- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR): Evaluating Valuation After Major Product Launches and Nationwide Expansion Push

Reviewed by Simply Wall St

Oscar Health (OSCR) just ramped up its nationwide footprint by rolling out new tech-enabled health plans and innovative options, such as an AI-powered support agent and the first menopause plan for individuals. These launches come ahead of the 2026 Open Enrollment period.

See our latest analysis for Oscar Health.

Oscar Health’s fresh slate of product rollouts and major geographic expansions have sharpened the spotlight on its growth story, but the market response has been a bit of a rollercoaster. Shares have pulled back recently, with a 1-week price return of -11.3% and a 1-month drop of 26%. However, the stock is still up 11.4% year-to-date, and the one-year total shareholder return stands at 12%. Even more striking, Oscar’s total return over the past three years has soared to over 420%, underscoring just how explosive the longer-term trajectory has been. Despite this, momentum has cooled lately amid wider market volatility and fresh losses in recent quarterly results.

If you’re interested in which other healthcare innovators are making waves, it’s a great time to explore See the full list for free.

With all these ambitious rollouts and expansion moves front and center, is Oscar Health’s recent selloff presenting a buying window, or are investors already factoring in the company’s growth opportunities and execution risks?

Most Popular Narrative: 22% Overvalued

Oscar Health’s most widely tracked narrative signals a mismatch between the company’s fair value and its last close price. With a narrative fair value set at $12.38, shares recently closed at $15.10, positioning the stock notably above what is implied by the narrative’s discounted cash flow and earnings trajectory.

Recent market-wide increases in morbidity within the individual ACA market highlight Oscar Health's vulnerability to dynamic risk pools, heightening uncertainty in claims costs and putting pressure on the company's ability to maintain or grow net margins and future earnings, even with planned repricing actions.

Want to know what could actually send Oscar Health toward a profitable future? The story is all about ambitious growth, tough cost pressures, and a margin target usually reserved for industry giants. Get the numbers behind these bold projections and discover what is propelling the narrative’s high valuation. The market is betting one way, but are the most critical assumptions hiding in plain sight?

Result: Fair Value of $12.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust digital adoption and aggressive cost reductions could drive unexpected margin gains. This may challenge the current cautious outlook on Oscar Health’s future.

Find out about the key risks to this Oscar Health narrative.

Another View: Relative Value Signals Opportunity

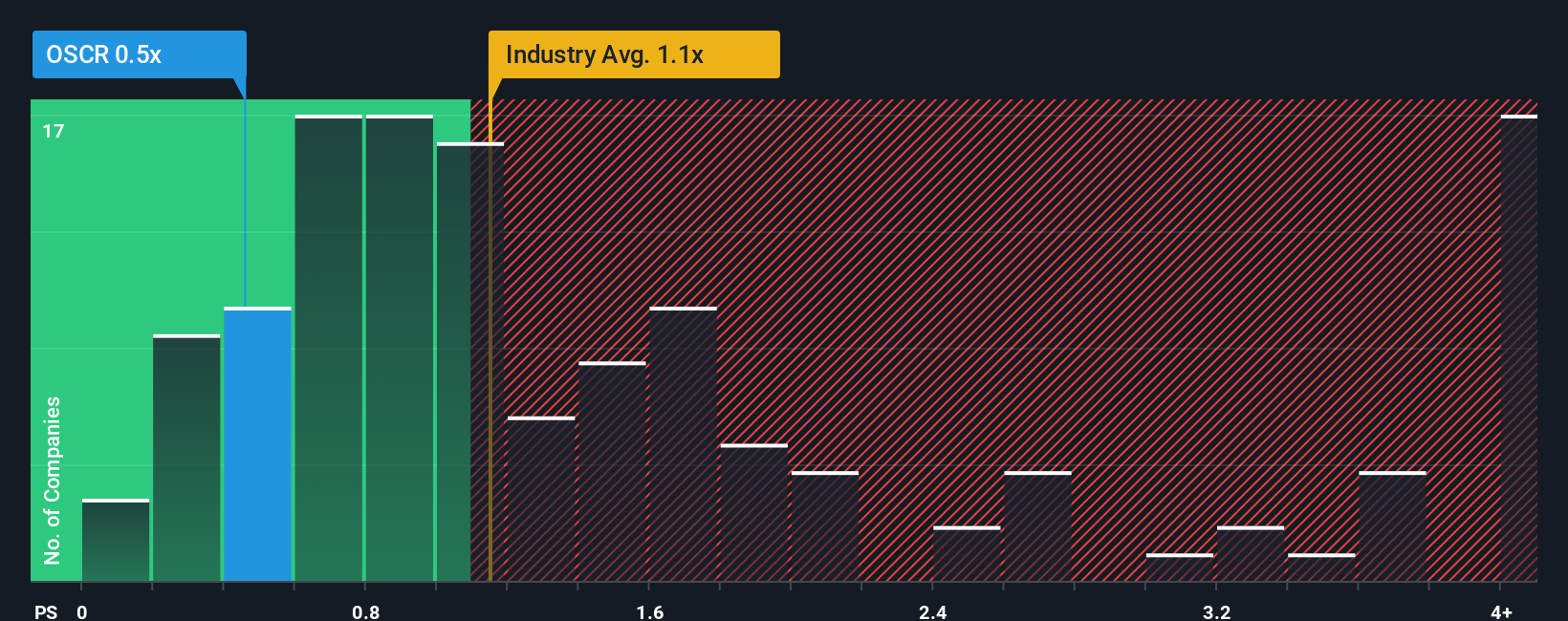

While the first valuation method suggests Oscar Health is overvalued, our take using the price-to-sales ratio paints a different picture. Oscar trades at just 0.4x sales, well below both its industry average of 1.1x and a fair ratio of 0.7x. This indicates shares may actually offer value at current levels. Could the market be pricing in too much pessimism, or is there hidden risk still to be uncovered?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Oscar Health Narrative

If you see the Oscar Health story differently, dig into the numbers and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Waiting on just one opportunity could leave you behind. Instead, seize your edge by acting now and see where smart investors are directing their attention.

- Tap into future-shaping technology by viewing these 26 AI penny stocks, which are powering breakthroughs in automation, machine learning, and the data revolution.

- Unlock cash flow potential and invest confidently in undervalued businesses with these 862 undervalued stocks based on cash flows, selected for their solid financial fundamentals.

- Capture powerful passive income streams when you access these 14 dividend stocks with yields > 3%, offering yields that set them apart in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives