- United States

- /

- Insurance

- /

- NYSE:CNA

Will Catherine Roe’s Appointment Shape CNA’s (CNA) Innovation Strategy in Canada?

Reviewed by Sasha Jovanovic

- CNA Financial recently announced the appointment of Catherine Roe as President of CNA Canada, effective November 10, 2025, bringing over 30 years of insurance and risk management experience to lead all aspects of the company's Canadian operations.

- This leadership move is expected to sharpen CNA's focus on growth and innovation, particularly in the Canadian commercial insurance market as highlighted by the company's leadership team.

- We'll explore how Catherine Roe's appointment to lead CNA Canada could influence the company's operational focus and future investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

CNA Financial Investment Narrative Recap

To be a CNA Financial shareholder today, an investor must have confidence in the company’s ability to drive profitable growth despite current volatility in insurance margins and pressure from recent catastrophe losses. The appointment of Catherine Roe as President of CNA Canada reflects a commitment to leadership renewal, but this move is unlikely to materially affect the company's immediate catalyst, which is improved underwriting performance, or offset the primary risk, a rising underlying loss ratio in the core Property and Casualty segment.

Of the recent company announcements, the August 19 leadership changes, including new presidents across global business lines, tie most strongly to this news, highlighting CNA’s intent to inject experienced talent into key roles. As operational discipline and fresh executive oversight emerge as near-term catalysts, the ongoing test will be whether these changes translate into consistent loss cost management and sustained earnings growth.

In contrast, investors should remain attentive to possible unfavorable developments in commercial auto and liability lines, as …

Read the full narrative on CNA Financial (it's free!)

CNA Financial is projected to reach $17.1 billion in revenue and $1.7 billion in earnings by 2028. This outlook is based on an assumed 6.2% annual revenue growth rate and an earnings increase of $741 million from the current $959.0 million.

Uncover how CNA Financial's forecasts yield a $48.37 fair value, a 3% upside to its current price.

Exploring Other Perspectives

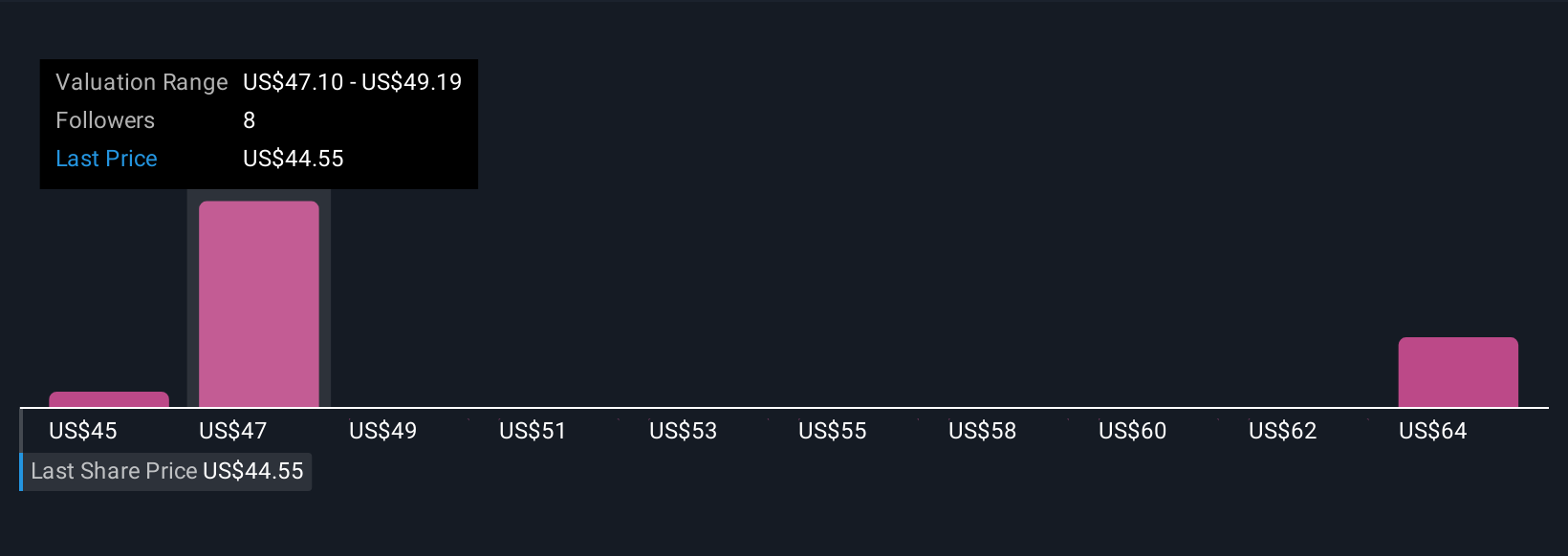

The Simply Wall St Community’s three fair value estimates for CNA Financial range widely from US$45.00 to US$65.97 per share. While these independent perspectives invite you to consider different growth scenarios, remember that rising loss costs across key insurance lines could influence future profitability and spark debate among market participants.

Explore 3 other fair value estimates on CNA Financial - why the stock might be worth as much as 41% more than the current price!

Build Your Own CNA Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNA Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CNA Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNA Financial's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNA

CNA Financial

An insurance holding company, primarily provides commercial property and casualty insurance products in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives