- United States

- /

- Insurance

- /

- NYSE:FAF

A Look at First American Financial’s Valuation After Q3 Earnings Jump, Dividend Growth, and New Price Target

Reviewed by Simply Wall St

First American Financial (FAF) just delivered some good news for shareholders, with third quarter results showing a strong 41% jump in revenue year over year and a return to profitability. The company also kept its 15-year streak of growing dividends going by declaring its regular cash payout, signaling that management remains confident about the firm’s future direction.

See our latest analysis for First American Financial.

Alongside the recent board appointment of seasoned insurance leader Jeffrey J. Dailey and another steady quarterly dividend, First American Financial’s 1-year total shareholder return of 2.17% underlines that momentum has been solid but modest, with long-term gains still outpacing short-term moves. The stock’s recent pickup, up over 5% in the last week, signals that investors have started to take a more optimistic view, perhaps responding to improvements in both earnings and leadership.

If you’re curious to see what else is catching investors’ attention right now, this is a good moment to broaden your search and discover fast growing stocks with high insider ownership

But after an impressive earnings boost and a rising price target, does First American Financial remain an undervalued pick? Or has the recent uptick already priced in the company’s future growth potential?

Most Popular Narrative: 18.5% Undervalued

With First American Financial closing at $64.01, well below the widely followed narrative’s fair value estimate of $78.50, the valuation gap stands out. This perspective points to meaningful upside potential if future growth and profitability targets are met.

Accelerating adoption and rollout of proprietary technology platforms such as Endpoint and Sequoia, aimed at automation of title and refinance transactions, are expected to unlock operational efficiencies and reduce processing costs. These advances are anticipated to support higher net margins over the next 2-3 years.

Wondering which quantitative leaps are fueling this bullish target? The narrative hinges on ambitious revenue expansion and margin transformation, fueled by bets on operational efficiency. Find out what bold growth assumptions are driving that valuation.

Result: Fair Value of $78.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent home affordability challenges and cooling commercial activity could limit First American Financial’s revenue momentum. This could put pressure on future earnings and margins.

Find out about the key risks to this First American Financial narrative.

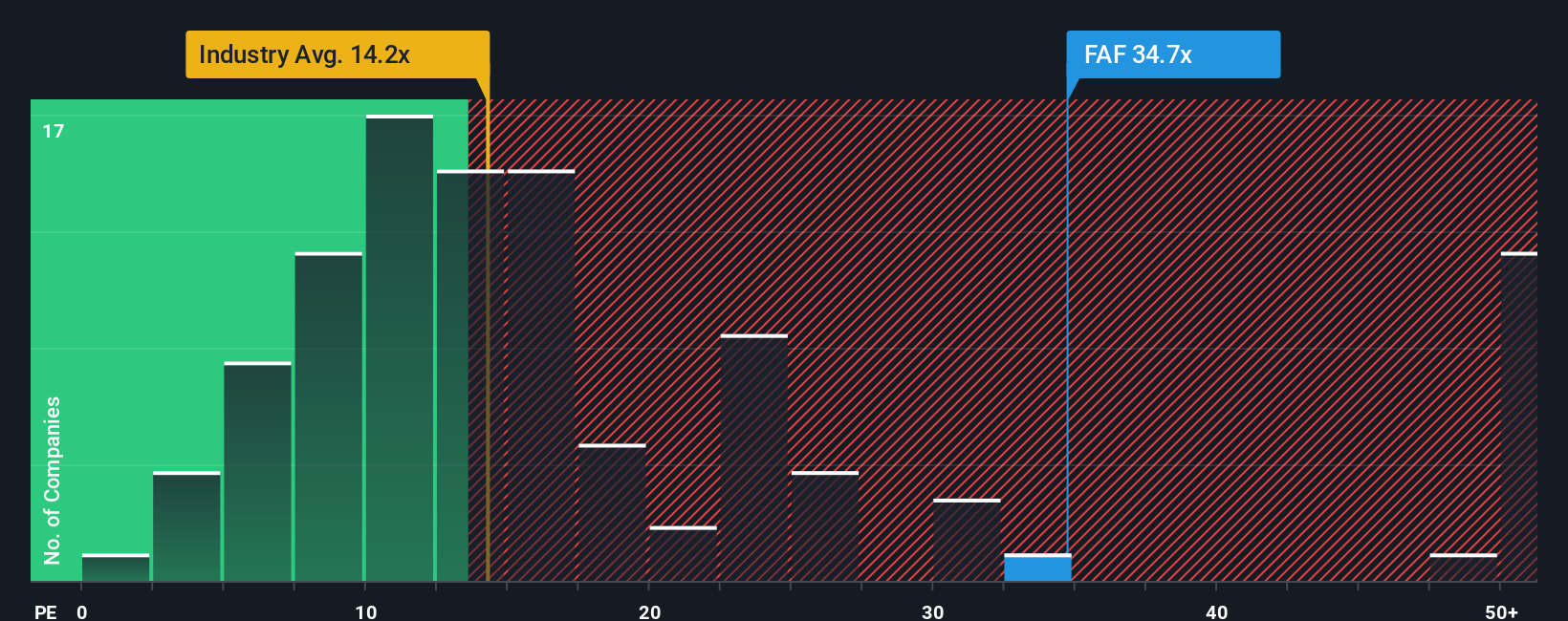

Another View: Putting Market Multiples in Perspective

While the popular narrative sees First American Financial as undervalued, taking a look at the market’s most-watched valuation ratio offers a more cautious outlook. The company’s current price-to-earnings ratio of 13.5x is slightly above both the US insurance industry average (13.3x) and its own fair ratio of 13.4x. That narrow premium suggests investors may already be paying up for some of the growth that is forecast, which could limit the room for a significant re-rating based on valuation alone.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First American Financial Narrative

If the current take does not match your perspective or you prefer to dive into the numbers personally, you can assemble your own story in just a few minutes. Do it your way

A great starting point for your First American Financial research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the biggest opportunities often go to those who act quickly on emerging trends and powerful shifts in the market landscape. Let Simply Wall Street’s handpicked screeners point you toward promising stocks you might otherwise miss.

- Tap into tomorrow’s outperformance by uncovering rare value opportunities using these 878 undervalued stocks based on cash flows and see which companies are trading well below their fair value right now.

- Catch the wave of innovation and high-growth potential by exploring these 28 AI penny stocks pioneering breakthroughs in artificial intelligence and transforming everything from healthcare to finance.

- Start earning more passive income by targeting reliable payers with these 15 dividend stocks with yields > 3%, featuring stocks with yields above 3% and a history of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FAF

First American Financial

Through its subsidiaries, provides financial services.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives