- United States

- /

- Insurance

- /

- NYSE:MCY

Mercury General (MCY): Assessing Valuation After a Strong Multi‑Year Share Price Rebound

Reviewed by Simply Wall St

Mercury General (MCY) has quietly turned into a strong insurance rebound story, with the stock up about 36% year to date and roughly 18% over the past 3 months, catching value-focused investors attention.

See our latest analysis for Mercury General.

That 35.8% year to date share price return, alongside a 3 year total shareholder return of about 175.5%, suggests investors are steadily warming to Mercury General again as underwriting results and sentiment improve around property and auto insurers.

If Mercury’s rebound has you rethinking where the next opportunity might come from, this could be a good moment to explore fast growing stocks with high insider ownership.

With shares now hovering just below analysts price targets after a powerful multi year run, is Mercury still trading at a sensible discount, or are investors already paying up for all the future growth on offer?

Most Popular Narrative Narrative: 10.7% Undervalued

With Mercury General last closing at $89.27 against a most popular narrative fair value of $100, the story hinges on steady cash generation and modest growth assumptions.

The expected capital generation from core underlying earnings in 2025 is anticipated to help rebuild statutory surplus, potentially positively impacting net margins and financial stability.

Want to see what is powering that surplus rebuild story? The narrative leans heavily on disciplined underwriting, firm premium growth, and a valuation multiple that has quietly shifted higher. Curious how those moving pieces combine into that fair value gap?

Result: Fair Value of $100 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, wildfire related losses and potential reinsurance cost spikes could quickly pressure margins and surplus, which would challenge the idea that earnings stability is locked in.

Find out about the key risks to this Mercury General narrative.

Another Angle on Value

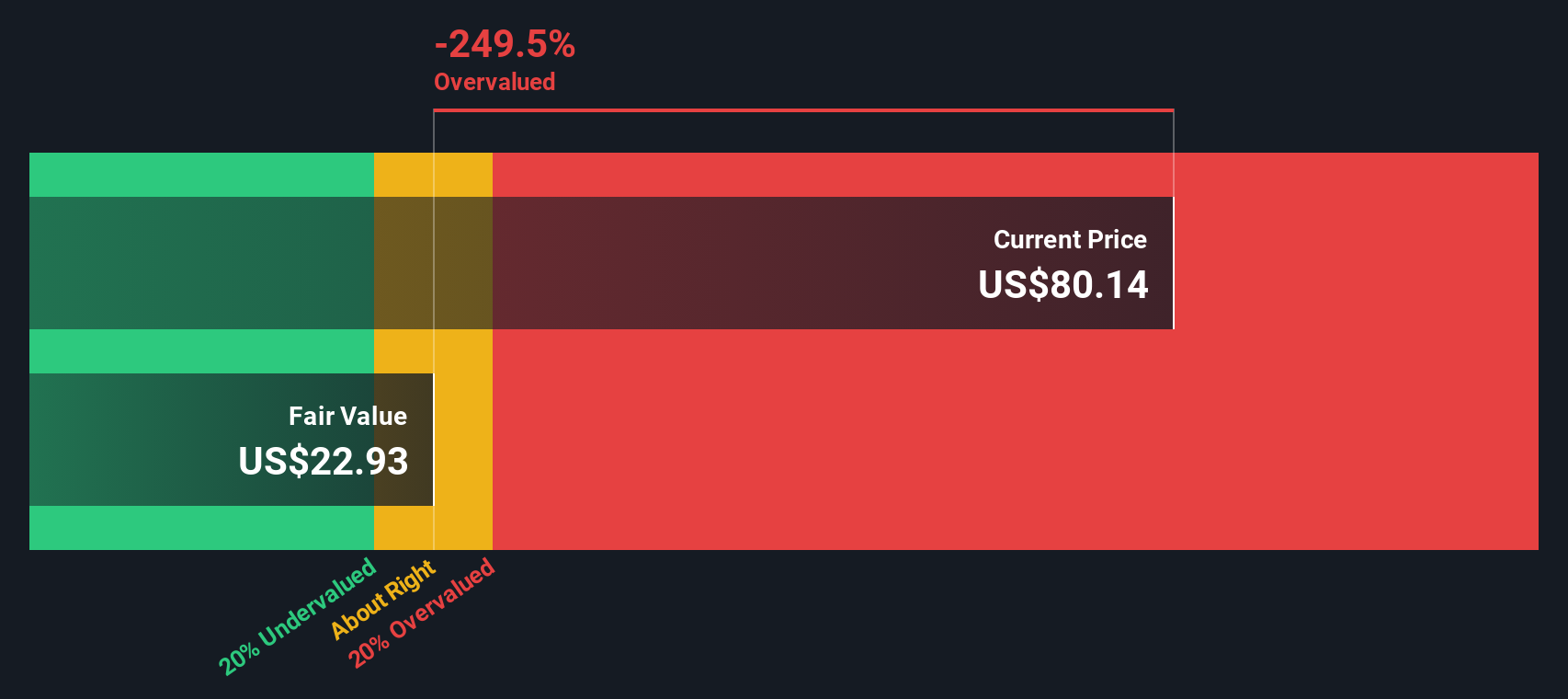

Our DCF model is less optimistic than the narrative fair value, pointing to a fair value of about $79.55 per share versus the current $89.27 price. That implies Mercury might already be priced ahead of its medium term cash flows. The question for investors is which story should carry more weight.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mercury General for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mercury General Narrative

If you see the numbers differently or want to dig into the fundamentals yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your Mercury General research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Put your research momentum to work and use the Simply Wall St Screener to spot your next edge before the crowd locks up the best ideas.

- Capture potential income opportunities by scanning for these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s long term cash flow.

- Ride the next wave of innovation by targeting these 27 AI penny stocks positioned to benefit from accelerating demand for intelligent automation.

- Lock in value early by focusing on these 901 undervalued stocks based on cash flows before the broader market fully recognizes their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026