- United States

- /

- Insurance

- /

- NYSE:MCY

Mercury General (MCY): Evaluating Valuation After Earnings Beat and Dividend Announcement

Reviewed by Simply Wall St

Mercury General (MCY) caught Wall Street’s attention after its third-quarter earnings surpassed expectations, helped by improved underwriting results. The company also declared a new quarterly dividend, reinforcing its commitment to shareholder returns.

See our latest analysis for Mercury General.

Momentum has been picking up for Mercury General, as reflected by its 30.8% year-to-date share price return and a one-year total shareholder return of 16.6%. The stock traded as high as $86.00 recently, supported by upbeat earnings and a fresh dividend. This added to a multi-year run that saw total shareholder returns increase by over 150% in three years. The market appears to be warming to Mercury’s improving fundamentals and stable outlook. Positive investor sentiment has driven gains over both the short and long term.

If Mercury's earnings jump has you thinking bigger, this could be the perfect time to broaden your investing universe and discover fast growing stocks with high insider ownership.

Yet with shares near recent highs and strong results now well known, investors are left to wonder: is the renewed optimism fully reflected in Mercury General’s price, or is there still untapped upside ahead?

Most Popular Narrative: 14% Undervalued

Mercury General’s narrative places its fair value at $100, notably higher than the latest close at $86. With this gap in view, the most widely followed narrative points to recent improvements in core operations as a powerful support for future gains.

The company's core underlying business, excluding catastrophe losses, is strong with favorable underlying combined ratios in their personal auto and homeowners business. This suggests potential for improvement in future earnings stability and net margins.

Want to know the math powering this price jump? The secret ingredient: bold assumptions about future growth, margins, and a premium profit multiple, usually reserved for industry standouts. Unpack the financial forecasts and hidden dynamics that drive this upbeat fair value. Start now for the full picture.

Result: Fair Value of $100 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened wildfire losses and rising reinsurance costs remain key risks. These factors could challenge the optimistic outlook for Mercury General's earnings growth.

Find out about the key risks to this Mercury General narrative.

Another View: What Do Multiples Say?

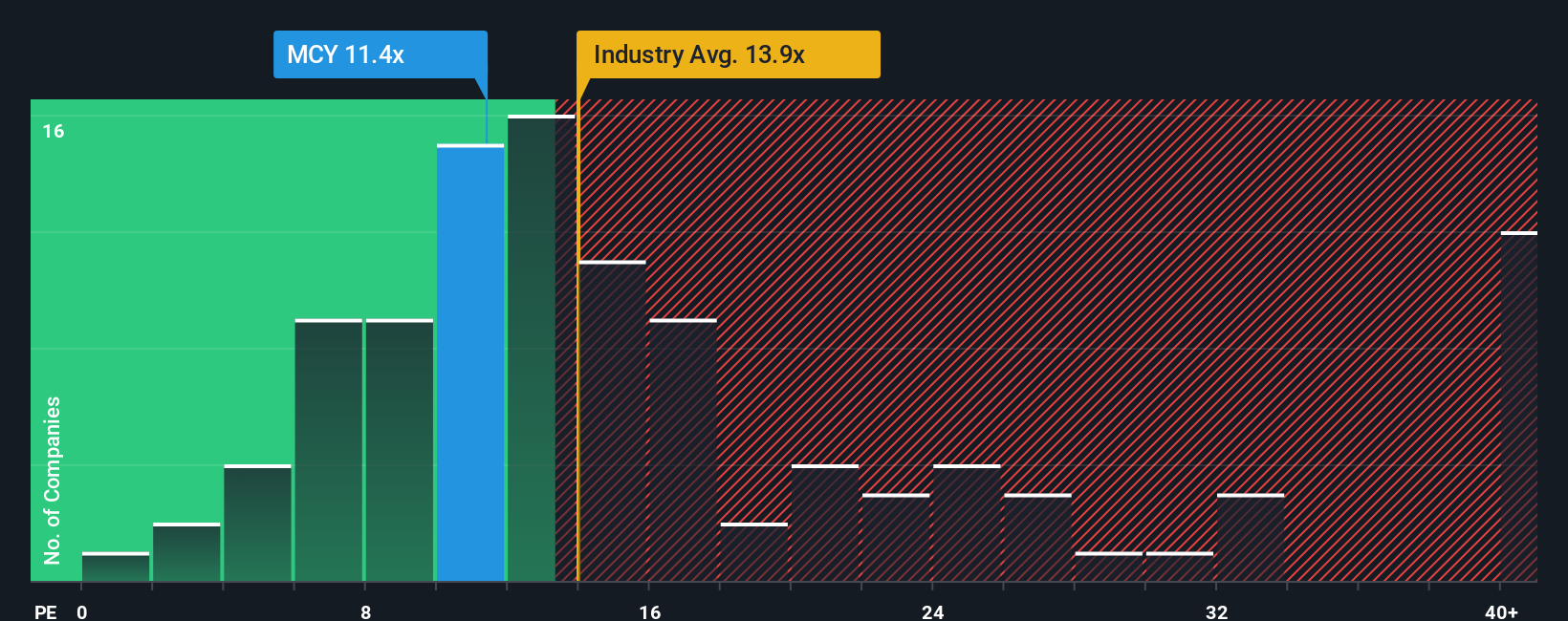

Analysts may see upside, but looking at Mercury General's current price-to-earnings ratio reveals a different angle. At 10.8x, it is cheaper than both US insurance industry peers (13.2x) and the company’s peer average (16.7x). However, it is pricier than its fair ratio of 9.3x. This matters because if the market decides Mercury should only earn a typical fair ratio, today’s price might be a bit high. Could this suggest the stock is ahead of itself, or is there real value left?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercury General for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercury General Narrative

If you see things differently or want to dig into the numbers on your own, you can build your own story from scratch in just minutes. Do it your way

A great starting point for your Mercury General research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss out on fresh opportunities beyond Mercury General. Use the Simply Wall Street Screener to pinpoint dynamic stocks that match your strategy and spark your portfolio’s growth.

- Uncover high yields and lock in income by checking out these 16 dividend stocks with yields > 3%, which delivers consistent returns above 3%.

- Get ahead of the next tech wave by following these 25 AI penny stocks, a selection of companies poised to transform industries with cutting-edge artificial intelligence breakthroughs.

- Capitalize on strong financials with these 3580 penny stocks with strong financials, combining low share price with impressive balance sheets and upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives