- United States

- /

- Insurance

- /

- NYSE:HGTY

Hagerty (HGTY) Is Up 14.6% After Earnings Beat and Liberty Mutual Partnership Announcement Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Hagerty, Inc. reported third quarter results this past week, showing quarterly revenue of US$380.0 million and net income of US$20.85 million, both up considerably from a year ago, and also raised its full-year 2025 earnings guidance.

- Shortly before this, Liberty Mutual announced a partnership with Hagerty to offer expanded collectible car coverage to Liberty Mutual and Safeco policyholders nationwide, potentially broadening Hagerty's customer base and revenue opportunities.

- We'll explore how Hagerty's raised earnings outlook and new Liberty Mutual partnership could reshape its investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Hagerty Investment Narrative Recap

To be a shareholder in Hagerty, you’d need confidence that the collector car insurance market will defy demographic shifts and find new growth by expanding its customer base and offerings. The company’s raised 2025 earnings guidance and new Liberty Mutual partnership may help address short-term revenue catalysts, yet they do not immediately erase the heightened risks related to underwriting and exposure to loss ratios, especially as Hagerty prepares for greater risk retention.

Of the recent announcements, Hagerty's expanded nationwide partnership with Liberty Mutual stands out, as it brings access to millions of potential new policyholders. While this could broaden premium flow, any meaningful long-term revenue boost hinges on execution, particularly given Hagerty's shift to a more targeted and selective growth model as seen in its recent market pullbacks.

But with heightened control over underwriting profit through the Markel fronting arrangement, investors should not overlook the risks of rising repair costs and loss ratios that could...

Read the full narrative on Hagerty (it's free!)

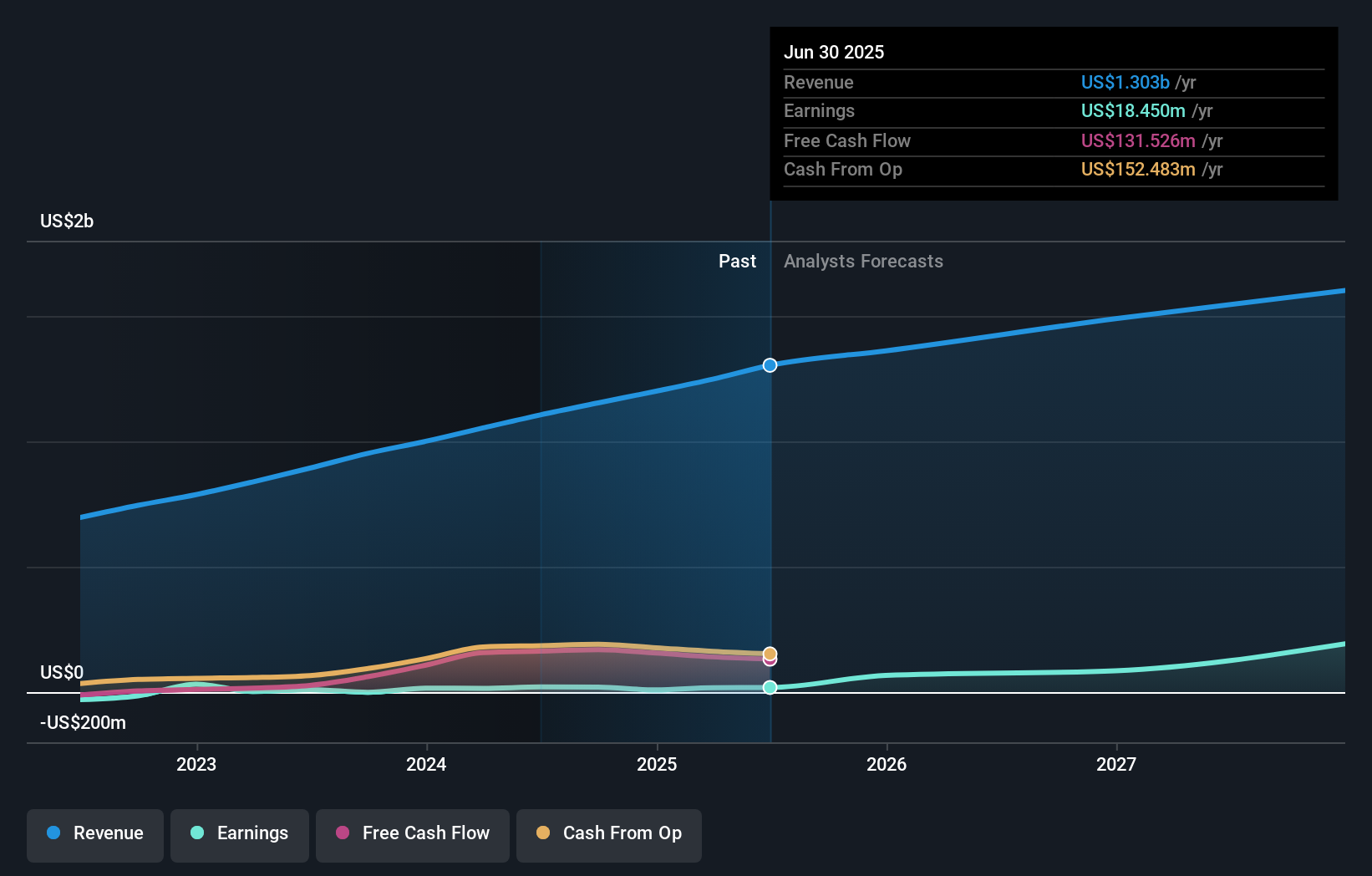

Hagerty's narrative projects $1.8 billion in revenue and $228.5 million in earnings by 2028. This requires 11.1% yearly revenue growth and a $210.1 million increase in earnings from the current $18.4 million.

Uncover how Hagerty's forecasts yield a $13.29 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Fair value views from the Simply Wall St Community range from US$3.99 to US$13.29, highlighting two distinct outlooks. With these perspectives, keep in mind that Hagerty’s risk exposure from 100 percent premium retention may amplify earnings swings if claims spike unexpectedly.

Explore 2 other fair value estimates on Hagerty - why the stock might be worth less than half the current price!

Build Your Own Hagerty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hagerty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hagerty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hagerty's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hagerty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGTY

Hagerty

Provides insurance services for collector cars and enthusiast vehicles in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives