- United States

- /

- Insurance

- /

- NYSE:RGA

Reinsurance Group of America (RGA): Evaluating Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Reinsurance Group of America (RGA) has quietly slipped about 2% over the past week and roughly 11% over the past year, even as its revenue and earnings continue to grow at a solid clip.

See our latest analysis for Reinsurance Group of America.

At around $188.64, the recent slide in RGA’s share price looks more like a pause than a breakdown. Short term share price pressure contrasts sharply with its robust multi year total shareholder returns, suggesting momentum is cooling but not broken.

If RGA’s risk reward profile has you reassessing your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for fresh ideas beyond the insurance space.

With double digit earnings growth, a sizeable gap to analyst targets, and a rich long term track record, the key question now is simple: Is RGA mispriced, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 20.4% Undervalued

Compared with RGA’s last close at $188.64, the most popular narrative points to a meaningfully higher fair value, built on ambitious growth and margin upgrades.

The company's leadership in digital underwriting solutions and customized reinsurance products, bolstered by data analytics and exclusive arrangements, enhances efficiency and pricing power. This is likely to improve net margins and generate higher earnings as these tech-enabled capabilities scale.

Curious how steady premium growth, fatter margins, and a deliberately lower future earnings multiple can still justify a higher value than today’s price? The full narrative lays out the math.

Result: Fair Value of $236.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent claims volatility and rising medical costs could pressure margins and challenge the growth assumptions that underpin the current undervaluation case.

Find out about the key risks to this Reinsurance Group of America narrative.

Another Angle on Valuation

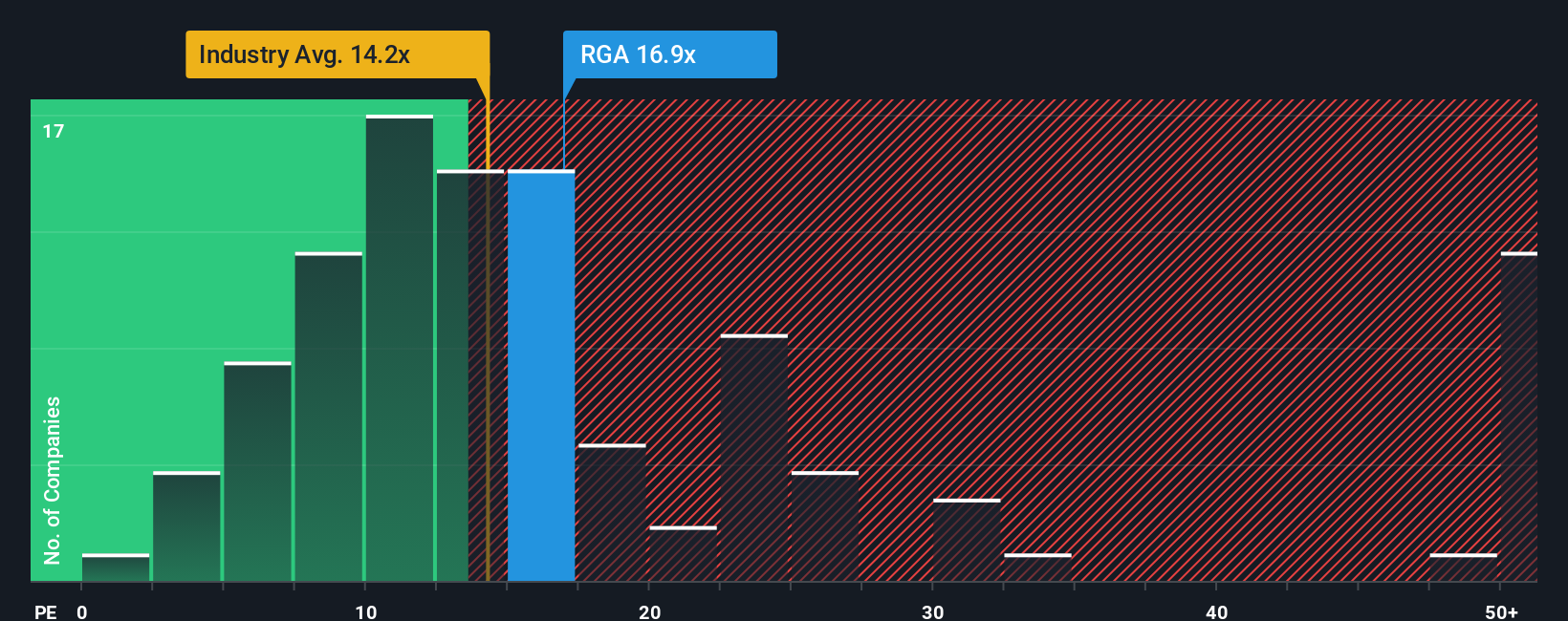

On earnings, the picture looks less clear cut. RGA trades at 14.3 times earnings, slightly richer than both peers at 14.1 times and the broader US insurance group at 12.8 times, yet below a fair ratio of 19.6 times. This leaves investors to weigh near term premium versus longer term catch up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reinsurance Group of America Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Reinsurance Group of America.

Ready for more investment ideas?

Before you move on, review fresh, data backed stock ideas from our screeners so potential opportunities do not slip past you.

- Pinpoint steady income opportunities by reviewing these 15 dividend stocks with yields > 3% that may help strengthen your portfolio’s cash flow.

- Explore cutting edge innovation through these 27 AI penny stocks positioned to benefit from advances in artificial intelligence.

- Search for potentially mispriced opportunities with these 909 undervalued stocks based on cash flows that appear attractively valued based on their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RGA

Reinsurance Group of America

Provides reinsurance and financial solutions.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026