- United States

- /

- Insurance

- /

- NYSE:PGR

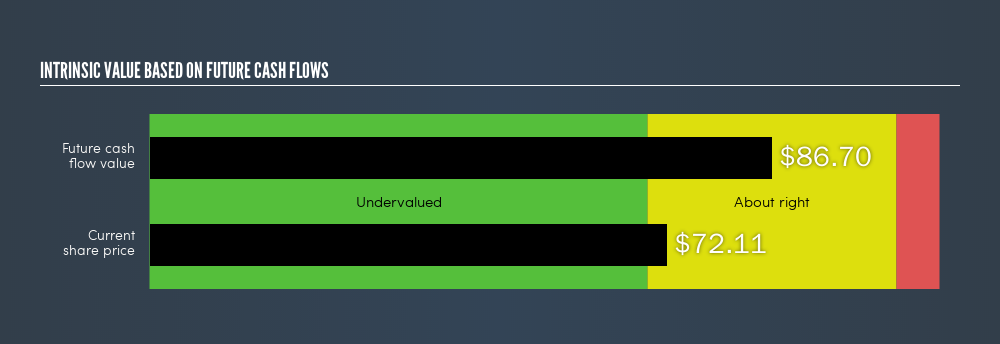

The Progressive Corporation (NYSE:PGR) Is Trading At A 16.83% Discount Right Now

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

PGR operates in the insurance industry, which has characteristics that make it unique compared to other sectors. Understanding these differences is crucial when it comes to putting a value on the insurance stock. For example, insurance companies are required to hold more capital to reduce the risk to shareholders. Focusing on data points like book values, in addition to the return and cost of equity, is fitting for computing PGR’s value. Today I’ll look at how to value PGR in a fairly accurate and simple approach.

Check out our latest analysis for Progressive

Why Excess Return Model?

Financial firms differ to other sector firms primarily because of the kind of regulation they face and their asset composition. Strict regulatory environment in United States's finance industry reduces PGR's financial flexibility. Furthermore, insurance companies usually do not have large amounts of tangible assets on their books. As traditional valuation models put weight on inputs such as capex and depreciation, which is less meaningful for finacial firms, the Excess Return model places importance on forecasting stable earnings and book values.

Deriving PGR's Intrinsic Value

The central belief for this model is, the value of the company is how much money it can generate from its current level of equity capital, in excess of the cost of that capital. The returns above the cost of equity is known as excess returns:

Excess Return Per Share = (Stable Return On Equity – Cost Of Equity) (Book Value Of Equity Per Share)

= (0.23% – 8.6%) x $25.28 = $3.6

Excess Return Per Share is used to calculate the terminal value of PGR, which is how much the business is expected to continue to generate over the upcoming years, in perpetuity. This is a common component of discounted cash flow models:

Terminal Value Per Share = Excess Return Per Share / (Cost of Equity – Expected Growth Rate)

= $3.6 / (8.6% – 2.7%) = $61.42

Combining these components gives us PGR's intrinsic value per share:

Value Per Share = Book Value of Equity Per Share + Terminal Value Per Share

= $25.28 + $61.42 = $86.7

This results in an intrinsic value of $86.7. Compared to the current share price of US$72.11, PGR is , at this time, priced in-line with its intrinsic value. This means there's no real upside in buying PGR at its current price. Pricing is only one aspect when you're looking at whether to buy or sell PGR. There are other important factors to keep in mind when assessing whether PGR is the right investment in your portfolio.

Next Steps:

For insurance companies, there are three key aspects you should look at:

- Financial health: Does it have a healthy balance sheet? Take a look at our free bank analysis with six simple checks on things like leverage and risk.

- Future earnings: What does the market think of PGR going forward? Our analyst growth expectation chart helps visualize PGR’s growth potential over the upcoming years.

- Dividends: Most people buy financial stocks for their healthy and stable dividends. Check out whether PGR is a dividend Rockstar with our historical and future dividend analysis.

For more details and sources, take a look at our full calculation on PGR here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:PGR

Progressive

An insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States.

Outstanding track record with excellent balance sheet.