- United States

- /

- Insurance

- /

- NYSE:FIHL

Fidelis Insurance Holdings (NYSE:FIHL): Exploring Valuation Perspectives as Latest Performance Data Emerges

Reviewed by Simply Wall St

Fidelis Insurance Holdings (NYSE:FIHL) shares have seen some movement recently, catching investors’ eyes as the company’s performance data rolls in. With annual revenue and net income figures now public, many are taking a closer look at the stock’s trajectory.

See our latest analysis for Fidelis Insurance Holdings.

Shares of Fidelis Insurance Holdings have been trending upward, with a 4% share price return over the past month and nearly 12% over the last 90 days. This suggests growing optimism as recent results hit the market. However, the total shareholder return for the past year is slightly negative, which indicates investors are still weighing the company’s long-term trajectory despite its recent momentum.

If Fidelis’s recent moves have you curious about broader opportunities, now's a great time to broaden your search and discover fast growing stocks with high insider ownership.

With shares climbing yet total returns remaining subdued, the real question is whether Fidelis Insurance Holdings is currently undervalued or if the recent gains simply reflect expectations of future growth. Is there a hidden opportunity, or has the market already accounted for what comes next?

Most Popular Narrative: 3.2% Undervalued

Fidelis Insurance Holdings currently trades at $19.14, just below the most popular narrative’s fair value estimate of $19.78. This narrow gap suggests analysts see only modest upside, hinging on future growth and operational improvements.

Stable fee income and scale advantages position Fidelis to benefit from market trends, enhance shareholder value, and drive predictable returns despite industry cycles.

Curious how Fidelis plans to turn a lack of profits into surging future earnings? The narrative’s math is built on bold assumptions, including expectations for rapid revenue growth, a dramatic expansion in margins, and a sudden profitability shift. Don’t miss which projections stand behind that fair value and how analysts think Fidelis could leap ahead.

Result: Fair Value of $19.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure and exposure to catastrophic events could quickly derail Fidelis’s earnings momentum. This could potentially shift the story for investors.

Find out about the key risks to this Fidelis Insurance Holdings narrative.

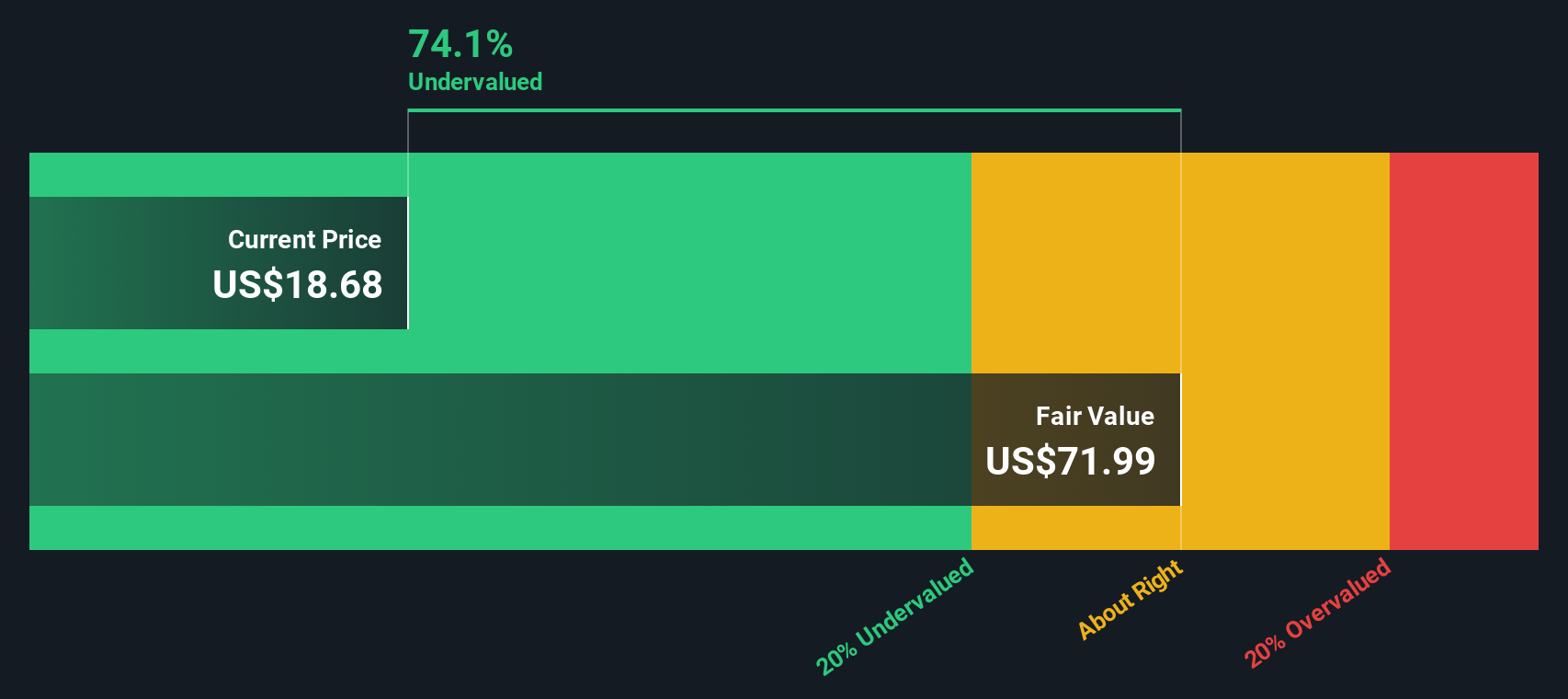

Another View: Discounted Cash Flow Offers a Different Perspective

While analysts see Fidelis Insurance Holdings as modestly undervalued based on price targets and growth assumptions, our DCF model presents a much more optimistic picture. According to this approach, the current share price is trading at a substantial discount compared with the calculated fair value. Could market skepticism be hiding a deeper opportunity, or is the DCF model too generous with its future forecasts?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Fidelis Insurance Holdings Narrative

If you see things differently or want to dive into the data yourself, you can shape your own perspective in just a few minutes, Do it your way.

A great starting point for your Fidelis Insurance Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means reaching beyond the obvious. Give yourself an edge by checking out these fresh opportunities. Missing them could leave untapped gains on the table.

- Tap into the next wave of digital finance by scanning these 82 cryptocurrency and blockchain stocks, helping redefine payments and blockchain-powered solutions.

- Uncover the power of stable returns and compounding with these 14 dividend stocks with yields > 3% that consistently deliver high yields and income growth.

- Accelerate your portfolio’s potential by targeting these 27 AI penny stocks, harnessing AI breakthroughs for rapid business expansion and market disruption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIHL

Fidelis Insurance Holdings

Provides insurance and reinsurance solutions in Bermuda, the Republic of Ireland, and the United Kingdom.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives