- United States

- /

- Insurance

- /

- NYSE:KMPR

Is Kemper Attractively Priced After 35% Drop and Regulatory Shifts in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Kemper might be trading at a bargain price, especially after so much market noise around insurance stocks?

- Kemper's share price has recently dropped by 5.9% over the past week and is down nearly 35% year-to-date, raising eyebrows about both risk and potential upside.

- Some of these sharp movements align with recent reports highlighting regulatory developments in the insurance sector and industry-wide shakeups impacting underwriting guidelines. Both factors have investors reassessing their outlook. For Kemper, this added uncertainty has put its next moves under the microscope.

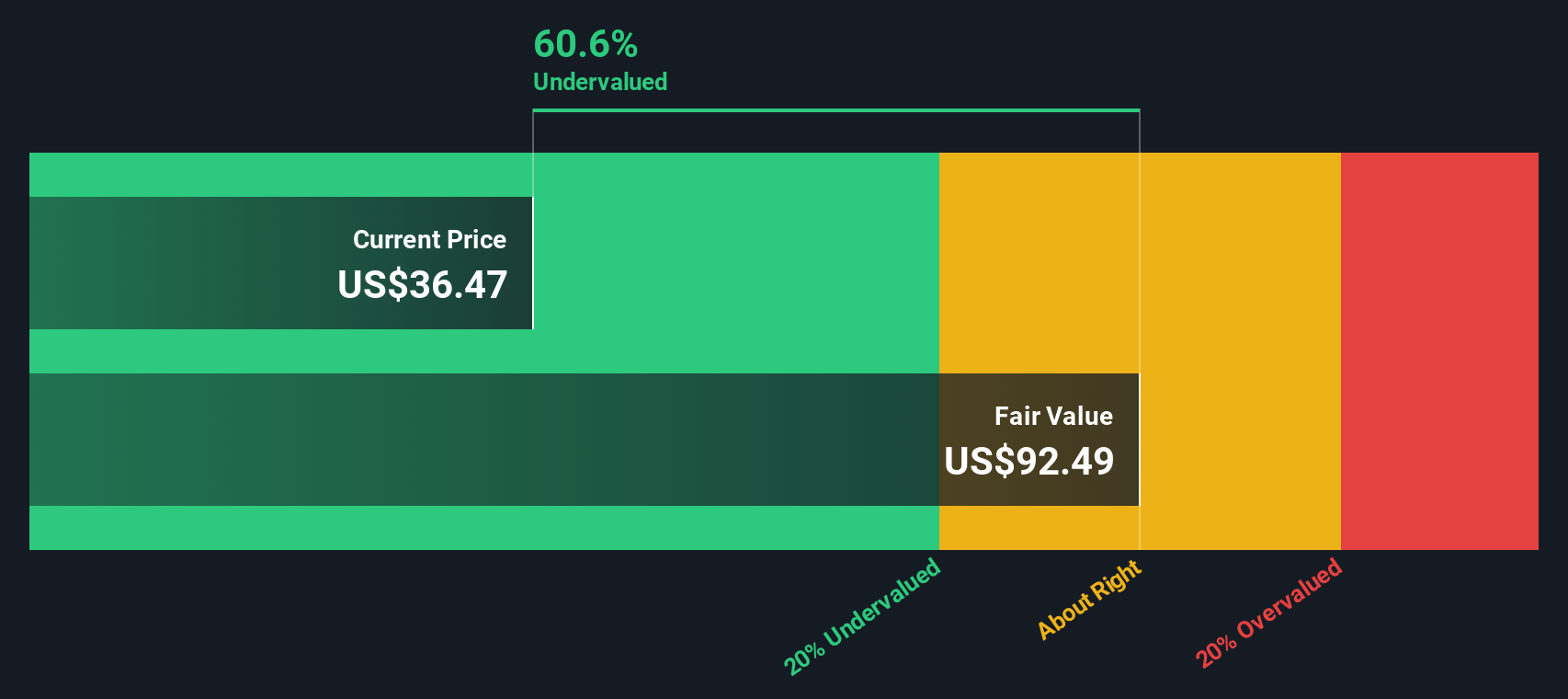

- When we break down its value score, Kemper earns a solid 5 out of 6 on our valuation checks, a strong result that deserves a closer look. In a moment, we’ll dive into exactly how we assess value, but keep reading for an even more useful way to frame Kemper’s investment story before you make up your mind.

Find out why Kemper's -34.3% return over the last year is lagging behind its peers.

Approach 1: Kemper Excess Returns Analysis

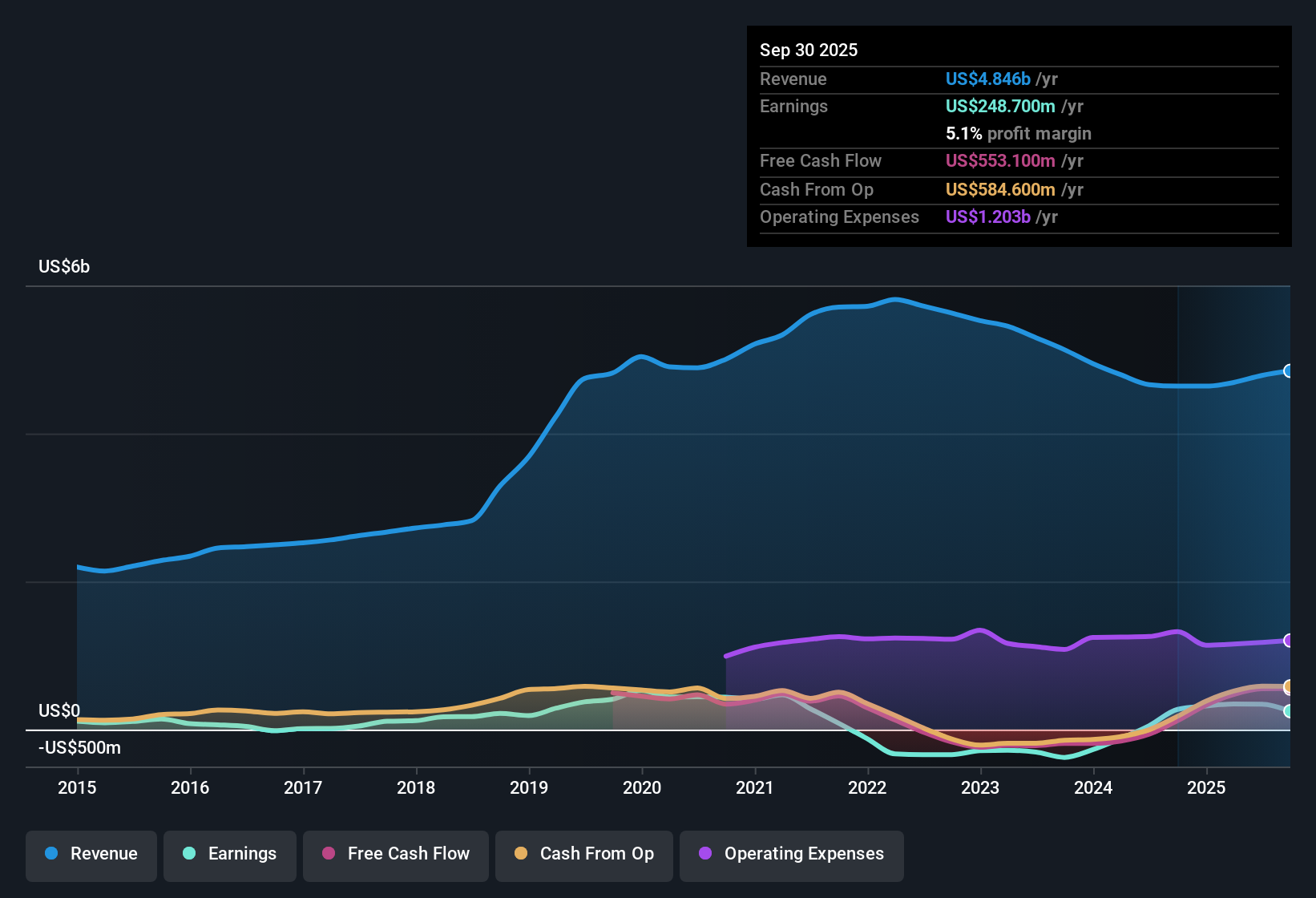

The Excess Returns model measures how much profit a company generates above the cost of its capital, focusing on whether Kemper is making efficient use of shareholders’ money. This valuation approach examines the relationship between return on invested equity and what it costs the company to finance that equity.

According to analyst projections, Kemper boasts an average Return on Equity of 11.63%, leading to stable earnings per share of $6.09. The company’s stable book value per share is estimated at $52.38, with a current book value of $46.45. Taking into account a cost of equity of $3.55 per share, Kemper achieves an excess return of $2.54 per share, which means it is generating meaningful value above its required cost of capital. These figures come from weighted future estimates provided by four analysts tracking the company’s fundamentals.

The Excess Returns model estimates Kemper’s intrinsic value at $121.12 per share. With the stock currently trading at a price that is roughly 64.8% below this valuation, the evidence points to the shares being significantly undervalued based on core profitability metrics rather than market sentiment.

Result: UNDERVALUED

Our Excess Returns analysis suggests Kemper is undervalued by 64.8%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Kemper Price vs Earnings

The Price-to-Earnings (PE) ratio is often the preferred method to value profitable companies like Kemper, as it directly relates a business’s share price to its per-share earnings. This multiple allows investors to quickly compare how much they are paying for each dollar of earnings, making it a practical tool for evaluating established firms with consistent profitability.

It’s important to remember that higher expected growth or lower risk typically justify a higher "normal" PE ratio. In contrast, greater uncertainty or sluggish growth generally lead to a lower one. With that in mind, Kemper’s current PE stands at 7.79x, which is noticeably below both the insurance industry average of 13.58x and its peer average of 11.05x. At first glance, this discount can signal a buying opportunity but can also reflect concerns about the company’s risk profile or growth outlook.

To provide more context, Simply Wall St calculates a proprietary "Fair Ratio" for Kemper at 11.43x. This metric is more reliable than simple peer or industry comparisons because it factors in critical elements such as the company’s projected earnings growth, profit margins, business risks, and market capitalization, all tailored to Kemper’s real-world situation. By comparing Kemper’s current PE to its Fair Ratio, we see that the stock trades at a noticeable discount to where it would be considered fairly valued based on its specific fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kemper Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique investor story. It allows you to link what you believe about Kemper’s future (its growth, margins, risks, and opportunities) with a financial forecast and a calculated fair value, giving real meaning to the numbers you see.

On Simply Wall St’s Community page, millions of investors can easily build or explore Narratives that show how a company’s latest developments might change its value. By comparing your assumed Fair Value (based on your Narrative) to Kemper’s current price, you can quickly decide if the stock is a buy, hold, or sell for your situation.

What makes Narratives so powerful is that they update automatically whenever important news or earnings are announced, so your investment view stays relevant without any extra effort. For example, one investor studying Kemper may see surging digital adoption and project a fair value of $81.00 per share, while another, concerned about industry competition, may estimate just $50.00. These different perspectives are all transparent and available for comparison within the Community.

Do you think there's more to the story for Kemper? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kemper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMPR

Kemper

An insurance holding company, provides insurance products in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives