- United States

- /

- Insurance

- /

- NYSE:HCI

HCI Group (HCI) Is Down 9.1% After Profit Surge on Favorable Weather and Exzeo IPO Success—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- HCI Group, Inc. recently reported third-quarter 2025 results, posting revenue of US$216.35 million and net income of US$65.51 million, both considerably higher than the previous year.

- A key insight is the company’s profit surge was fueled by lower insurance losses from favorable weather and the successful IPO of its technology subsidiary, Exzeo.

- We'll explore how HCI Group's improved profitability and success with the Exzeo IPO could influence its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

HCI Group Investment Narrative Recap

To own HCI Group stock, an investor must believe in the company's ability to leverage its technology and insurance expertise for sustained profitability, while efficiently managing risk concentrated largely in Florida. The recent third-quarter results showcased a considerable earnings boost thanks to lower insurance losses and the Exzeo IPO, but this doesn’t materially resolve the exposure to geographic catastrophe or the underlying challenge of growing beyond the Citizens Insurance depopulation pool, which remains the near-term catalyst and risk.

Among recent company announcements, the completion of the Exzeo IPO stands out. By unlocking value from its technology arm and retaining a controlling stake, HCI aims to reinforce its tech-driven insurance advantage, directly tied to its ability to maintain lower loss ratios, address underwriting efficiency, and support continued margin expansion as the business faces shifting Florida market dynamics.

Yet, even with strong earnings, potential investors should not overlook that when weather patterns turn adverse...

Read the full narrative on HCI Group (it's free!)

HCI Group's narrative projects $1.1 billion in revenue and $342.7 million in earnings by 2028. This requires 13.5% yearly revenue growth and a $205.1 million earnings increase from the current $137.6 million.

Uncover how HCI Group's forecasts yield a $213.75 fair value, a 14% upside to its current price.

Exploring Other Perspectives

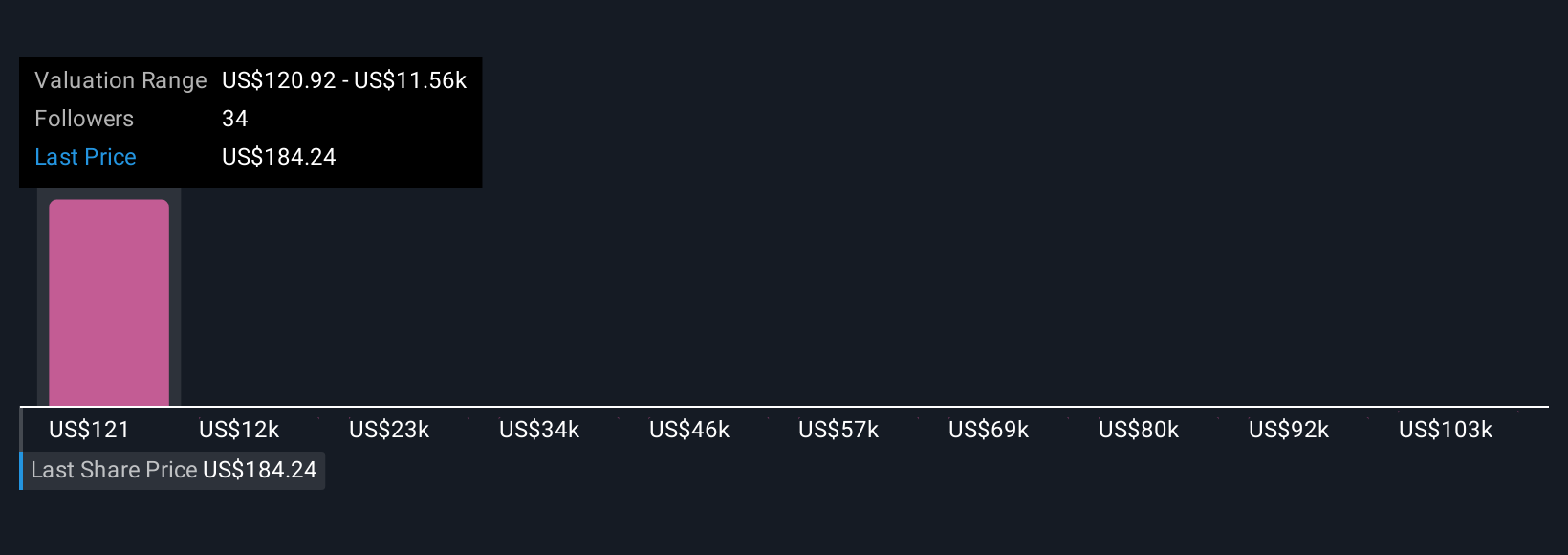

Simply Wall St Community members have posted fair value estimates for HCI ranging from US$120.92 to US$114,561.05 across six perspectives. This diversity comes as the business still faces the risk of heavy exposure to Florida catastrophes, a factor worth weighing against these varying expectations.

Explore 6 other fair value estimates on HCI Group - why the stock might be worth 35% less than the current price!

Build Your Own HCI Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCI Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HCI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCI Group's overall financial health at a glance.

No Opportunity In HCI Group?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HCI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCI

HCI Group

Engages in the property and casualty insurance, insurance management, reinsurance, real estate, and information technology businesses in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives