- United States

- /

- Insurance

- /

- NYSE:HGTY

A Look at Hagerty’s (HGTY) Valuation Following Upbeat Earnings, Raised Guidance, and New Liberty Mutual Partnership

Reviewed by Simply Wall St

Hagerty (HGTY) has caught investor attention after reporting strong third quarter and year-to-date earnings growth. The company has raised its full-year guidance and announced a new partnership with Liberty Mutual to broaden its collectible car insurance reach.

See our latest analysis for Hagerty.

The upbeat earnings, raised guidance, and Liberty Mutual partnership have supercharged Hagerty’s momentum and propelled its share price up 39% year-to-date. Investors seem optimistic about long-term potential, with the 3-year total shareholder return at an impressive 68%.

If standout gains like these have you curious about what else could be moving the needle, now might be the perfect time to discover fast growing stocks with high insider ownership

With shares near analyst targets and stellar recent growth fueling investor excitement, the key question now is whether Hagerty remains undervalued or if markets have already priced in the company’s next phase of expansion.

Most Popular Narrative: Fairly Valued

Hagerty's most widely followed narrative suggests the current share price, sitting just above $13, is almost exactly aligned with consensus fair value. The narrow gap between the valuation and recent close sets the stage for debate over what is driving market confidence.

The ramping State Farm partnership is expected to significantly accelerate new business growth, providing access to over 500,000 current program vehicles and thousands of motivated agents. This will materially expand Hagerty's customer acquisition funnel and recurring commission revenues at attractive margins over the next several years.

Want to know what powers this narrative’s razor-thin fair value premium? It revolves around a bold set of growth levers and a margin story that rivals the industry’s best. Is the next rally already priced in, or is there an element analysts know that you don’t? Discover the assumptions hiding inside the full narrative.

Result: Fair Value of $13.29 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including potential demand headwinds from younger generations as well as uncertainties surrounding the execution and profitability of new international expansions.

Find out about the key risks to this Hagerty narrative.

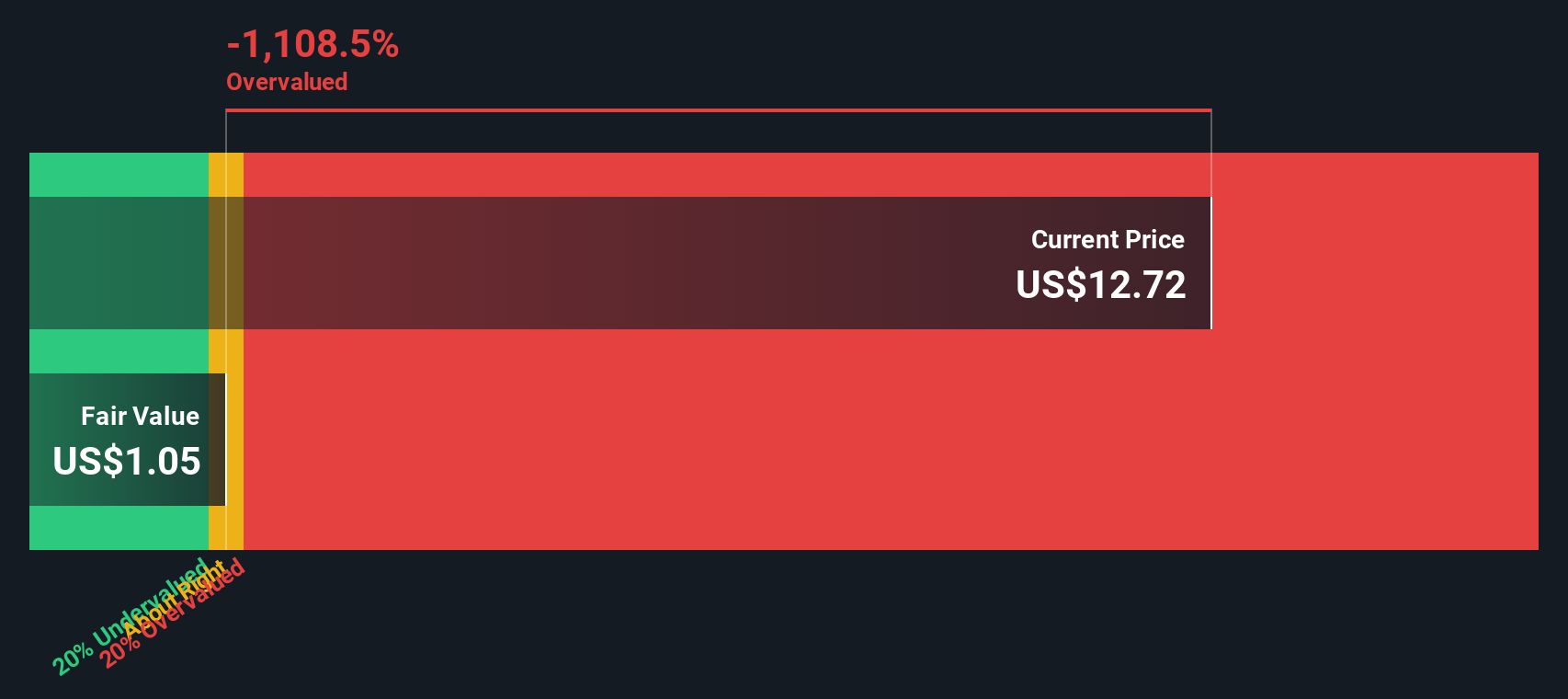

Another View: DCF Tells a Different Story

While recent multiples suggest Hagerty could be fairly priced, our SWS DCF model draws a starker conclusion. According to this approach, the current share price trades well above its intrinsic value and signals potential overvaluation if aggressive growth targets do not materialize. What if reality fails to catch up with the narrative?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hagerty Narrative

If you feel another angle might better capture Hagerty’s future or want to dig into the numbers yourself, you can craft your own view in under three minutes with Do it your way

A great starting point for your Hagerty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

If you want your portfolio on the leading edge, don’t settle for yesterday’s winners. Stay strategic and spot tomorrow’s opportunities before everyone else.

- Tap into next-gen financial trends by reviewing these 82 cryptocurrency and blockchain stocks, which is making waves in digital assets and blockchain innovation.

- Zero in on stocks combining healthy dividends with growth by using these 14 dividend stocks with yields > 3% to uncover reliable performers with yields above 3%.

- Catch breakthroughs in healthcare technology by checking out these 32 healthcare AI stocks, which is reshaping patient care with artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hagerty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGTY

Hagerty

Provides insurance services for collector cars and enthusiast vehicles in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives