

Most Popular Narrative: 22.7% Undervalued

With Ryan Specialty Holdings last closing at $55.63 and the most widely followed narrative assigning fair value at $72, the prevailing viewpoint expects a significant price gap to close. This valuation puts the spotlight on some bold growth assumptions and sets the stage for further debate on whether the market is too pessimistic.

The company's continued expansion into higher-margin specialty lines, especially through innovative product launches in alternative and complex risks, and acquisition of niche MGUs, should increase the contribution from diverse, less commoditized business, stabilizing and growing earnings even when traditional property pricing cycles are volatile.

Curious what financial leaps justify this view? The real intrigue lies in the narrative’s assumptions: think explosive earnings, margin expansion, and a future profit multiple that outpaces most industry peers. Hungry for the specifics pushing this target? Find out how this narrative forecasts Ryan's value climb.

Result: Fair Value of $72 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as prolonged soft property insurance pricing or slower-than-expected earnings from major growth investments could quickly challenge these optimistic assumptions.

Find out about the key risks to this Ryan Specialty Holdings narrative.

Another View: Caution from the Market's Comparison

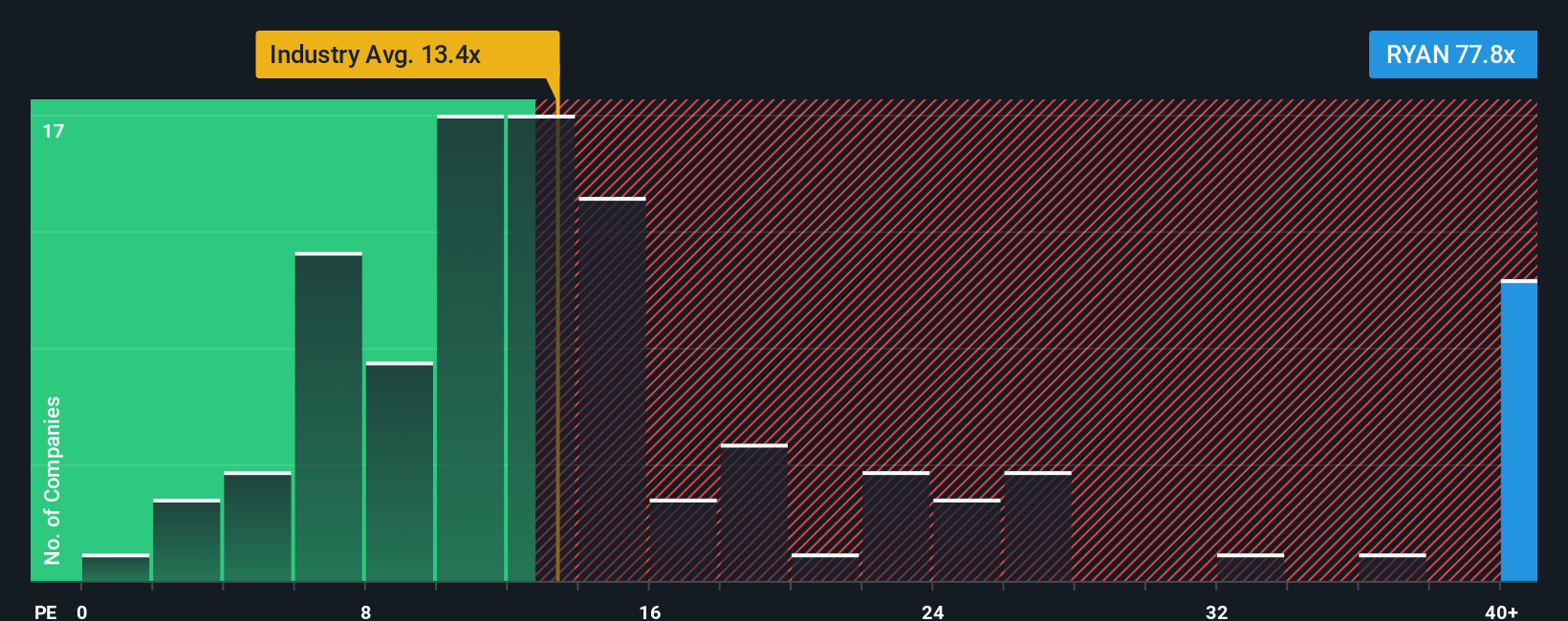

While analyst forecasts suggest Ryan Specialty Holdings is undervalued, market ratios tell a different story. Its price-to-earnings ratio stands at 123.2x. This is much higher than the industry average of 14.2x, a peer group average of 50.4x, and even above the fair ratio of 68.8x. That kind of gap means investors are paying a steep premium for future growth, making downside risk harder to ignore if expectations are missed. Would a market reset toward the fair ratio bring pain or opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryan Specialty Holdings Narrative

If you see things differently or want to dig deeper into the numbers yourself, it’s easy to shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Ryan Specialty Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to one opportunity. Let Simply Wall Street connect you to investment strategies proven to outperform. Stay ahead by acting on these top ideas today:

- Boost your income with consistent yields by checking out these 18 dividend stocks with yields > 3%, which boasts returns above 3%.

- Uncover tomorrow’s breakthroughs by getting into these 26 quantum computing stocks, focused on quantum computing, encryption, and advanced new tech.

- Capitalize on market mispricing by targeting these 891 undervalued stocks based on cash flows, trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYAN

Ryan Specialty Holdings

Operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, rest of Europe, India, and Singapore.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives