- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

3 Growth Companies With Insider Ownership Up To 17%

Reviewed by Simply Wall St

As the U.S. stock market begins the week with gains across major indices, investors are closely watching corporate earnings and economic indicators that may influence Federal Reserve decisions on interest rates. In this environment, companies with strong growth potential and significant insider ownership can offer unique insights into confidence levels from those most familiar with their operations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 75.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.1% | 52.6% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We'll examine a selection from our screener results.

Harrow (HROW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Harrow, Inc. is an eyecare pharmaceutical company focused on the discovery, development, and commercialization of ophthalmic products with a market cap of $1.48 billion.

Operations: Harrow generates revenue through its Branded segment, contributing $144.94 million, and the ImprimisRx segment, which adds $82.72 million.

Insider Ownership: 15.9%

Harrow, Inc. is positioned as a growth company with high insider ownership and notable revenue growth prospects, forecasted to outpace the US market significantly at 26.3% annually. Recent strategic moves include securing a US$40 million credit facility and launching the Harrow Access for All program to enhance medication affordability and accessibility. The company anticipates profitability within three years, supported by its recent financial restructuring efforts through debt offerings aimed at optimizing capital structure and funding future business opportunities.

- Delve into the full analysis future growth report here for a deeper understanding of Harrow.

- Our valuation report here indicates Harrow may be undervalued.

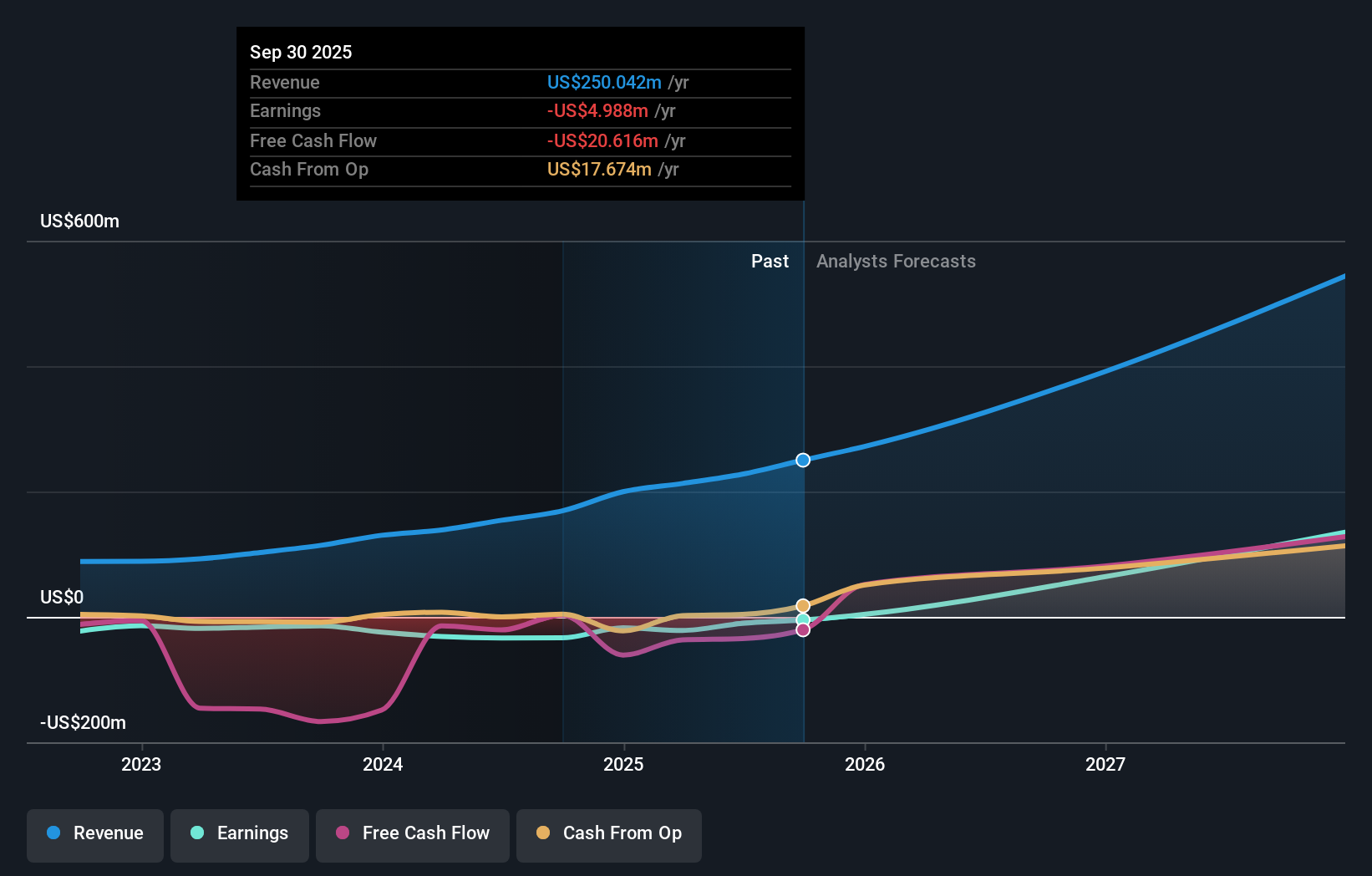

PDF Solutions (PDFS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property for integrated circuit designs, measurement hardware tools, methodologies, and professional services globally with a market cap of approximately $1.08 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $196 million.

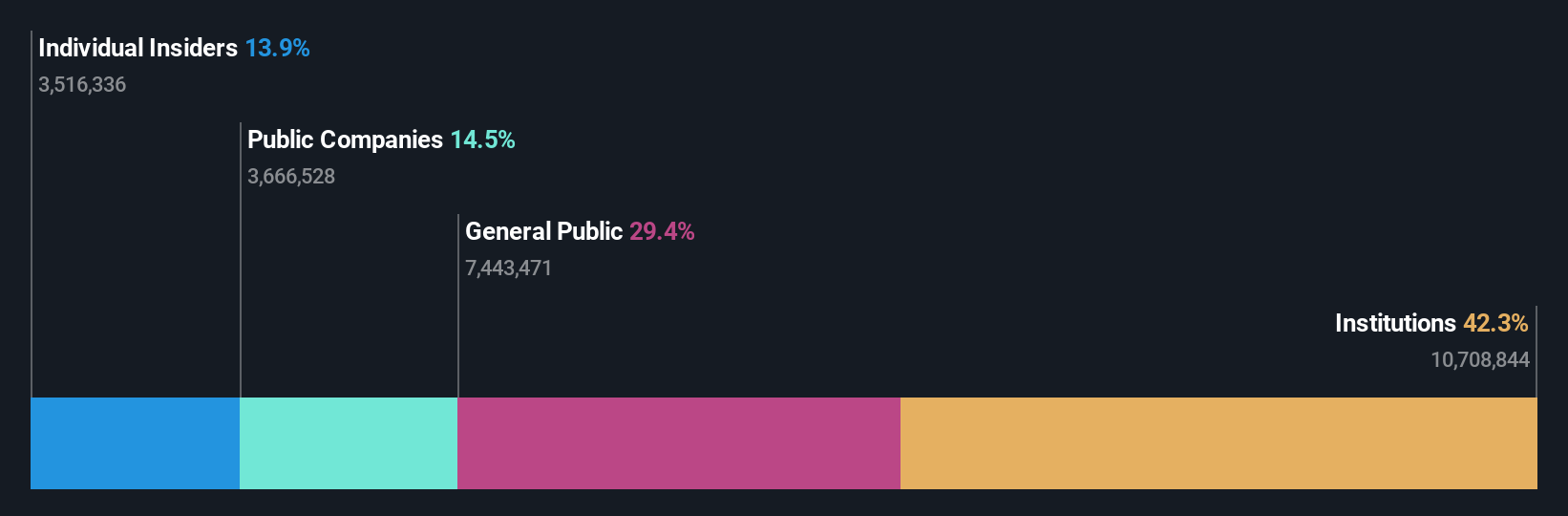

Insider Ownership: 17.3%

PDF Solutions showcases strong growth potential, with earnings forecasted to increase significantly at 88.6% annually, surpassing the US market's average. Recent collaborations, such as with Lavorro Inc., aim to enhance semiconductor manufacturing efficiency through AI-driven solutions. Despite a recent net loss, PDF Solutions reaffirms its revenue growth guidance of 21% to 23% for 2025. The company's strategic initiatives and high insider ownership suggest confidence in its long-term prospects within the semiconductor industry.

- Get an in-depth perspective on PDF Solutions' performance by reading our analyst estimates report here.

- Our expertly prepared valuation report PDF Solutions implies its share price may be too high.

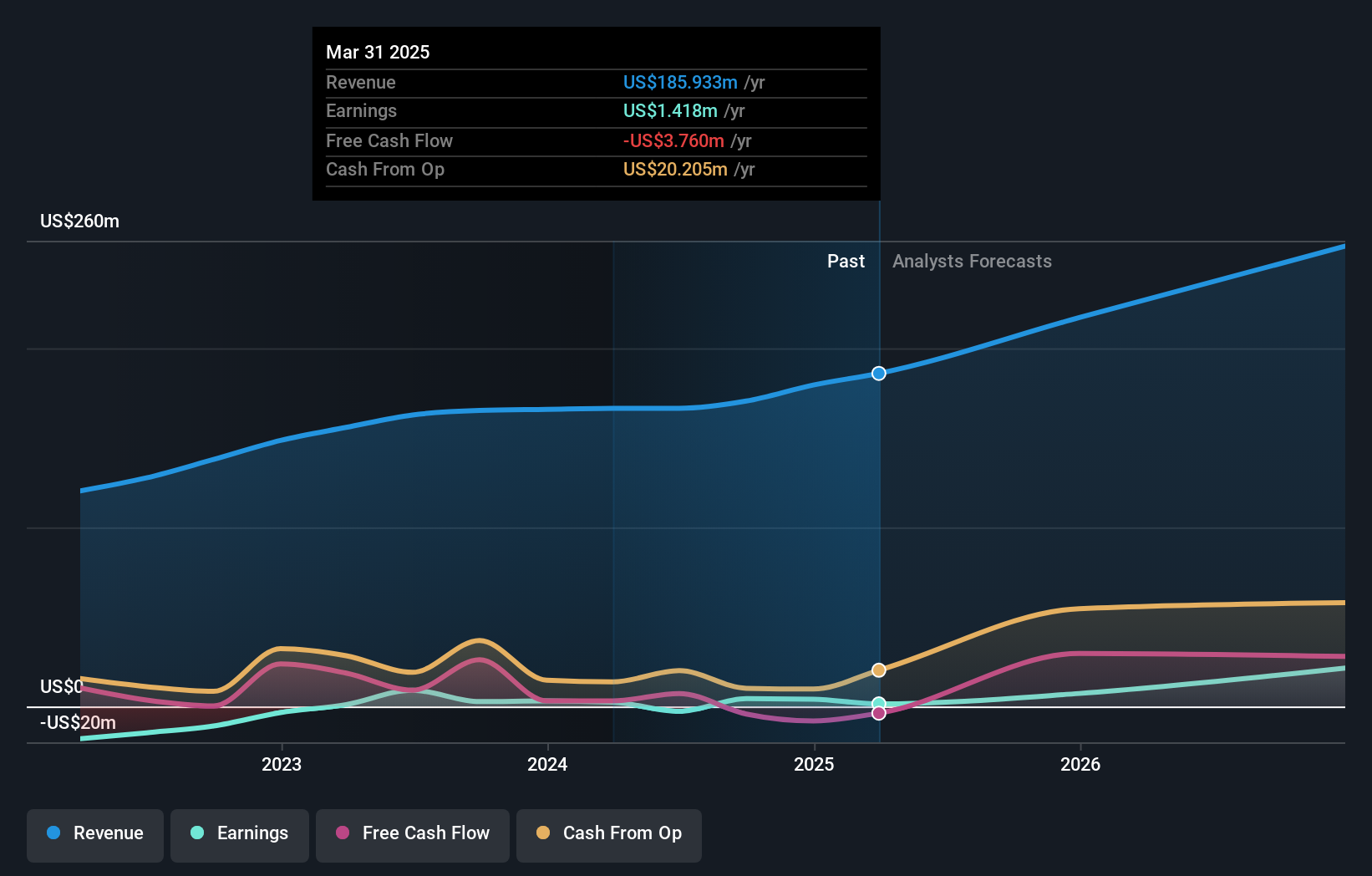

Hippo Holdings (HIPO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hippo Holdings Inc. offers property and casualty insurance products to individuals and businesses in the United States, with a market cap of approximately $0.86 billion.

Operations: The company's revenue is primarily derived from its Hippo Home Insurance Program at $247.60 million, followed by Insurance-As-A-Service at $141.60 million, and Services contributing $48.10 million.

Insider Ownership: 14.0%

Hippo Holdings demonstrates potential as a growth company with high insider ownership, driven by strategic leadership changes and enhanced data capabilities. The recent appointment of Robin Gordon as Chief Data Officer underscores its focus on leveraging technology for risk management and growth. With revenue forecasted to grow at 16.9% annually, Hippo is expected to become profitable within three years, surpassing average market growth. Recent earnings revisions indicate improved financial performance, supporting its strategic diversification efforts.

- Unlock comprehensive insights into our analysis of Hippo Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hippo Holdings shares in the market.

Seize The Opportunity

- Explore the 204 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Ready To Venture Into Other Investment Styles? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives