- United States

- /

- Insurance

- /

- NYSE:CB

Chubb (CB): Evaluating Valuation as Leadership Transition Signals Strategic Continuity

Reviewed by Simply Wall St

Chubb (CB) has announced that John Lupica, Vice Chairman and Executive Chairman of North America Insurance, will retire at the end of this year after a 25-year career with the company. John Keogh, currently President and Chief Operating Officer, will step in to take on the additional role of Chairman for North America Insurance. This move reinforces Chubb's focus on stable leadership and management continuity as it navigates the next chapter.

See our latest analysis for Chubb.

Chubb's share price has climbed 6.6% over the past three months, showing solid momentum even as the company navigates a significant leadership transition and completed a $1.5 billion buyback program in late October. While its 1-year total shareholder return of 3.8% lags somewhat behind previous multi-year gains, the longer-term 46.5% total return over three years and 105.6% across five years demonstrate strength in compounding value for investors.

If you're weighing potential moves in the insurance space, now is an ideal moment to broaden your focus and discover fast growing stocks with high insider ownership

With shares hovering close to price targets and steady long-term returns, investors now face a key question: Is Chubb undervalued amid executive changes, or is the market already factoring in the company's future growth?

Most Popular Narrative: 6.5% Undervalued

Chubb's current share price of $287.55 sits nearly 7% below the most widely followed fair value estimate of $307.50. The narrative behind this figure is shaped by expectations of future profitability and disciplined capital allocation, setting the stage for investors to scrutinize the assumptions driving these projections.

Capital deployment through ongoing share repurchases (new $5B authorization), growing dividends, and selective M&A is creating upward pressure on earnings per share (EPS). Robust cash flow and a strong capital position provide flexibility for further shareholder returns.

Curious how buybacks, rising profit margins, and a tech-era profit multiple work together to define Chubb’s future price? See which forecasted trends fuel this bullish valuation. One surprise may change how you see the whole sector.

Result: Fair Value of $307.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure from falling premium rates and rising claims costs could quickly undermine Chubb’s profitability. This may challenge these optimistic assumptions about future returns.

Find out about the key risks to this Chubb narrative.

Another View: How Realistic Is the Multiple?

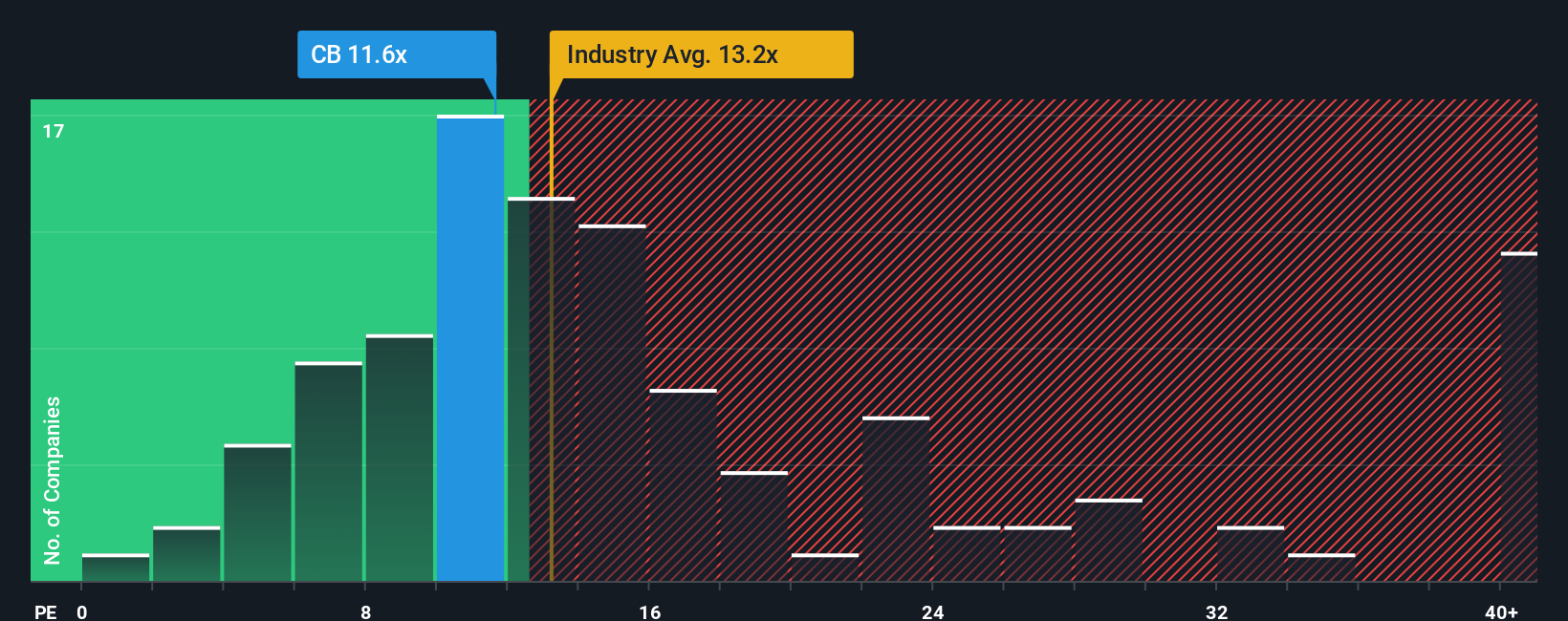

While the fair value discussion points to upside, Chubb’s shares trade at an earnings ratio of 11.7 times, which is noticeably higher than the peer average of 9.8 times. However, the market’s fair ratio could be closer to 13.5 times. This gap suggests there is risk if peer multiples slide further, or opportunity if investors become more comfortable with Chubb’s earnings power. Is the premium justified, or do risks outweigh optimism for this stock?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chubb Narrative

If you want to challenge these viewpoints or prefer your own angle, you can dive into the numbers and craft an analysis in just a few minutes, Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Chubb.

Looking for More Investment Ideas?

Keep your portfolio ahead of the curve by tapping into emerging trends and alternative opportunities that could redefine your returns. Don’t let these timely ideas pass you by.

- Tap into potential market leaders by reviewing these 875 undervalued stocks based on cash flows that screen as undervalued based on their cash flows and fundamentals.

- Spot AI innovators making headlines. Get the inside edge with these 25 AI penny stocks revolutionizing real-world industries with advanced intelligence.

- Boost your steady income prospects and enjoy reliable payouts by checking out these 16 dividend stocks with yields > 3% that offer yields greater than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CB

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives