- United States

- /

- Insurance

- /

- NYSE:HMN

Horace Mann Educators (HMN): Evaluating Valuation After Record Q3 Earnings and Upgraded Guidance

Reviewed by Simply Wall St

Horace Mann Educators (HMN) caught investor attention after reporting record third-quarter earnings and a sharp rise in net income. The company also raised its full-year earnings guidance, highlighting strong operational momentum.

See our latest analysis for Horace Mann Educators.

Following those robust results, Horace Mann Educators’ share price has climbed steadily in 2025. This reflects renewed confidence from investors after posting record earnings and raising its full-year outlook. The stock’s solid year-to-date share price return of nearly 18% points to strengthening momentum, with a 12% total shareholder return over the past year further underscoring long-term value creation.

If you’re looking to discover what else is catching attention in today’s dynamic market, this is a great moment to broaden your horizons and explore fast growing stocks with high insider ownership

With earnings surging and guidance raised, investors now face a classic question: does Horace Mann Educators still offer untapped value, or is the current share price already reflecting all of its future growth potential?

Most Popular Narrative: 6.9% Undervalued

Compared to its latest closing price of $45.61, the most widely followed narrative sets a fair value for Horace Mann Educators at $49. This positions the stock as modestly undervalued, raising the stakes for investors trying to gauge if positive momentum still has room to run.

Ongoing expansion of digital engagement platforms and proprietary technology solutions (such as the Catalyst lead management system) are improving agent productivity and making it easier for educators to engage. This is likely to drive increased policy sales, higher customer conversion rates, and improved customer retention, positively impacting both revenue growth and net margins.

Curious about the formula behind this compelling fair value? The backbone of this narrative hinges on ambitious revenue expansion and an optimistic future margin. Which bold forecasts set this target? Dive deeper to see how these numbers stack up, and whether the outlook really lives up to the hype.

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, relying so heavily on public K-12 education and facing rising climate-related losses could pose challenges for Horace Mann Educators in sustaining long-term momentum.

Find out about the key risks to this Horace Mann Educators narrative.

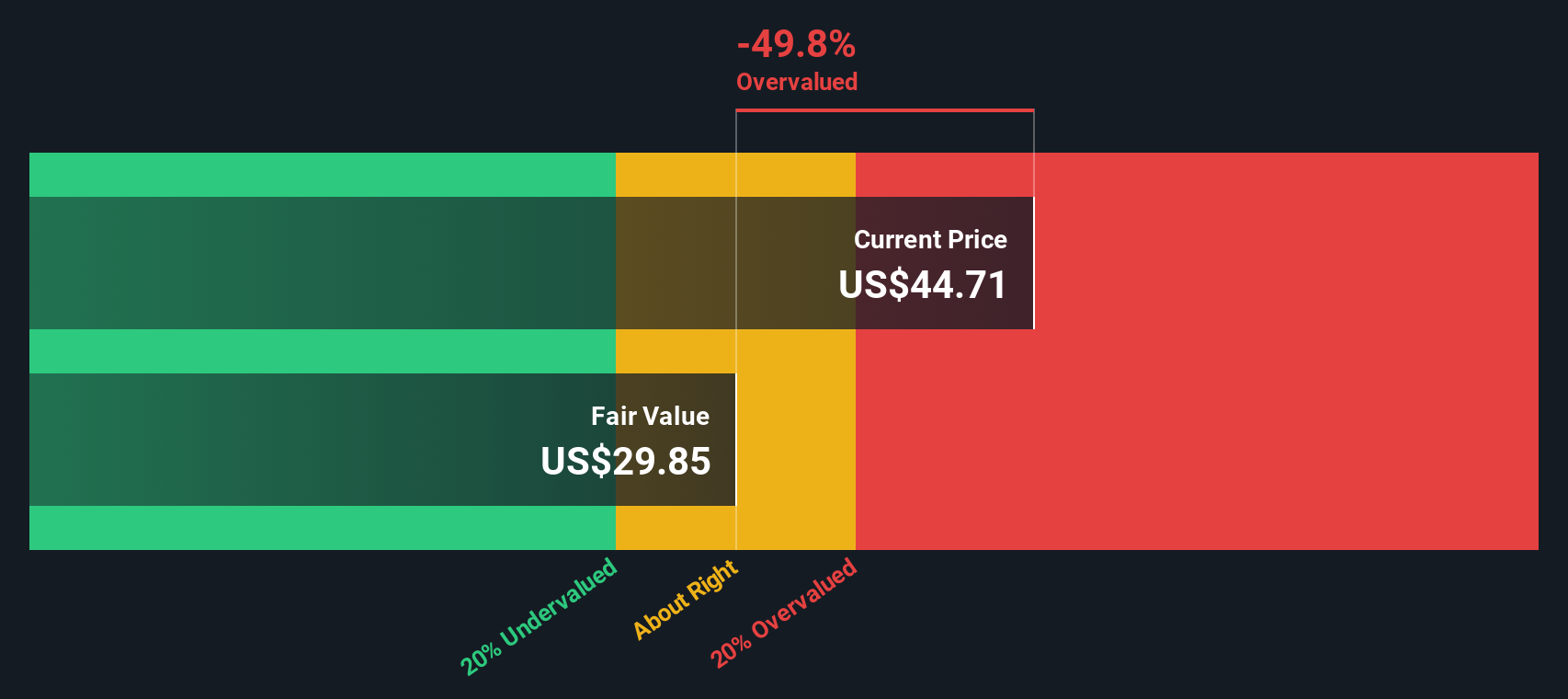

Another View: Discounted Cash Flow Signals a Different Story

Shifting to our SWS DCF model, there is a distinctly different perspective. This math-driven approach suggests Horace Mann Educators could actually be trading above its estimated fair value, which indicates less upside than multiples-based comparisons might suggest. Could this mean caution is warranted as momentum builds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Horace Mann Educators for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Horace Mann Educators Narrative

If you have a different perspective, or want to dig into the numbers and trends yourself, it’s simple to craft your own view in just minutes with Do it your way

A great starting point for your Horace Mann Educators research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Capitalize on today’s market momentum by putting the Simply Wall Street Screener to work for you. Don’t let other opportunities pass you by. Prime your portfolio for growth with these targeted stock ideas:

- Tap into income potential and stability by checking out these 15 dividend stocks with yields > 3% delivering yields above 3% and robust cash flows.

- Ride the wave of artificial intelligence innovation; uncover tomorrow’s leaders through these 26 AI penny stocks already making strides in this transformational space.

- Position yourself ahead of the curve with underappreciated opportunities by reviewing these 872 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives